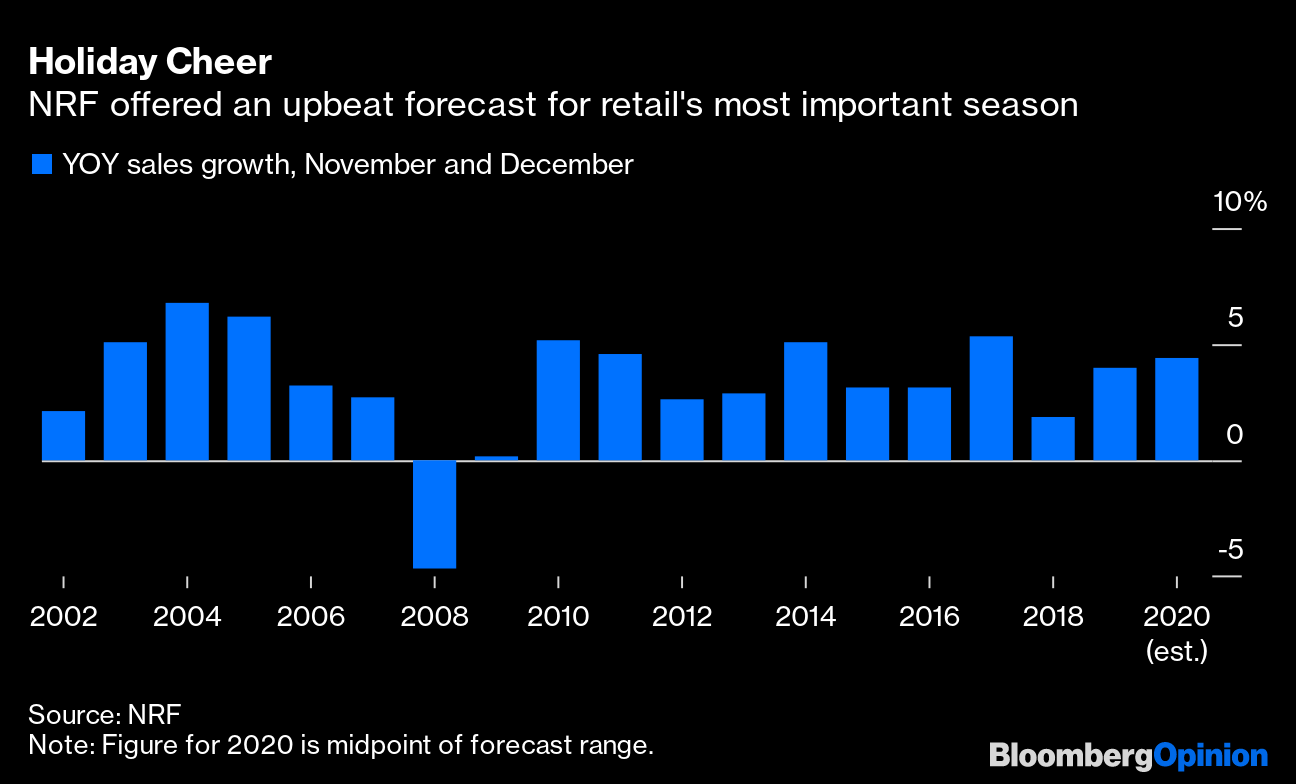

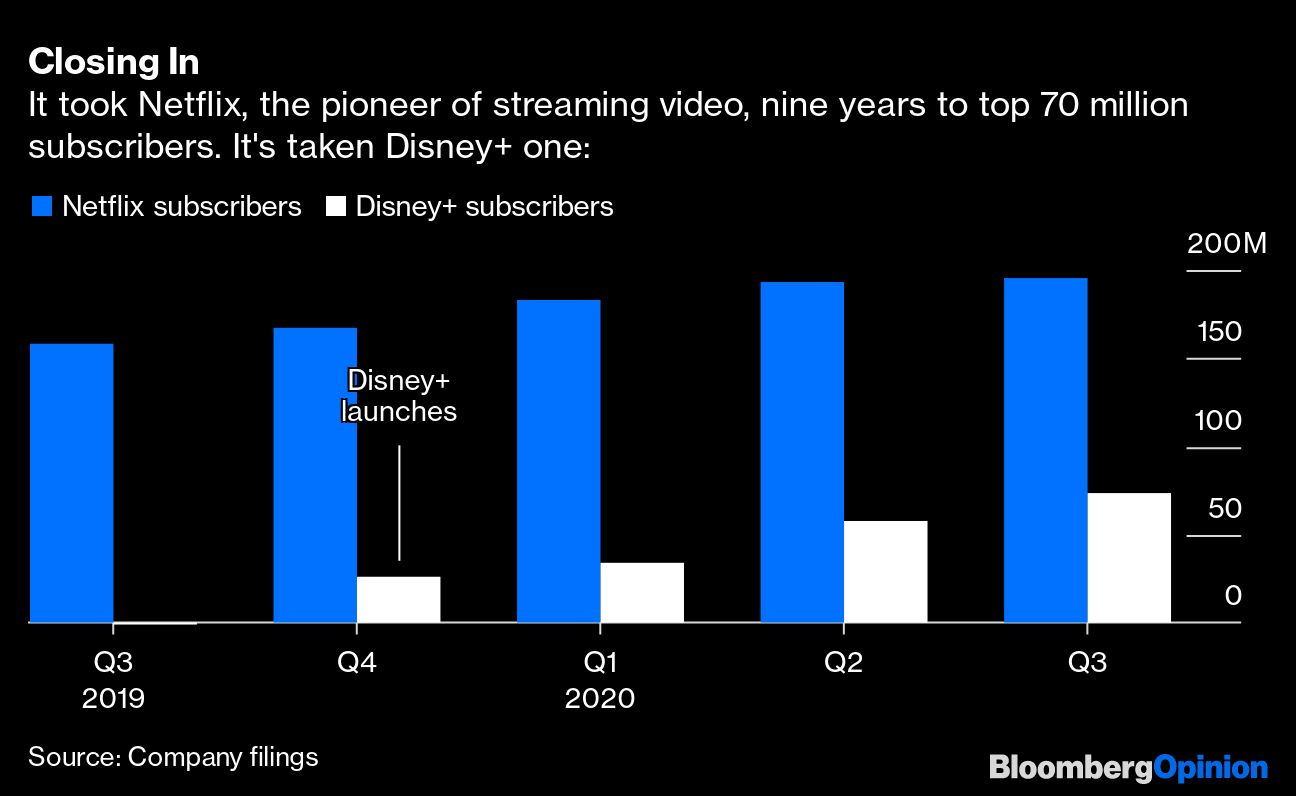

| This is Bloomberg Opinion Today, a kitchen cabinet of Bloomberg Opinion's opinions. Sign up here. Today's Agenda Dave Portnoy, having the last laugh. Photographer: John Parra/Getty Images North America Shoutin' and Yellen About Normalcy Maybe Dave Portnoy is right after all: Stocks do only go up. Take the Dow Jones Industrial Average. It's a fairly pointless stock index, but one the normies and a certain president of the United States obsess over. It rose to the round, satisfying number of 20,000 early in the term of that same president, despite warnings that his election would crash the market. Today, despite warnings from that same president that electing Joe Biden to replace him would crash the market, the Dow rose to the rounder, even more satisfying number of 30,000 — partly on confirmation Biden will soon be president. No matter what happens, it seems, stocks go up. Of course, just as the market quickly found reasons to like Donald Trump, it has very different reasons to like Biden. One of the biggest is the likely nomination of former Fed Chair Janet Yellen as his Treasury secretary. As Bloomberg's editorial board writes, Yellen has depth of experience in both fiscal and monetary policy, cares about the climate, and can forge alliances. Karl Smith worries about her orthodoxy on interest rates when she ran the Fed, which may have caused her to raise rates too soon, triggering a mini-recession that probably kept Hillary Clinton confined to Chappaqua. Her orthodoxy on government debt could be similarly bad for Biden's economy. Still, the pandemic seems to have given her religion about the importance of fiscal stimulus, writes Brian Chappatta, just as it did her successor, Jerome Powell. And it will be good to have Yellen and Powell working closely, writes Dan Moss, protecting the central bank if it must undertake further heroic efforts, while avoiding fights and bad communication. News of Yellen's gig came