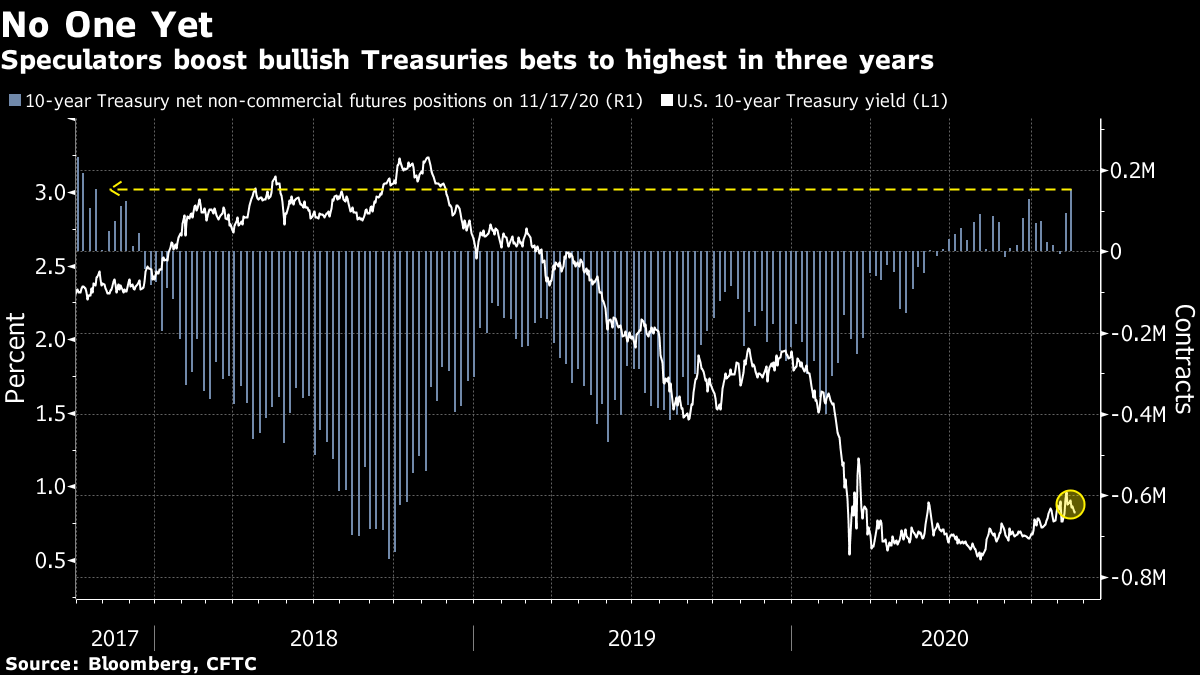

| Good morning. Dollar weakness continues amid vaccine optimism and the U.S. reportedly plans to ban exports to some Chinese tech firms. Here's what's moving markets. Dollar's DeclineThe dollar dropped to a two-and-a-half year low as fast-tracked plans to roll out a Covid-19 vaccine in the U.S. bolstered appetite for risk assets. An index tracking the currency slipped 0.2% after U.S. officials said vaccinations may start in less than three weeks, while Asian stocks began the week with gains alongside European and U.S. equity futures. Global equities remain within a whisker of the all-time high set earlier this month. Still, JPMorgan Chase said rebalancing flows may lead to an exodus of around $300 billion from global shares by the end of the year. Astra AwaitedAfter trial successes from Pfizer and Moderna, findings from the final stage of vaccine studies by AstraZeneca and the University of Oxford are next on the agenda. The stakes for lower- and middle-income nations are immense, as the shot accounts for more than 40% of the supplies going to those countries. Elsewhere, there was positive news on the treatment front, as Regeneron Pharmaceuticals's antibody cocktail received an emergency-use authorization from U.S. drug regulators for treatment of early symptoms. Trump's China Tech PlansThe White House is close to issuing a list of 89 Chinese aerospace and other companies that would be unable to access U.S. technology exports due to their military ties, Reuters reported. A spokesman for the U.S. Department of Commerce declined to comment, the news agency said. Such a move would restrict the companies from buying American goods and technology, Reuters added. It could also fuel already-heightened tensions between the two nations as President-elect Joe Biden prepares to take over from Donald Trump. G20 Discusses ClimateWorld leaders urged countries not to lose sight of climate goals in the coronavirus pandemic, endorsing the aims of the Paris agreement amid hopes that Biden will rejoin the accord. Participants at a virtual Group of 20 summit discussed climate change in a session hosted by Saudi Arabia. "G-20 members should strengthen the fight against climate change, and continue to play a leading role to achieve full, effective implementation of the Paris agreement," Chinese President Xi Jinping said. The U.S. formally exited the accord, which pledges limits on fossil-fuel pollution, earlier this month. Coming Up…We'll get purchasing managers' index data from several regions, while here's what else to look out for on the economy this week. Meanwhile, keep an eye on Bitcoin again as price forecasts soar. Elsewhere, watch cruising stocks after the U.S. escalated its warning for cruise travel to the highest level. Finally, note that Elliott Advisors confirmed it made a proposal to Swiss baking company Aryzta. What We've Been ReadingThis is what's caught our eye over the weekend. And finally, here's what Cormac Mullen is interested in this morningBenchmark Treasury yields are backing further and further away from the 1% level and fast money accounts are betting they will stay that way. Speculative net long positions have jumped to their highest in three years, according to the latest Commodity Futures Trading Commission data. After threatening briefly to hit the closely-watched psychological 1% barrier earlier this month, the U.S. 10-year yield fell back to the 0.82% level on Friday, as investors weighed the impact of tougher virus restrictions against the prospect of a vaccine rollout in the months ahead. Fading hopes for additional fiscal support have also boosted expectations that the Federal Reserve will step in with further monetary support by year-end that will likely include a focus on bond purchases at longer-dated maturities. Policy makers' next decision is scheduled for Dec. 16 and some market commentators have even called for earlier action. The most successful advice for traders so far this year has been don't fight the Fed and the hedge funds look to be back following it after briefly considering lacing up their gloves.  Cormac Mullen is a Cross-Asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment