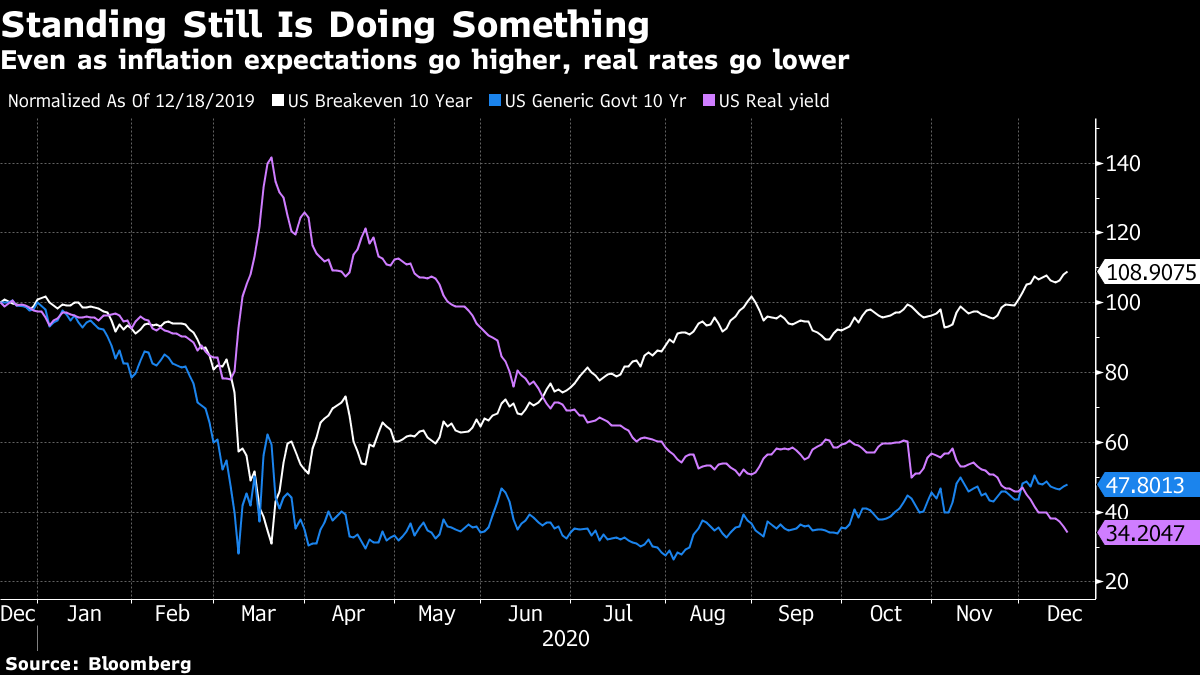

| The Fed continues buying bonds. Trump's spy chief mulls China's role in election meddling. Australia's stock market is set for big things next year. The Federal Reserve strengthened its commitment to support the U.S. economy, promising to maintain its massive asset purchase program until it sees "substantial further progress" in employment and inflation, in doing so scrapping their previous pledge to keep buying "over coming months." They didn't announce changes to the composition of purchases, as some economists had predicted. The Fed meeting came as lawmakers on Capitol Hill tried to wrap up an agreement on new stimulus after months of deadlock, and earlier data showed U.S. retail sales dropping by more than forecast in November and business activity growing at a slower pace in December. President Donald Trump's spy chief is considering stalling delivering a report to Congress that covers foreign efforts to sway the Nov. 3 election. Director of National Intelligence John Ratcliffe says that China should be cited more prominently for its attempts to influence American voters, according to people familiar with the matter. The disagreement is dividing U.S. intelligence officials and analysts, with the report due to be handed in on Friday. Meanwhile, the U.S. Treasury Department designated Switzerland and Vietnam as currency manipulators for the first time, while keeping China on a watch list, though traders in Vietnamese assets aren't likely to be ruffled. Asian stocks looked set to follow gains on Wall Street amid speculation lawmakers are edging closer to a stimulus deal aimed at reviving the world's largest economy. Treasuries fell as the Federal Reserve disappointed some traders who expected changes to its bond buying program. Futures rose in Japan and Australia, and were little changed in Hong Kong. Treasuries pared some losses, with the yield on 10-year notes remaining just above 0.9%. The dollar edged lower. Elsewhere, oil closed higher on a surprise decline in U.S. crude inventories. Australia's stock market struggled to regain ground during the pandemic, while the U.S. surged as investors continued their love affair with all things tech. Next year looks different: With a vaccine-fueled global rebound benefiting cyclical shares, Australian stocks are set to shine. Strategists from AMP Capital Investors and Commsec expect the local benchmark to reach a record high in 2021, while Macquarie Group forecasts double-digit returns amid a recovery in earnings on economic stimulus and rising commodity prices. That's likely to be a boon for the economy too, after the country stuck with a conservative iron ore price forecast in its latest budget update, setting the nation up for a windfall. New Zealand aims to begin vaccinating its entire population against Covid-19 in the second half of next year in its largest-ever immunization program, Prime Minister Jacinda Ardern said Thursday. The nation's currency rose. The government has secured two additional vaccines from pharmaceutical companies AstraZeneca and Novavax, and will have enough for all five million New Zealanders, and it will all be free to the public. New Zealand has eliminated community transmission of the virus but the country's border remains closed, a big blow for the important tourism industry and the economy. What We've Been ReadingThis is what's caught our eye over the past 24 hours: And finally, here's what Tracy's interested in todayEarlier this month, I wrote about the "Fed feedback loops" thesis. That's , the idea that the U.S. central bank is easing even as it does nothing: Keeping monetary policy loose as the economy recovers further stimulates recovery and makes monetary policy even looser. That view seems to be gaining some credence, with Michael Dardas at MKM Partners reportedly saying recently: "If the neutral rate/velocity of money are rising, the Fed will be easing policy simply by standing still ... In other words, by 'doing nothing' the Fed is actually doing something."  It's a point worth remembering as the market digests the Federal Reserve's latest policy decision. The central bank chose to do a big fat nothing even as it identified some near-term risks, pledging to keep its bond purchases going until it sees "substantial further progress" in employment and inflation. In doing nothing while inflation expectations rise, the central bank is choosing for monetary policy to grow looser. You can follow Tracy Alloway on Twitter at @tracyalloway. |

Post a Comment