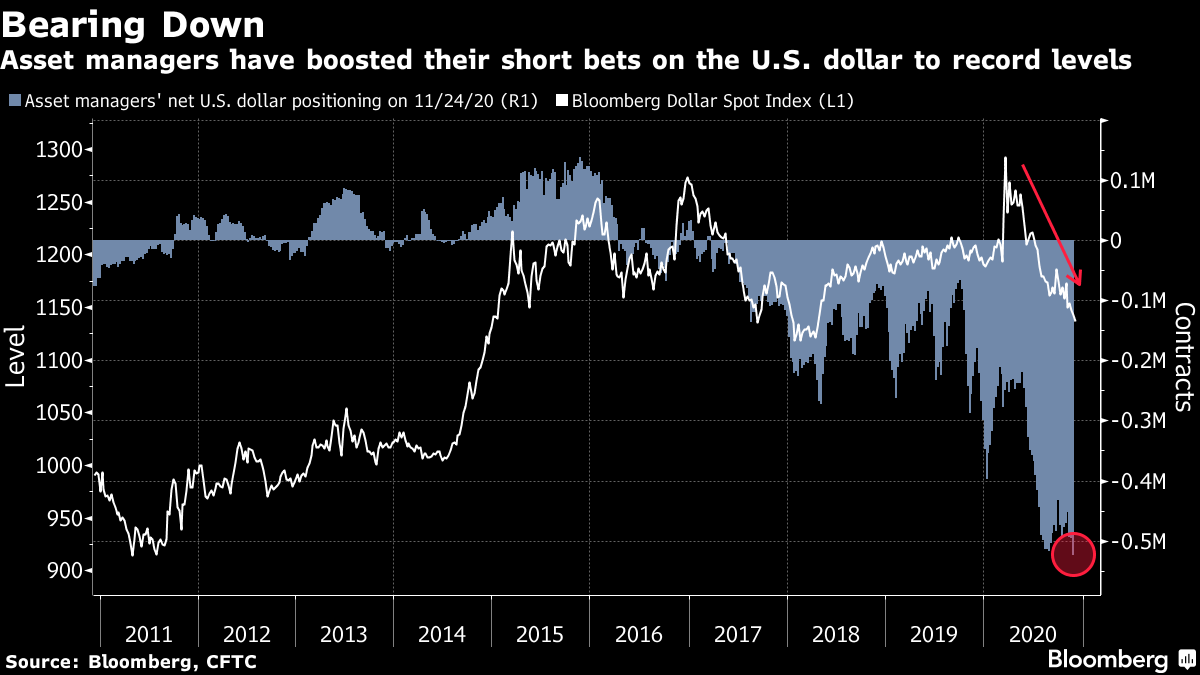

| Want the lowdown on what's moving European markets in your inbox every morning? Sign up here. Good morning. Countdown to BioNTech's vaccine, a delicate stage in post-Brexit trade talks and signs of a bidding war for G4S. Here's what's moving markets. Just WeeksThe first U.S. shipments of BioNTech and Pfizer's coronavirus vaccine will be delivered on Dec. 15, CNN reports, citing an Operation Warp Speed document it obtained. Meanwhile, the Telegraph reported that the shot may gain U.K. approval by the weekend, with distribution, aided by the NHS and the military, ready to start only hours later. Earlier, the country had invoked a special rule allowing it to bypass EU health authorities to speed up vaccines' clearance. The EU's European Medicines Agency said it could issue an opinion within weeks, with a meeting for its assessment scheduled for Dec. 29 at the latest. Incredibly DelicateBritish and EU negotiators are racing to strike a post-Brexit trade deal before the end of the week. While intensive, round-the-clock talks in London are making progress, genuine disagreement remains on the two biggest obstacles, namely fisheries and a level playing field for business, people with knowledge of the discussions said. However, two officials said the general mood on both sides is one of optimism. The next few days are crucial, with the U.K. and EU teams hoping that an agreement can be reached on Friday or over the weekend. One official warned that while a final picture was beginning to emerge, the situation remains incredibly delicate. Bidding WarThe fight to buy British security firm G4S is heating up, with Canadian peer GardaWorld likely to raise its hostile offer ahead of today's deadline, according to people familiar with the matter. Some key G4S shareholders rejected Garda's previous 190 pence per share offer as too low, urging an improvement to 220 pence as the basis of more serious talks. Rival suitor Allied Universal is preparing a fresh offer of its own. They have another week to outbid any offer Garda makes today. Elsewhere on the deals front, Salesforce sealed its acquisition of Slack for $27.7 billion in cash and stock, and Airbnb estimated a price range of $44 to $50 for its long-awaited IPO, implying a market value of as much as $35 billion. New PushEfforts in the U.S. Congress to pass additional coronavirus relief crept ahead Tuesday as House Speaker Nancy Pelosi presented a fresh Democratic proposal and Senate Majority Leader Mitch McConnell floated a revision of his much smaller plan to fellow Republicans. McConnell said his plan has President Donald Trump's backing. Meanwhile, President-elect Joe Biden said that any package passed in a lame duck session would likely be "at best just a start." The sudden emergence of the proposals after a six-month stalemate followed evidence that surging Covid-19 cases are undermining the economic recovery as past fiscal support runs out. Coming Up…European stock futures are pointing lower after a mixed session in Asian markets. Upcoming earnings include gas mask maker Avon Rubber, which saw its stock price more than double this year, and vodka maker Stock Spirits, another lockdown outperformer. Spanish jobless claims data for November are expected to show a worsening trend. In the afternoon, Poland's central bank is expected to keep its base rate unchanged. What We've Been ReadingThis is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morningThe investment world's least-favorite currency continued to conform to expectations Tuesday as the dollar slumped to its lowest in more than two years. The greenback's deepening slide has prompted asset managers to boost their bearish bets on the currency to record levels, according to the latest data from the Commodity Futures Trading Commission going back to 2006. Net dollar short positions held by institutional investors such as pension funds, insurers and mutual funds hit an all-time high last week, based on an aggregate of positioning in eight currencies courtesy of my colleague Masaki Kondo. But whenever an overwhelming consensus appears in a market, it's often time to take the other side. Tuesday's dollar slide came despite a spike higher in Treasury yields, an unusual divergence that is unlikely to be sustained if bonds continue to sell off. And the euro's surge past the $1.20 level will reignite chatter about whether the European Central Bank might respond, which could also trigger a quick reversal. If you're betting against the dollar now, you are not alone, but remember misery loves company.  Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment