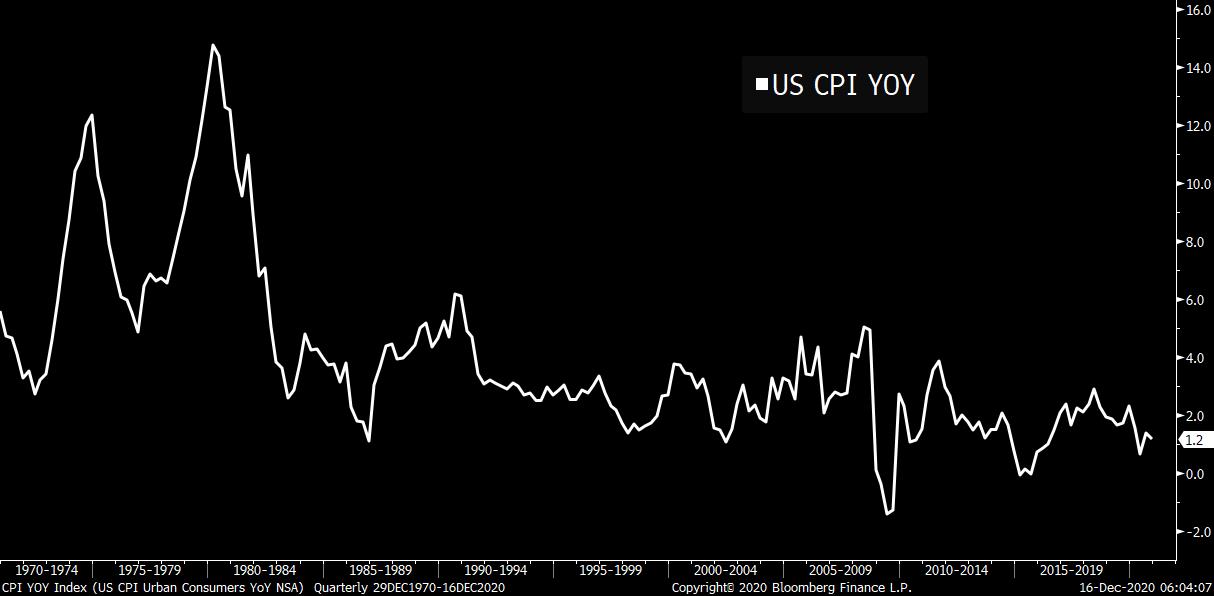

| No stimulus deal yet, decision day at the Fed, and a health check for the economy. Today?The top congressional leaders from both parties met for several hours yesterday and afterwards reported that they are making progress while not there on an accord yet. Later today lawmakers are expected to unveil a $1.4 trillion omnibus spending bill which must be passed by Friday to avert a government shutdown. Across the Atlantic, negotiations continue over a post-Brexit trade deal between the U.K. and the European Union with signs of cautious optimism from both sides that agreement can be reached. Decision day The Federal Reserve is all but certain to announce it is holding interest rates unchanged when the latest monetary policy decision is released at 2:00 p.m. Eastern Time. The statement will be accompanied by economic forecasts and followed 30 minutes later by a press conference with Chair Jerome Powell. For investors, the biggest thing will likely be any comments on progress of the asset purchase program, currently at $120 billion a month. Analysts at Goldman Sachs Group Inc. said there is a possibility of a dovish surprise today that could spur further dollar weakness. PMI day The December Composite Purchasing Managers Index for the euro area published by IHS Markit came in at 49.8, just below the level that points to an expansion in the economy. The reading, well ahead of economist expectations for 45.7, was boosted by German manufacturing and French services. The euro rose above $1.22 for the first time since 2018 in the wake of the better-than-expected numbers. PMIs for the U.K. showed the country returned to growth in December as stockpiling boosted manufacturers. Markit's numbers for the U.S. economy are due at 9:45 a.m. Markets riseStock investors holding onto stimulus optimism got rewarded this morning from the economic data ahead of the Fed decision. Overnight the MSCI Asia Pacific Index added 0.8% while Japan's Topix index closed 0.3% higher. In Europe the Stoxx 600 Index had gained 0.9% by 5:50 a.m. with every industry sector in the green. S&P 500 futures pointed to a higher open, the 10-year Treasury yield was at 0.923% and gold gained. Coming up... U.S. retail sales data for November is released at 8:30 a.m. with expectations for a 0.3% contraction. The December NAHB housing market index is at 10:00 a.m. and oil traders are expecting an increase in crude stockpiles when the data is released at 10:30 a.m. The Northeast of the U.S. is forecast to get hit by a storm which could blanket the region in snow from this afternoon. What we've been readingThis is what's caught our eye over the last 24 hours. And finally, here's what Joe's interested in this morningYesterday I got annoyed because I read a note that said that the stimulus deal being debated in Washington would represent the "(un)official kick-off of Modern Monetary Theory." For one thing, if there is a deal, it will just be a garden-variety fiscal relief bill, the likes of which Congress has passed multiple times in the past. Granted it's a big deal, and potentially very important, but qualitatively it wouldn't be particularly novel. Furthermore MMT isn't really a thing that gets kicked off like this. To the extent that MMT offers specific policy prescriptions, it's about permanently reorienting our approach to fiscal policy, not doing one-off deals with clear-end dates. Anyway enough ranting. I was thinking about this note in the context of a conversation we had on TV with Jens Nordvig, the founder of Exante Data, discussing inflation and the myth that the Fed can generate inflation on its own just by expanding measures of the money supply. Jens wrote a blog post on the subject here. A key point he made is that to the extent inflationary pressures start to build in the economy, it not only requires fiscal support, it requires "sustained" fiscal support. One bill likely won't cut it.  If you look at CPI (or core CPI, or really any inflation measure) over the last 40 or so years, you see a big downtrend, punctuated by episodes where it falls, and then rises, but usually to levels that are below the peak of the prior cycle. If you're concerned about inflation, what matters is what kind of policy changes happen on a long-term or permanent basis that would change the trend, not one bill here or there temporarily providing relief in the middle of a pandemic. Joe Weisenthal is an editor at Bloomberg. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment