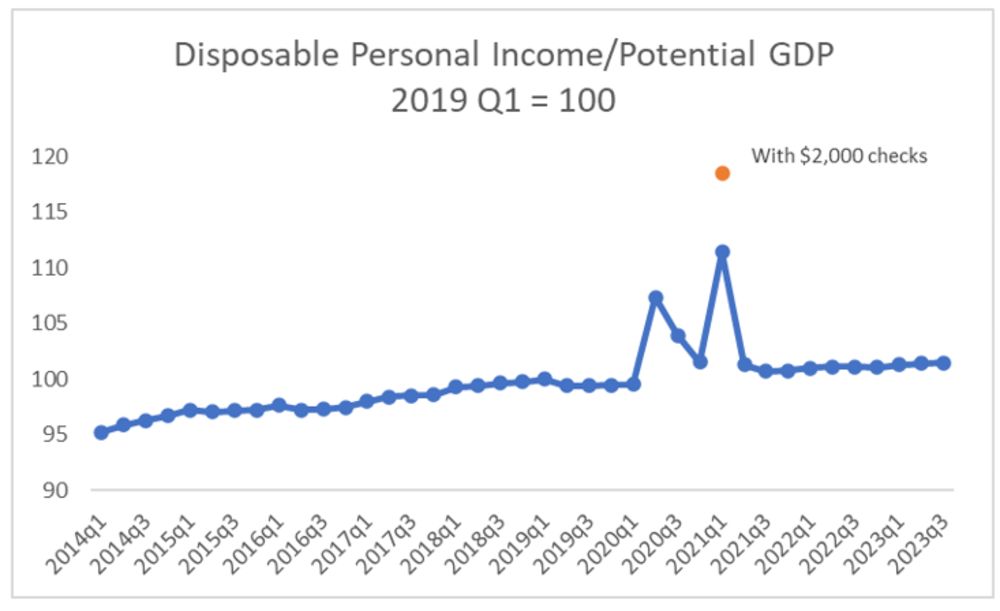

| This is Bloomberg Opinion Today, a heart-shaped box of Bloomberg Opinion's opinions. Sign up here. Today's AgendaThe $2,000 QuestionAh, 2020. In like a lion, out like Godzilla. As if this double-facepalm of a year could end without sneaking in one more exhausting plot twist — because the recent discovery of a potentially more infectious strain of the coronavirus wasn't enough — there's the latest confusing chapter of wrangling over stimulus funds. President Donald Trump finally signed a $900 billion relief measure on Sunday, though his delay in doing so deprived millions of Americans a week of expanded unemployment assistance. Why he held up the funding even as Covid-19 cases ballooned across the country, only to cave and sign it without scoring any wins is a mystery. But now, Democratic lawmakers and Trump are actually aligned on something: wanting to replace the $600 in stimulus payments included in the new law with $2,000 checks instead. It sounds good, in theory. And to the extent that Trump sees the stock market as the ultimate (even if misleading) grading scale of his presidency, investors like any talk of free money, too. The S&P 500 index continued its record-breaking ascent Monday, climbing 0.9%. But here's the rub: Do we really need those $2,000 checks? The chart below would suggest not, and distributing these direct payments would be a mistake that could overheat the economy, Lawrence H. Summers writes.  That's because family incomes aren't down all that much. Providing more targeted relief and resources to get the country's raging virus problem under control — rather than making a larger Tooth Fairy-like deposit to everyone's bank accounts — may be more effective in motivating consumer spending and getting back to normal, Summers writes. Then again, a return to normal may be more painfully distant for some who are out of work, such as employees of restaurants and movie theaters that may not bounce back even after vaccines mitigate the virus threat. - Further recovery reading: Prioritizing vaccination of teachers and child-care workers is one way policy makers can help minority women, who have been among the hardest hit by the crisis. — Luisa Blanco