out around the same time Team Biden announced a bunch of other strikingly competent cabinet picks, including Antony Blinken for secretary of state and Alejandro Mayorkas for secretary of homeland security. People looking for a complete reversal of Trump's immigration policies may not care for Mayorkas, writes Noah Smith. And progressives won't like the foreign-policy picks, writes Eli Lake, given their centrism. But frustrating centrism is apparently just the prescription for a market sick of drama. A Decent Recovery, If We Can Keep ItPresident Donald Trump fanned the flames of normalcy when he finally surrendered and let General Services Administrator Emily Murphy give Biden a set of keys to the White House. Along with a steady patter of good news on Covid vaccines, investors are pricing in not just a return to 2019 normal, but 2016 normal, with a government that can handle a pandemic while mostly staying out of the way otherwise. Such bullishness isn't showing up in bond yields yet, writes Brian Chappatta. That may be because the Fed is keeping rates buried in the earth as long as possible. It could also be a recognition the economy will still need a lot of help in 2021, as Michael R. Strain warns. The Cares Act got us halfway through the pandemic, but more stimulus will have to carry us that last mile. Otherwise we may finally truly stress-test Portnoy's theorem. Further Pandemic-Recovery Reading: Europe is losing control of the virus and risks losing control of its economy without more relief. — Ferdinando Giugliano Retail Therapy Counts as Holiday ShoppingMaybe it's the leftover Cares Act funds talking, but consumer spending still seems to be holding up fairly well despite the dismal new coronavirus wave. In fact, Sarah Halzack dares you to spot the economy-crushing pandemic in this chart of holiday shopping:  No, people won't be busting down doors to get at flat-screen TVs this year, and they might not even buy as many gifts as usual. But they're still shopping for stuff, even if it's only to