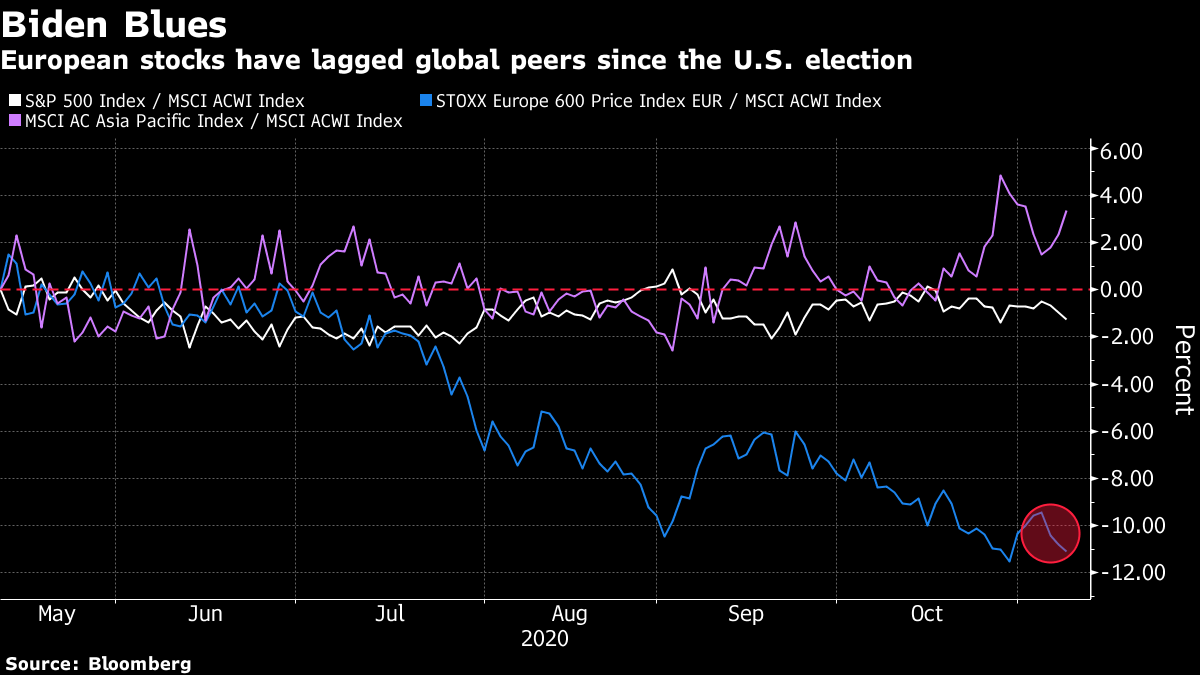

| Want the lowdown on what's moving European markets in your inbox every morning? Sign up here. Good morning. There's a risk of a messy transition after Joe Biden was declared President-elect, the pandemic continues to escalate, and European markets are looking up. Here's what's moving markets. Messy TransitionPresident-elect Joe Biden is due to announce his transition's coronavirus task force today, the first core policy step since being declared the winner of the presidential race on Saturday. President Donald Trump has so far refused to concede and vowed to challenge the election outcome in several states where he trails. Trump's final two months in office could see a whirlwind of recrimination, executive action and efforts to make governing more difficult for Biden, including pardons for allies and attacks on perceived enemies. At a Florida rally last Monday, Trump egged on a crowd encouraging him to fire Anthony Fauci, the nation's top infectious disease expert. Still Getting WorseThe pandemic shows no signs of slowing down, with worldwide infections surpassing 50 million. The U.K. reported more than 20,000 cases for the sixth straight day and Italy posted its fifth day above the 30,000 mark. Belgium, which has suffered the most deaths per capita since the pandemic began, reached record intensive-care bed occupancy, and France reported pressure on hospitals. Meanwhile in the Eastern German city of Leipzig, protests against containment measures turned violent. Final WeekBrexit talks are resuming in London, with only a week left to bridge major points of contention -- fisheries and regulations -- before it's too late for both sides to ratify any agreement in time for Britain's year-end exit from the single market. The two chief negotiators, David Frost and Michel Barnier, will try to thrash out their differences over the coming days. But even as they do so, events in the U.K. Parliament risk further souring ties and could still scupper a deal. Prime Minister Boris Johnson confirmed he's pushing ahead with legislation that rewrites parts of the Brexit withdrawal deal he struck with the EU last year, with key votes in the upper House of Lords scheduled for today. Deals to Be MadeVolkswagen's board signed off on a $3.7 billion deal to buy U.S. truck maker Navistar International, deepening the German company's bet on the lucrative North American market. VW's Traton unit has coveted the company as a means to challenge sector leaders Daimler and Volvo on a global scale. The VW unit makes Scania and MAN vehicles and is largely dependent on sales in Europe and Latin America. Meanwhile, private equity firm EQT is planning an IPO of German enterprise software developer SUSE, according to people familiar with the matter. Coming Up…Euro Stoxx 50 futures are pointing to a strong open, following gains in Asian markets. The morning's earnings highlight will be German chip maker Infineon, with its next-year guidance in focus amid signs of improving demand from the auto sector. Italian brake maker Brembo and Serie A soccer team Juventus are also due to report. McDonald's is the largest U.S. firm set to report, due in Europe's early afternoon hours, with Beyond Meat's third-quarter results expected after U.S. markets close. Elsewhere, SoftBank Group's Vision Fund unit posted a record $7.6 billion profit in the second quarter, bolstered by a recovery in some startup valuations and a blockbuster public offering by a Chinese real estate startup. What We've Been ReadingThis is what's caught our eye over the weekend. And finally, here's what Cormac Mullen is interested in this morningInvestors round the world took the news of a Joe Biden victory in the best possible way on Monday with a gauge of global stocks heading for a record high in early trading. But while Europe investors should be happy to see gains, on a relative basis they risk further slipping behind their regional rivals. U.S. stocks find themselves in an almost Goldilocks position with a high likelihood of fiscal and monetary stimulus, an increased focus on infrastructure and a reduced risk of severe tax hikes and anti-trust concerns. That's going by the premise that Biden will be able to spend a little bit more than Trump but will be reined in elsewhere by the constraints of a split Congress. Meanwhile, Asian shares will get a boost from a less-confrontational approach on trade -- in a "war" that is focused on their region -- as well as a rapidly recovering Chinese economy and better management of the coronavirus pandemic. But while European stocks can benefit at the margin from both trade and corporate tax -- at least if they do much business stateside -- they still have to cope with the uncertainty of a coronavirus response that risks weighing on the nascent recovery.  Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment