| Welcome to the Brussels Edition, Bloomberg's daily briefing on what matters most in the heart of the European Union. If EU officials had a say in the U.S. election, there's little doubt for whom they'd vote. It's hard to name a single policy area on which the EU and Donald Trump's administration see eye to eye: He left the Paris climate accord, deemed by the EU as essential to avert the catastrophic overheating of our planet. He pulled the plug on the Iran nuclear deal. He imposed tariffs on European goods and sought to discredit the WTO, the guardian of the rules-based trade order. He rejoiced at Brexit, scolded his allies over defense spending, and threatened them over their push to tax U.S. tech giants. Trump does have a few fans among eastern European leaders, but the house view in Brussels is that a Joe Biden win is necessary to mend transatlantic ties. Today we find out if America agrees.

— Nikos Chrysoloras and Viktoria Dendrinou What's HappeningVienna Attack | At least three people have been killed and many more wounded in a terror attack in Vienna last night, which follows a series of brutal killings in France. While the circumstances are being investigated, one thing is clear: it will further polarize debate in a continent already struggling with the steepest recession on record and a deadly pandemic.

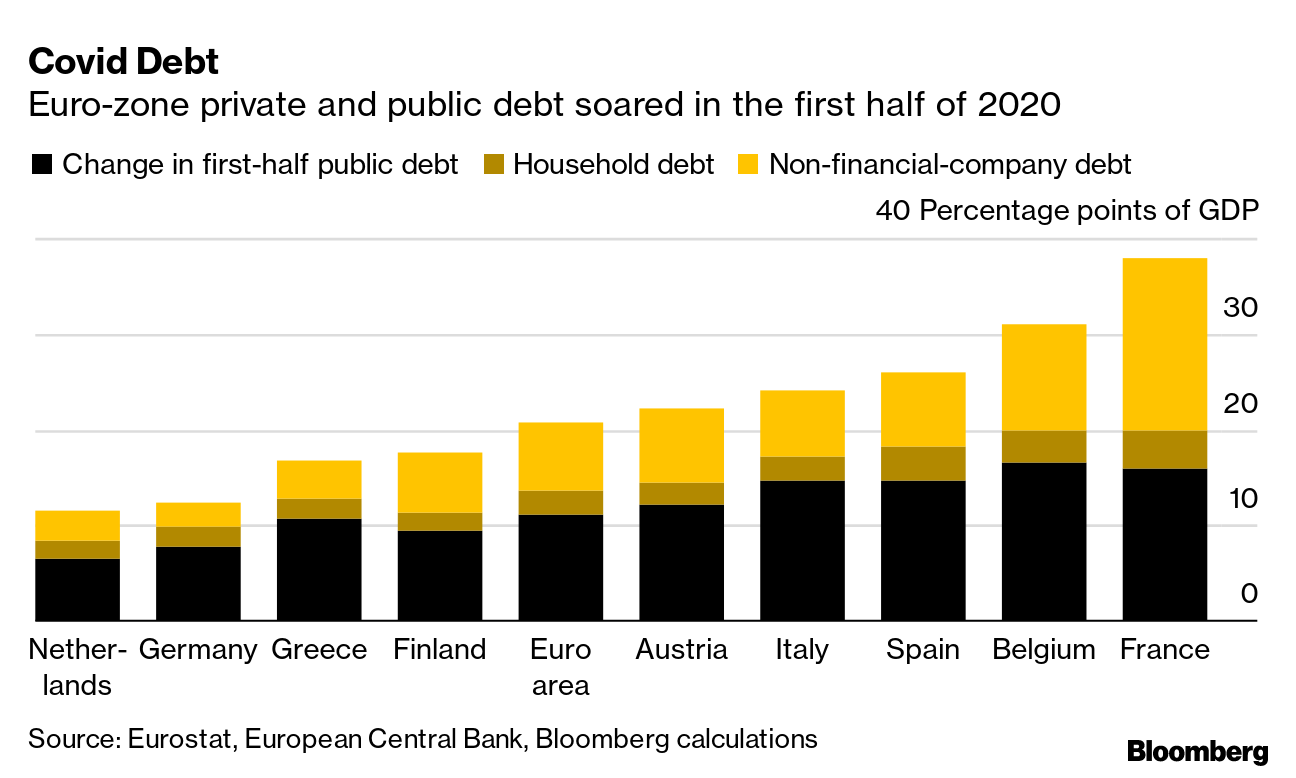

Economy Talks | Euro area finance ministers today will discuss the economic impact of the second wave of the coronavirus. With the EU's recovery fund not yet operational and other support tools still unused, there's not much they can do. Still, looming large over the debate will be their ballooning fiscal needs and deteriorating public finances. Virus Update | Italy laid out new plans to try and halt the spread of the virus as large swathes of Europe prepare to enter lockdown and global fatalities topped1.2 million, after the deadliest week in the pandemic since April. Here's the latest. More Hurdles | The WTO's effort to select a new leader next week could be delayed for at least one more month with Geneva's strict new lockdown measures. The development could further disrupt the trade body's ability to confirm Nigeria's Ngozi Okonjo-Iweala as its first African and first woman leader – although that's far from the greatest hurdle to her appointment. In Demand | The EU is seeking to build on the record-breaking demand for its new social bonds by exploring the appetite for a second round of such debt. The bloc has sent banks a request for pricing and strategists predict a sale as soon as next week. The level of demand in the first sale took strategists by surprise and left investors looking for more. In Case You Missed ItFleeting Recovery | German manufacturing drove Europe's uneven recovery in October, which saw a fourth consecutive monthly increase in euro-area factory output. Still, the pickup will almost certainly be derailed now by new restrictions to contain Covid-19, and governments are already announcing new support to help companies through the crisis. No Backing | Support for Poland's ruling party plunged after its chairman defended a Supreme Court abortion ruling, denounced protesters and called on people to defend churches "at all costs." The verdict further tightened one of Europe's strictest abortion legal regimes and requires that fetuses with lethal birth defects be carried to term and delivered. OECD Boss | Ten countries nominated candidates to head the OECD, with the U.S. facing off against Sweden, Greece and Canada among others. As the organization is at the heart of discussions on highly contentious digital taxes, the race to appoint someone to its helm could get heated. Here's a look at the candidates. Collision Course | Ten of the biggest banks in Europe set aside the least amount of money in the third quarter for doubtful loans since the onset of the coronavirus, with some wanting to restart dividends or give out bigger bonuses. The tone is in stark contrast with a deteriorating backdrop of new infections. and risks putting bankers on a collision course with regulators. Continental Flight | Germany will take the lion's share of assets that lenders are moving out of the U.K. because of Brexit, according to the Bundesbank. The shift comes as financial centers across the EU vie to win business and well-paid bankers even as the fallout from Brexit could hit the region's economy as a whole. Chart of the Day French debt rose by double the euro-area average in the first half, with private debt pushing it to outstrip all European peers, according to Bloomberg calculations based on Eurostat and ECB data. Company debt in France rose by 18.1 percentage points of gross domestic product compared to 7 percentage points of GDP in Italy and 2.6 in Germany. Today's AgendaAll times CET. - Euro-area finance ministers hold video conference, to discuss economic outlook, digital euro, banking union

Like the Brussels Edition?Don't keep it to yourself. Colleagues and friends can sign up here. For even more: Subscribe to Bloomberg All Access for full global news coverage and two in-depth daily newsletters, The Bloomberg Open and The Bloomberg Close. How are we doing? We want to hear what you think about this newsletter. Let our Brussels bureau chief know. |

Post a Comment