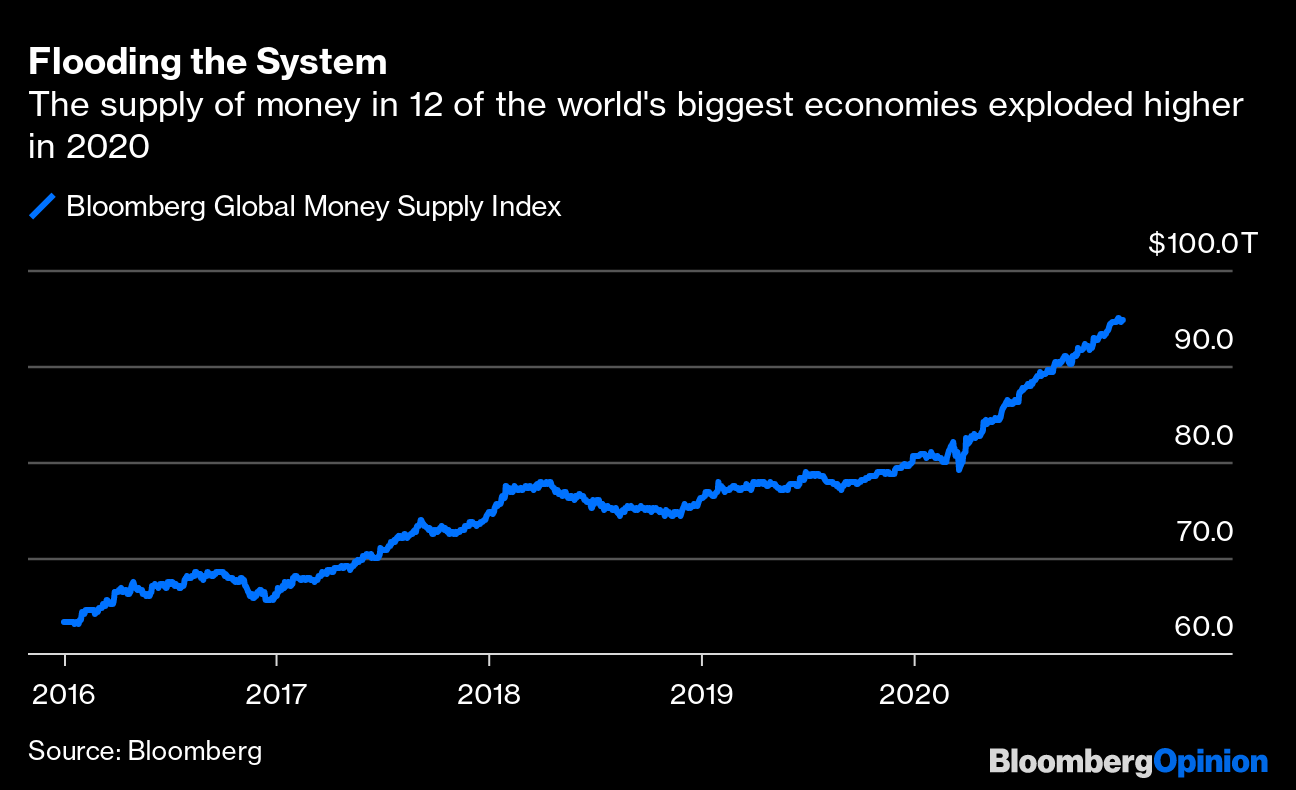

The Valentine's Day GoalpostIn a year like this, it helps to set mental checkpoints because thinking too far ahead can be daunting. We don't know how long we'll be wearing masks in public, avoiding our dearest friends or subsisting on hand sanitizer and reruns of "The Office." And in all likelihood Covid-19 cases will have exploded over the holidays, restoring the dreadful sense that this pandemic will never end. But for now, set your sights on Valentine's Day as the next checkpoint, because Cathy O'Neil has a prediction: that the numbers of cases will start to fall by mid-February. She writes that as more people get vaccinated, there's likely to be a greater-than-linear effect on cases and deaths. That's because just as each Covid-positive person has the potential to kick off a chain of infections, for each vaccination you'll have someone not infecting a whole bunch of people. So buy as many heart-shaped boxes of chocolates that it takes to get you through these lonely next few weeks, and things may be looking more hopeful by then. And just think, if you don't have a Valentine date this year, you're doing this whole social-distancing thing right. A Unicorn Loses Its SparkleWorse than not having a Valentine? A holiday breakup. Chinese regulators didn't outright suggest one, but they came close in ordering over the weekend that billionaire Jack Ma — the 25th-richest person in the world — rein in his Ant Group Co. and return it to being just a payments provider. For U.S. readers, this would be a bit like the government telling Jeff Bezos that Amazon.com Inc. must go back to primarily selling books. Ant's growth lately has come from providing consumer loans and wealth management, and the company had been looking to go public at a $300 billion valuation as a result. But those plans were derailed by Beijing in November after Ma likened the country's financial system to pawnshops. With Ant now seemingly cut off from its biggest growth avenues, it's a far less valuable business, Tim Culpan writes. Shuli Ren adds that the broader takeaway is that China is showing it's no place for ESG investing. Telltale ChartsA search for the underlying causes of this year's rallies in stocks, junk bonds and cryptocurrencies led Robert Burgess to one number: $14 trillion. That's how much the aggregate money supply increased in 12 of the world's biggest economies.  Oil became the smallest sector of the S&P 500 as we stopped traveling this year. While that may be just a temporary side effect of the pandemic, the industry still needs to spend like oil is going out of fashion, Liam Denning writes. Further ReadingDefined-benefit pensions are headed for worsening shortfalls as the Federal Reserve holds down interest rates. — Brian Chappatta Christopher Nolans' "Tenet" spy thriller is full of noise — in the behavioral economics sense, that is. — Cass R. Sunstein How will historians look back on 2020: the onset of a new dark age, or a new beginning? — Hal Brands Trump's export controls may backfire by hurting U.S. companies more than China. — Noah Smith Exhausted by the U.K.'s Brexit ordeal already? The negotiations are far from over. — Bloomberg's editorial board ICYMIPrivate equity firms are buying up doctors' offices and forcing patients to sign binding arbitration forms. Carnival Cruise Lines' new roller-coaster-equipped "Fun Ship" is ready to set sail. Bitcoin at more than $27,000 is on its longest monthly winning streak since mid-2019. KickersAirbnb doesn't want you to have a New Year's Eve party. David Attenborough is hopeful that the pandemic made humans appreciate nature more. "Home Alone" fans, can you solve Scott Duke Kominers' most labyrinthine puzzle of the year? Note: Please send candy hearts and complaints to Tara Lachapelle at tlachapelle@bloomberg.net. Sign up here and follow us on Twitter and Facebook. |

Post a Comment