feel somewhat normal in the middle of all this weirdness, Sarah writes. There's that "normal" word again! Who knew it could be so intoxicating? Further Retail Reading: There's no good reason for European retailers to have a Black Friday. — Andrea Felsted Disney Needs to Grow UpThe other thing we're doing a lot of besides shopping is watching TV, which makes this a fine time for Walt Disney to have launched its Disney+ streaming service. But despite rapid subscriber growth, Disney+ is still not a moneymaker, Tara Lachapelle writes, partly because its content is still limited to kid-friendly fare (a descriptor that may not apply to "Fuzzbucket"). Adding grown-up content to the mix will help convince people to stick around and maybe even pay more.  Further ReadingThe world must pressure Abiy Ahmed to stop Ethiopia from sliding into a disastrous civil war. — Bloomberg's editorial board Goldman Sachs going to Paris makes clear London is losing European stock-trading business. — Elisa Martinuzzi A better pandemic plan and good vaccine news may mean Boris Johnson's fortunes are starting to improve. — Therese Raphael Even as he goes out, Trump shows he only cares about states that voted for him. — Francis Wilkinson Democrats blew a chance to engage with police reform constructively. They can still fix this before 2022. — Robert George Taiwan and New Zealand would make a better travel bubble than Hong Kong and Singapore. — Tim Culpan ICYMISteve Mnuchin is hiding $455 billion from Yellen. New Zealand (duh) is the best place to be during this pandemic. Herd immunity is not helping Sweden. KickersSo it begins: A monolith appears in the Utah desert. (h/t Mike Smedley) Evolutionary transitions suggest intelligent life is rare. Everything you wanted to know about carbon capture. Everything you ever wanted to know about the color palette of Garfield comics. Note: Please send monoliths and complaints to Mark Gongloff at mgongloff1@bloomberg.net. Sign up here and follow us on Twitter and Facebook. |

Post a Comment