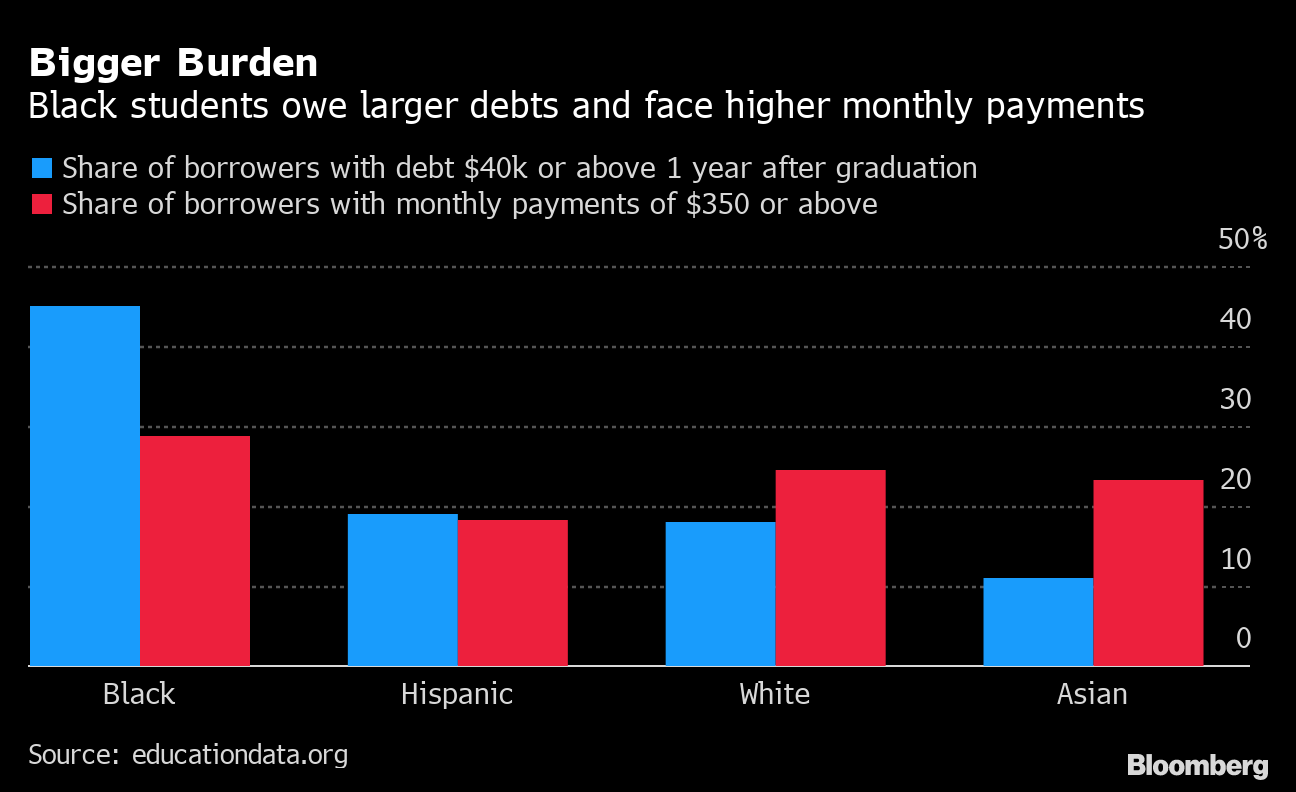

Americans owe some $1.7 trillion in student debt, a financial albatross that Biden is eager to slay. This week he called on the legislature to immediately forgive $10,000 for borrowers; he could cancel $50,000 by executive order when he takes office in January, according to Senate Minority Leader Chuck Schumer. "Student loan forgiveness is good, actually," New York Representative Alexandria Ocasio-Cortez posted in a tweet that gathered more than 454,000 likes. Writing off student debt could act as stimulus during the pandemic and eventual recovery. It could also be a boost to Black households in a country with a yawning racial wealth gap. As of now, Black students owe more, face higher monthly payments and are more likely to fall behind. One study called forgiveness "transformative" for racial and economic inequality -- but the details really do matter. Some research shows forgiving $50,000 of debt would instantly boost a Black household's median wealth by 34%.  At the same time, cancelling student loan debt disproportionately benefits people who have gone to college -- the same people who tend to be higher earners. Households in the top 40% of annual income (more than $74,000) owe almost 60% of outstanding education debt, according to a Brookings Institution analysis of Federal Reserve data, while households in the bottom 40% hold less than 20% of outstanding loans.

Student-debt forgiveness could exacerbate long-term inequality between those who have gone to college or graduate school and those who haven't, the think tank said. Other objections are political and philosophical. "Given the potential backlash, legal uncertainties, and potential for moral hazard, student debt cancellation by executive fiat might not be worth it at all," wrote Bloomberg Opinion columnist Noah Smith.

Biden's plan is more modest than the proposals from Schumer and Massachusetts Senator Elizabeth Warren. Whatever assistance is ultimately implemented, it'll add to relief programs enacted by Congress and President Donald Trump to freeze payments on federally-backed student loans until the end of the year.

"This debt is an anchor on our economy, holding back entire generations from buying homes, starting businesses and families, and adding to the economy in ways that benefit everyone," Warren tweeted. "Generations of discrimination have left communities of color with less savings and intergenerational wealth--forcing them to borrow more for the same degrees. Cancelling student loan debt will build Black and Brown wealth and help close the racial wealth gap," she added.

Whether an economic or racial-equality issue, or both, it's clear that U.S. leaders want to mitigate the rising burden on borrowers. Another small bit of relief for students and families: The consumer price index for college tuition and fees rose just 1.3% in August on a year-over-year basis, the smallest increase on record. |

Post a Comment