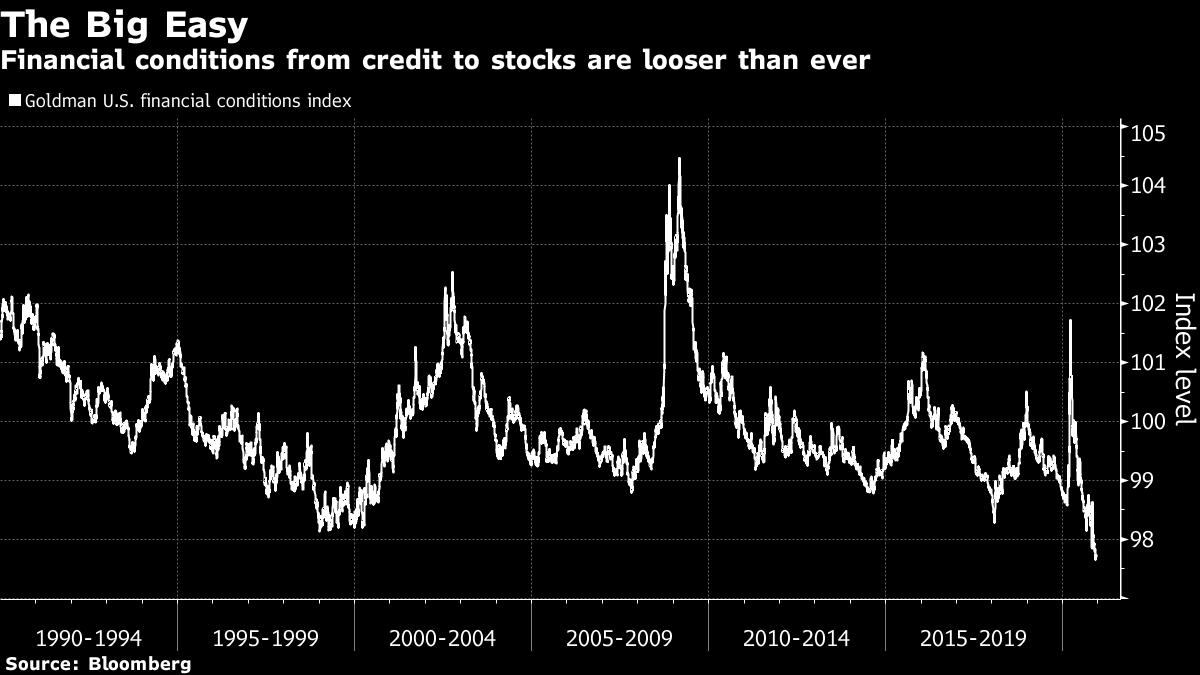

| Trump demands stimulus changes, a rush of economic data due, and Brexit talks still on a knife edge. Delay?President Donald Trump threw Congress a curveball when he expressed unhappiness with the stimulus package that passed through both legislative chambers on Monday. He demanded payments to individuals be increased to $2,000 from $600, something House Speaker Nancy Pelosi welcomed, adding that Democrats were ready to bring it to the House. Trump didn't say he would veto the bill as it currently stands, and he has until Dec. 28 to sign it. Also yesterday, the president issued a raft of pardons including for two people convicted as part of Special Counsel Robert Mueller's Russia probe. So much data The Christmas shortened week means there is a lot of economic data to get out of the way today. Initial jobless claims at 8:30 a.m. Eastern Time are expected to hold near last week's 885,000 level. There is also little good news expected in the other numbers dropping at that time, with personal income and spending for November and durable goods orders all projected to decline. November new home sales and the latest Michigan Consumer Sentiment reading are at 10:00 a.m. The oil market will be watching crude oil inventories at 10:30 a.m. and the Baker Hughes rig count at 1:00 p.m. Still talking Talks between the U.K. and the European Union over the post-Brexit relationship between both sides continue in Brussels today. After nearly nine months of negotiations and countless missed deadlines, negotiations still hang in the balance, with fishing rights remaining the big sticking point. People close to the discussion played down suggestions a deal is imminent. There was some better news for U.K. Prime Minister Boris Johnson with the announcement that French authorities would allow sea and rail connections with Britain to reopen. Markets mixed Investor reaction to the possibility that Trump may derail the stimulus package has been fairly muted so far as traders look forward to a few days off. Overnight the MSCI Asia Pacific Index added 0.7% while Japan's Topix index closed 0.2% higher. In Europe the Stoxx 600 Index had gained 0.5% by 5:50 a.m. in the wake of the French announcement that it would open its border with the U.K. S&P 500 futures pointed to a higher open, the 10-year Treasury yield was at 0.926%, while oil and gold both advanced. Bad news, good newsGerman deaths from Covid-19 rose 986 yesterday, the most since the start of the pandemic. Boris Johnson may extend the tightest lockdown to more areas of England, while even countries that thought they had the virus under control are seeing fresh outbreaks. Cases of the U.K. variant of the virus have been found in an increasing number of countries. There was some better news on the vaccine front with Pfizer Inc. nearing a deal to supply an additional 100 million doses of its shot to the U.S. What we've been readingThis is what's caught our eye over the last 24 hours. And finally, here's what Sid's interested in this morning'Tis the season for Wall Street's prognosticators to embark on the notoriously thankless task of sketching the market landscape for the year ahead. Bloomberg News will deliver its annual wrap of major calls on Jan. 4, but already the pattern is becoming clear: Even after a historic pandemic made a mockery of every best-laid investing plan, the sell-side is full of conviction that more market gains lie ahead. Everywhere. More juice for emerging markets. More for value stocks. More for small caps. A steeper yield curve. A rally in financials. A credit supercycle on steroids. Even hated Europe stocks are finding fresh love these days. With trillions of dollars still tucked away in safe assets from bonds to money market funds, fresh inflows can power the cross-asset rally anew next year. But all this euphoria is striking, with a pandemic raging, new lockdowns beckoning and vaccine plans hitting roadblocks. There's also the fact that risk assets are already trading at historic prices. Almost 40% of S&P 500 companies are now severely overvalued, the most in more than 40 years, according to SentimenTrader, who cite a price/earnings ratio above 30. Even if everything goes to plan in 2021, the market looks all set for a reality check given the froth.  Follow Bloomberg's Sid Verma on Twitter at @_SidVerma Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close.

Five Things will return on Jan. 4 |

Post a Comment