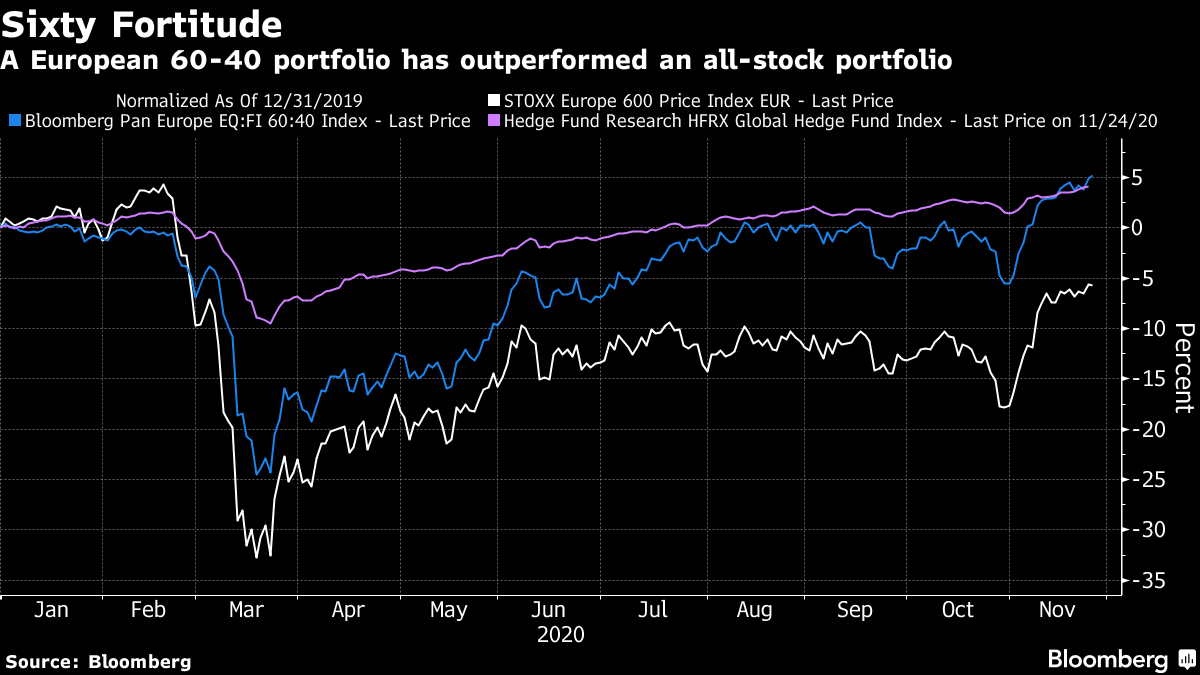

| Want the lowdown on what's moving European markets in your inbox every morning? Sign up here. Good morning. The U.K. pushes to approve vaccines ahead of Europe, difficult talks are ahead for OPEC+, and a huge financial data deal is said to draw near. Here's what's moving markets. Dashing AheadThe U.K. is poised to approve BioNTech and Pfizer's Covid vaccine as early as this week, according to a person familiar with the matter, making it the first country in the Western world to clear one of the shots under development. Foreign Secretary Dominic Raab told the BBC he hopes a roll-out can begin before Christmas, with life returning to something ``akin to normal'' by spring of next year. Last week, the U.K. government took steps to bypass EU authorities and get AstraZeneca and the University of Oxford's vaccine approved ahead of the European Medicines Agency, which still holds sway in the U.K. until the end of the post-Brexit transition period. The U.K. has purchased 100 million doses of the shot in advance, and estimates 4 million of them will be available by year-end. Tough StartA panel of OPEC+ ministers couldn't reach an agreement on whether to delay January's oil-output increase, leaving the matter unresolved before today's full meeting of the cartel and its allies. Most participants in an informal online discussion on Sunday evening supported maintaining the production curbs at current levels into the first quarter, said a delegate. Yet while Russia spoke in favor of postponing the supply hike that's currently scheduled to happen in the new year, the United Arab Emirates and Kazakhstan were opposed, said the delegate, asking not to be named because the talks were private. Unless the agreement is revised this week, they will restart about 1.9 million barrels a day of halted output, potentially pushing the global market back into surplus and undermining the recent surge in crude prices. Point of PrincipleU.K. Prime Minister Boris Johnson's officials believe a Brexit trade deal could be reached within days if both sides continue working in "good faith" to resolve what the U.K. sees as the last big obstacle in the talks -- fishing rights. "I think it's important that the EU understand the point of principle," the country's Foreign Secretary said ahead of what could be the final week of talks to secure Britain's post-Brexit trade relationship with the EU. If negotiations fail, millions of businesses and consumers will face higher costs, with tariffs on goods as well as disruption to critical supply chains. The Brexit transition period ends on Dec. 31, when the U.K. is scheduled to leave the EU's single market and customs regime. Data DealS&P Global is in advanced talks to buy IHS Markit for about $44 billion, according to a person familiar with the matter, amid increasing demand for data particularly from the finance industry. An announcement could come as early as today, the person added, declining to be identified because the information isn't public. Representatives for S&P Global and IHS Markit didn't immediately respond to requests for comment. The tie-up would be the year's second-biggest deal, coming behind the $56 billion set of transactions among China's biggest oil and gas companies to sell their pipeline networks to a new national carrier. In other M&A news, Taiwan's GlobalWafers said it's in advanced talks to buy German silicon wafer maker Siltronic for 3.75 billion euros. Coming Up…Euro Stoxx 50 futures are pointing lower ahead of the final trading session of what could be the best month ever for Europe's main equities gauge. The LSE's Turquoise Europe trading platform goes live in Amsterdam this morning. Also, according to people familiar, Philip Green's Arcadia Group is poised to file for insolvency as soon as today, putting as many as 13,000 jobs at chains including Topshop at risk. What We've Been ReadingThis is what's caught our eye over the weekend. And finally, here's what Cormac Mullen is interested in this morningFor all the handwringing over the outlook for a balanced portfolio of stocks and bonds, in reality it looks like it will be another year of solid performance for 60/40. A model portfolio composed of 60% European stocks, 40% bonds has climbed about 5% year-to-date through Thursday, according to a Bloomberg index. That's a touch more than the 4% gain in the HFRX Global Hedge Fund Index and streets ahead of the 6% decline in the Stoxx 600. As my colleague Gregor Stuart Hunter recently pointed out, the U.S. version has performed more or less in line with the S&P 500 Index. The strategy's resilience is a rebuttal to the many critics who have been calling for its demise for some time. Adding a hefty chunk of bonds to a basket of stocks has been a staple of diversified investing for decades, with the more stable fixed income component acting as a balance to riskier growth-sensitive equities. This year has seen periods when stocks and bonds have moved together, which critics have seized upon to disparage the strategy. The argument went that bonds can't be a hedge against equities if they both rise and fall together. But that's a misunderstanding of the concept of 60/40 investing, one meant to result in a diversified portfolio for the longer-term investor, not a short-term focused absolute-return hedge fund.  Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment