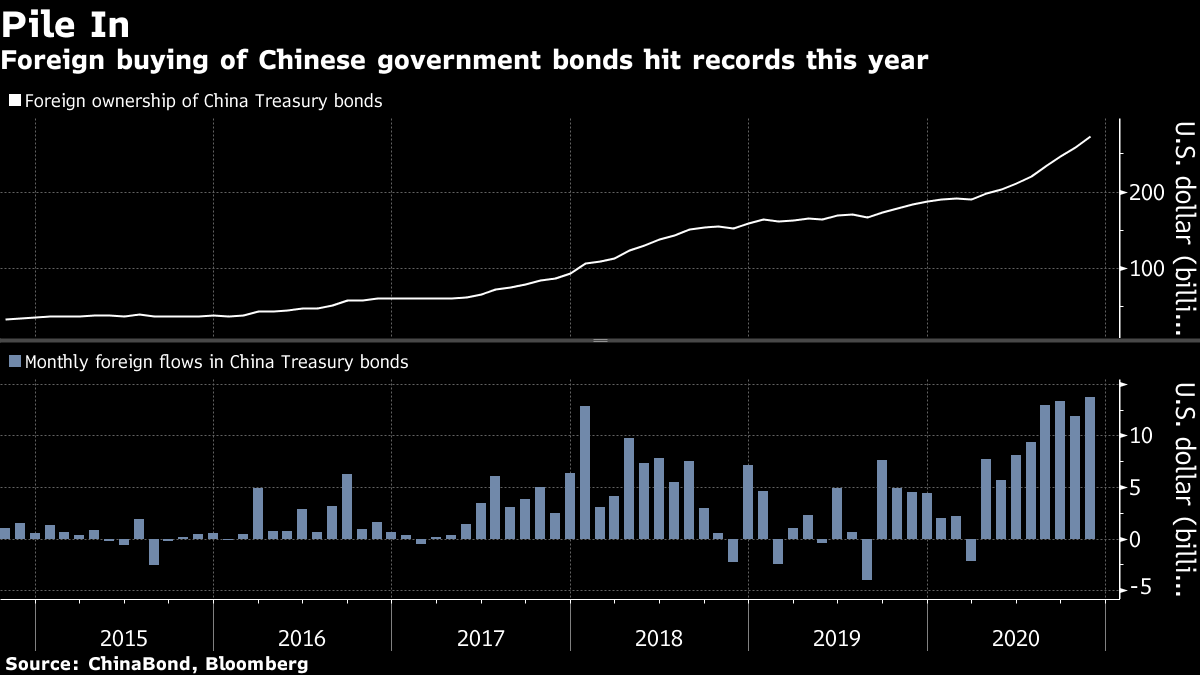

| The U.S. hits Chinese officials with more sanctions. China's markets price in deleveraging. Suga is set to unveil his first stimulus package. The U.S. announced sanctions Monday against 14 members of China's National People's Congress as the Trump administration ratchets up pressure on Beijing over its crackdown on Hong Kong. The 13 men and one woman targeted with asset-freezes and travel bans are all vice chairpersons of the NPC's standing committee. Earlier Monday, after news of the impending sanctions filtered out, Chinese Foreign Ministry spokeswoman Hua Chunying said Beijing would take countermeasures should the U.S. continue down the "wrong path." Meanwhile, Hong Kong police made a series of arrests over a university protest last month, heightening concerns about an erosion of academic freedom there. Asian stocks looked set for a muted open as swelling coronavirus infections across the U.S. weighed on risk assets. Futures slipped in Japan and Australia and edged higher in Hong Kong. The S&P 500 dropped from an all-time high, led by energy and financial stocks, amid fears of restrictions as infections climb. The Nasdaq 100 rose for a ninth straight day, its longest winning streak in almost a year. Ten-year Treasury yields dropped back toward 0.9% as risk-off sentiment built up and the dollar strengthened against its major peers. Oil dropped and gold jumped more than 1%. China is bucking the global trend of greater economic stimulus amid the coronavirus, preferring instead to refocus on controlling its record debt burden. Policy makers are allowing for tighter liquidity in the financial system and an economic recovery and a strong currency are giving them more room to focus on the task at hand. The shift is pushing up market rates: government-bond yields trade near an 18-month high and interbank borrowing costs last month jumped to the highest since January. China's big banks have been unwilling to lend to smaller financial firms after a string of defaults at some of the country's safest borrowers. Yoshihide Suga is set to unveil his first stimulus package as Japan's prime minister on Tuesday with an overall value of 73.6 trillion yen ($707 billion). The package will include around 40 trillion yen in fiscal measures, such as loans, investment and direct expenditure, and the spending will be partly financed by 19.2 trillion yen from a third extra budget. Despite the incoming boost, Suga saw the biggest fall in support for a Japanese cabinet in seven years in one media poll Monday as debate continues over whether a subsidized travel program contributed to its worst-yet wave of coronavirus infections. U.K. Prime Minister Boris Johnson will head to Brussels for urgent talks with European Commission President Ursula von der Leyen, amid growing fears on both sides that Brexit trade talks will fail. The two spoke on Monday evening and agreed to meet after they concluded a deal remained far off. British businesses fired a broadside at ministers for leaving them no time to adapt to post-Brexit rules. What We've Been ReadingThis is what's caught our eye over the past 24 hours: And finally, here's what Tracy's interested in todayThe sound you hear is China sucking in global capital. As my colleague Stephen Spratt puts it, 2020 marked the year where Chinese government bonds really became a global yield play and a growing component of foreign investors' portfolios. There are a few things that account for this heightened interest in China's debt. At a time when most central banks are cutting interest rates and introducing more monetary easing, China is going in the opposite direction.  It's weathered the pandemic better than many Western nations, putting its economy in a relatively better position. And of course, the Chinese economy's focus on goods over services means it's already at an advantage during a pandemic that has shut down restaurants, bars and the like. As John Turek at the Cheap Convexity blog puts it: "China is in the midst of a durable suck in of capital, both via the trade side and the financial side. So while talk of 'dual circulation' will likely be the focus, especially post the fifth plenary, the real story is the external account." You can follow Tracy Alloway on Twitter at @tracyalloway. |

Post a Comment