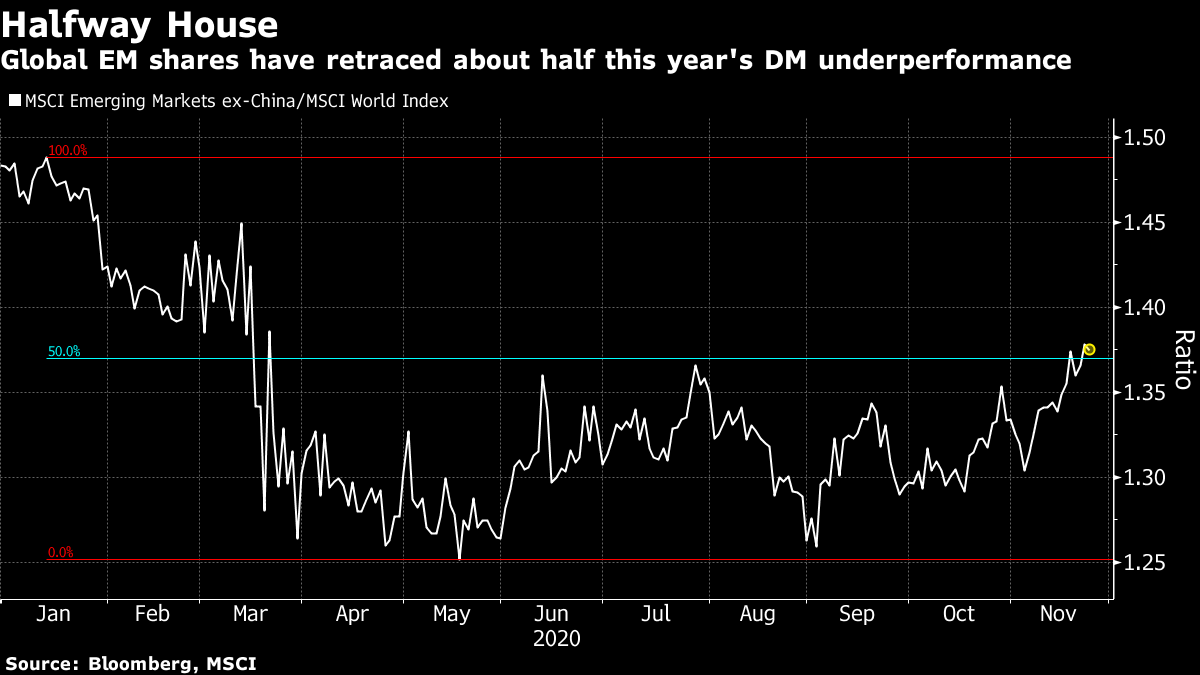

| Want the lowdown on what's moving European markets in your inbox every morning? Sign up here. Good morning. The transition process in the U.S. takes a step forward, the debate on vaccine efficacy rages and governments continue to contend with virus responses. Here's what's moving markets. Biden's TeamU.S. President-elect Joe Biden continues to fill up posts in his administration, with former Federal Reserve Chair Janet Yellen set to be nominated as Treasury Secretary. That news was welcomed by Wall Street, with investors cheered by the prospect of her working effectively with the central bank to help the economy bounce back. Elsewhere, former Secretary of State John Kerry is to be appointed climate czar, a key policy area likely to attract much attention from a booming global renewable-energy industry. President Donald Trump, meanwhile, faces increasing calls from allies across the spectrum to concede and move on, a development which came a step closer as Biden's team won their battle to trigger the formal transition process. Vaccine VarietyAnother week gets underway, another vaccine candidate produces early results to be pored over, turning everyone into amateur epidemiologists. The shot from AstraZeneca and Oxford University appears to work, though some analysts took a skeptical view of the initial trial results. Now the scramble to get hold of it begins in earnest -- and the challenge of ramping up production, both for this vaccine as well as the inoculations from Pfizer and Moderna, will come into sharp focus. An experimental treatment from Regeneron will also be shipping this week. Meanwhile, Merck splashed out on a deal to buy OncoImmune in order to get hold of a possible therapy for severe Covid infection. Bleak OutlookThe impact of Covid-19 on the U.S. continues to worsen, with the Centers for Disease Control and Protection warning that another 30,000 people could be killed by the virus by Christmas. New York has opened an overflow ward to cope with the rush of patients and a study has tied a significant number of infections early in the pandemic to meatpacking plants. Elsewhere, the U.K. will end its national lockdown on schedule on December 2 but confirmed that the next phase will be tougher regional restrictions. An easing of tourist quarantine restrictions, however, could help the beleaguered travel sector. Meanwhile, Hong Kong is shuttering more indoor entertainment venues and Japan too is eyeing tighter regional rules. Market OptimismEuropean and U.S. equity-futures are trending solidly higher going into Tuesday's session, buoyed by the ongoing vaccine optimism, Yellen's appointment and the triggering of the formal transition process to Biden. Oil prices are at the highest level since March on hopes that demand will bounce back. The dollar touched the lowest since 2018 on Monday before gaining ground and gold is at a four-month low amid the risk-on mood. Still, global leaders are warning that a vaccine will not be a quick-fix, and a fresh downturn in 2021 is still on the cards. A wave of defaults has sent shockwaves through the Chinese credit market. In Europe, fears about the implications of a debt binge are coming into focus. Coming Up…European Central Bank President Christine Lagarde is due to speak on Tuesday along some of her colleagues. One of them, Olli Rehn, has already criticized the "irresponsible" political standoff over virus relief for the European economy. It's a quiet day for economic data but a few stock sector bellwethers and lockdown winners will report in Europe. This includes catering group Compass and Irish building materials firm CRH, along with high-flying pet products retailer Pets at Home, a big beneficiary of consumers spending on cats and dogs during lockdown. What We've Been ReadingThis is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morningA third effective vaccine courtesy of AstraZeneca has given a further boost to the global 2021 economic re-opening trade but attention may soon shift to the next phase of the recovery process — logistics. That could take the wind out of the sails of the pro-emerging market investment case, at least in the short-term. While developed countries have snapped up the 95% effective shots from Pfizer and Moderna, Astra's one accounts for more than 40% of supplies going to lower- and middle-income nations. Its efficacy data wasn't quite as good as its two peers and Pfizer and Moderna may have an initial advantage in dealing with production challenges, as their novel messenger RNA technology can be scaled up relatively simply. That could lead to a two-speed vaccine rollout, one which favors wealthier economies. An MSCI gauge of emerging market stocks excluding China has risen 65% since its March low, pulling ahead of the 59% rebound in the MSCI World developed markets index. That's enough to retrace about half of EM's underperformance against developed market stocks this year. There are solid reasons to bet on developing country shares to continue to push higher as the global economic recovery continues. But traders will focus on vaccine logistics at some point, and that might provide a speed bump for what may have looked like an open road ahead for emerging market stocks.  Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment