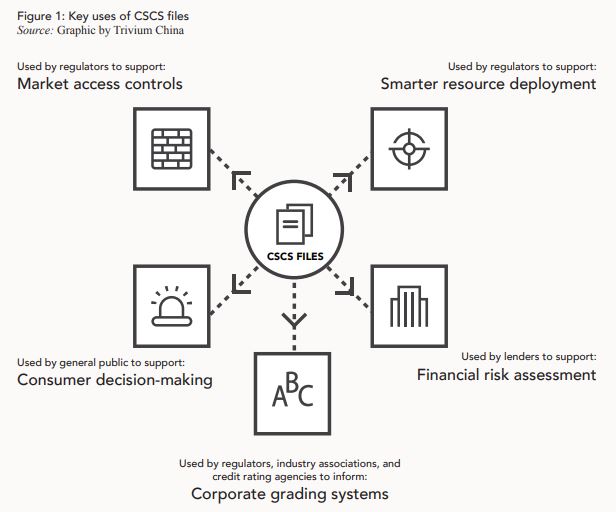

| The U.S. cracks down on China tech companies. Australia cancels an order for 51 million vaccine doses. Airbnb shares double. The U.S. Federal Communications Commission ordered carriers to remove equipment made by Huawei, and commenced a proceeding asking whether to end China Telecom America's permission to operate in the U.S. "We do so for good reason," FCC Chairman Ajit Pai said about China Telecom. Security agencies contend the company hasn't complied with cybersecurity and privacy laws, and the company is owned by the Chinese government, he said. Earlier, China said it will sanction more U.S. officials and place new travel restrictions on American diplomats in retaliation for measures taken by the Trump administration over Hong Kong. Markets MixedAsian stocks looked set for a mixed start to Friday trading as investors weighed prospects for a stimulus deal in Washington against disappointing U.S. jobs data. Treasuries gained and U.S. shares ended a volatile session modestly lower. Futures were little changed in Japan, edged higher in Hong Kong and slipped in Australia. The S&P 500 dipped for a second day without any signs of a breakthrough on the top issues that have held up a deal by lawmakers. The pound slid as U.K. Prime Minister Boris Johnson warned Britain should prepare to leave the EU without a trade deal. The Australian government canceled an order for 51 million doses of a Covid-19 vaccine being developed by CSL and the University of Queensland after clinical trials ran into difficulties. The nation still has agreements to purchase three vaccines undergoing trials from other companies, and has increased orders, Prime Minister Scott Morrison said Friday. CSL said in a statement it would not progress to further clinical trials, adding that a small component of the vaccine comes from the human immunodeficiency virus, and while that posed no risk of infection, some trial participants had false positive tests for HIV. Here's more on how other shots are progressing. Meanwhile, Walmart is adding freezers and dry ice to its U.S. pharmacies to prepare for a vaccine rollout. Thousands of new funds opened this year to capitalize on the bull market in China, where stocks hit a record $10.7 trillion this month. And what a year it's been: in February, China's stock market suffered the biggest single-day loss of value on record, with more than 3,000 shares limit down. Then, amid ultra-low interest rates and a drive to stocks, index levels surged to levels not seen since the 2015 bubble. Three of China's top-performing fund managers — who made at least 100% this year with bets on stocks like China Tourism Group Duty Free, LONGi Green Energy Technology or electric-vehicle makers — explain what they are buying, selling or holding on to for 2021. Airbnb shares more than doubled in their trading debut, propelling the home-rental company to a $100 billion-plus valuation and one of the biggest first-day rallies on record. The stock opened Thursday at $146 apiece, above the $68 initial public offering price. The listing comes 24 hours after DoorDash soared in its public debut, adding to exuberance for new listings in America's equity markets as retail investors embrace companies poised to thrive as vaccines promise a loosening of pandemic restrictions. The stratospheric rises are making some question: Why weren't shares priced higher? What We've Been ReadingThis is what's caught our eye over the past 24 hours: And finally, here's what Tracy's interested in todayChina's been working on its plan to create social credit scores for companies for some time now. A new report from the U.S.-China Economic and Security Review Commission details exactly how this system, which would allow Chinese officials to track companies' behavior and then punish or reward it, is shaping up. It also contains a bigger question of whether corporate social credit scores might be part of a broader "challenge to Western financial credit models."  China's corporate social credit system Bloomberg There's an obvious link between data collection and the business of borrowing and lending. Good data tends to help the free flow of credit, and can even dictate who has access to that credit. As the commission's paper notes, this hasn't been lost on Chinese officials, with a 2018 report from China's Economic and Social Council noting that: "Mastering the right to issue a credit rating means mastering global information dominance and capital allocation rights." In other words, collecting more data about what companies are doing could end up being a valuable input into credit rating models, especially if that data leads to monetary rewards or punishments — known as as redlisting or blacklisting — by Chinese authorities that might ultimately impact the financial health of companies. Understanding exactly how that system of incentives works could also be advantageous for anyone doing credit ratings, and potentially give China's domestic agencies a leg-up in appraising risk. For that reason, the commission notes, "It is possible that over the long-term, [China's Corporate Social Credit System] could present a challenge to U.S.-led sovereign debt and corporate bond rating models developed by S&P, Moody's, and Fitch Ratings." You can follow Tracy Alloway on Twitter at @tracyalloway. |

Post a Comment