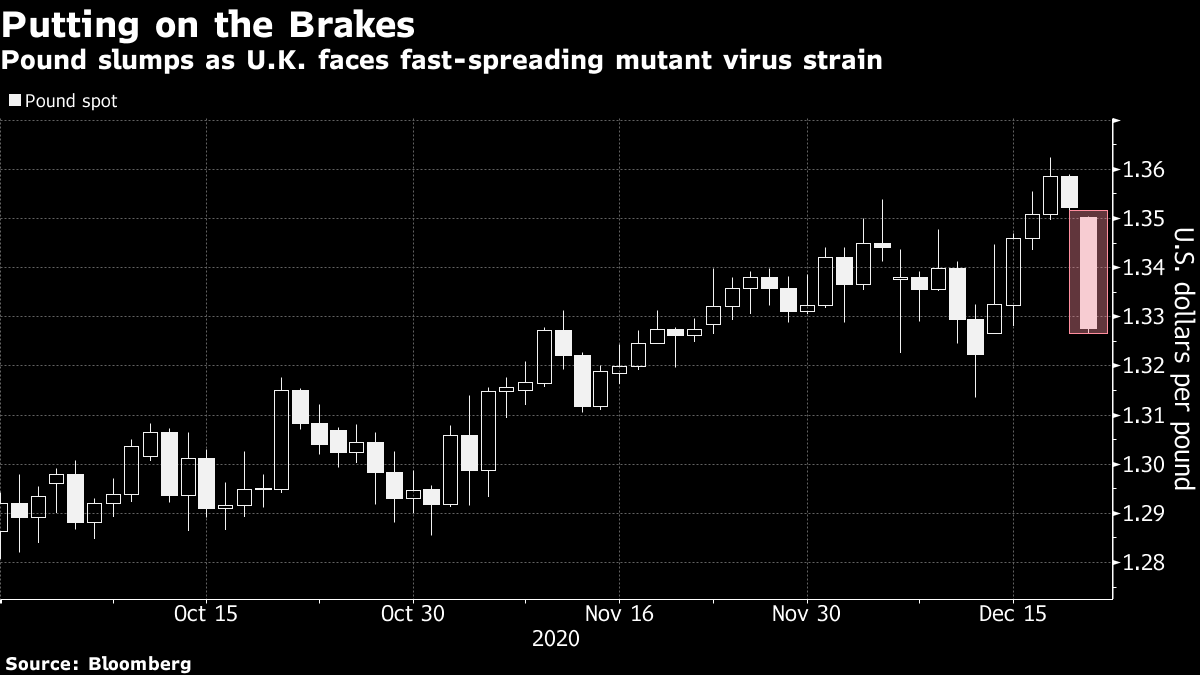

| Lawmakers to vote on stimulus package, mutant Covid strain isolates U.K., and it's a risk-off day in markets. Today!The House and Senate will vote today on a roughly $900 billion pandemic relief package, with the White House saying President Donald Trump would sign it. The deal includes help for small businesses, the jobless and direct payments to most Americans. The bill that lawmakers will vote on will be attached to a $1.4 trillion measure to fund government operations through the end of the fiscal year. As part of the compromise needed to reach agreement, Democrats allowed a provision to be inserted that would prohibit the Federal Reserve from restarting a program supporting corporate bonds and small businesses due to expire Dec. 31. Isolation The U.K. has been plunged into chaos after the government revealed a new strain of the coronavirus is "out of control." Authorities effectively locked down the southeast of the country including London, restricting travel into and out of the region. Most European countries have banned flights and ships to Great Britain. Given freight travel bans, there is a risk of delays to essential food supplies in the days before Christmas. A WHO official said it could take more than a week to find out how the new strain responds to vaccines. And this...If being cut off from the rest of the world wasn't enough of a headache for British Prime Minister Boris Johnson, he also faces Brexit negotiations that continue to drag on without a deal. With only days left until the U.K. leaves the European Union's Single Market, talks remain deadlocked over the issue of fishing rights. The European Parliament, which has a veto over the whole agreement, warned it won't be able to ratify any deal in time for the end of the transition period on Dec. 31. The bad weekend for the U.K. can be seen most clearly in the foreign-exchange markets where the pound has dropped more than 2.2% against the dollar. Risk offInvestors are seeking safety as concerns rise about the mutant Covid strain in the U.K. and more travel restrictions. Overnight the MSCI Asia Pacific Index dropped 0.7% and Japan's Topix index closed 0.2% lower. In Europe the Stoxx 600 Index had plunged 3.3% by 5:50 a.m. Eastern Time with every industry sector firmly in the red. S&P 500 futures were down more than 2.5% and the 10-year Treasury yield was at 0.888%. Oil also plunged and gold dropped. Coming up... The Chicago Fed National Activity Index for November is at 8:30 a.m. Tesla Inc. shares start trading on the S&P 500 Index, and early signs are for a difficult start with the companies shares 6% lower in premarket trading. With this being Christmas week, Wednesday is a busy one for economic data with jobless claims, durable goods orders and personal income all published then. What we've been readingThis is what's caught our eye over the weekend. And finally, here's what Sid's interested in this morningThe world is rushing to close off connections with the U.K. including air, ferry and rail travel. Brits are once again fretting about the threat of food shortages. Overseas logistics companies are cancelling business plans given the risk that inventories and equipment will be stuck on the island. Welcome to the home of a new coronavirus mutation ending the free movement of people, goods and services -- with or without a hard Brexit. All this means the fact the negotiators have just missed yet another deadline on forging a new European trading deal is of diminished real-world significance right now. Yet, it's worth mentioning that the European Parliament now has no time to ratify any deal before the transition period ends this year. And the bloc's 27 national governments will still have to have a say in any 11th hour agreement that's looking less and less likely.  One view will naturally hold that the U.K. has an extra incentive to adopt a more accommodative stance, given its already ruptured supply chains and intensifying economic woes. Even before news of this new virus strain broke, households were increasing their savings at a fast clip. But equally, with Brits so gloomy, the economy on the floor, supply chains already frazzled and Brexit expectations so low, a hard departure from Europe's trading bloc may not feel like a material blow -- increasing the incentive to go it alone. Follow Bloomberg's Sid Verma on Twitter at @_SidVerma Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment