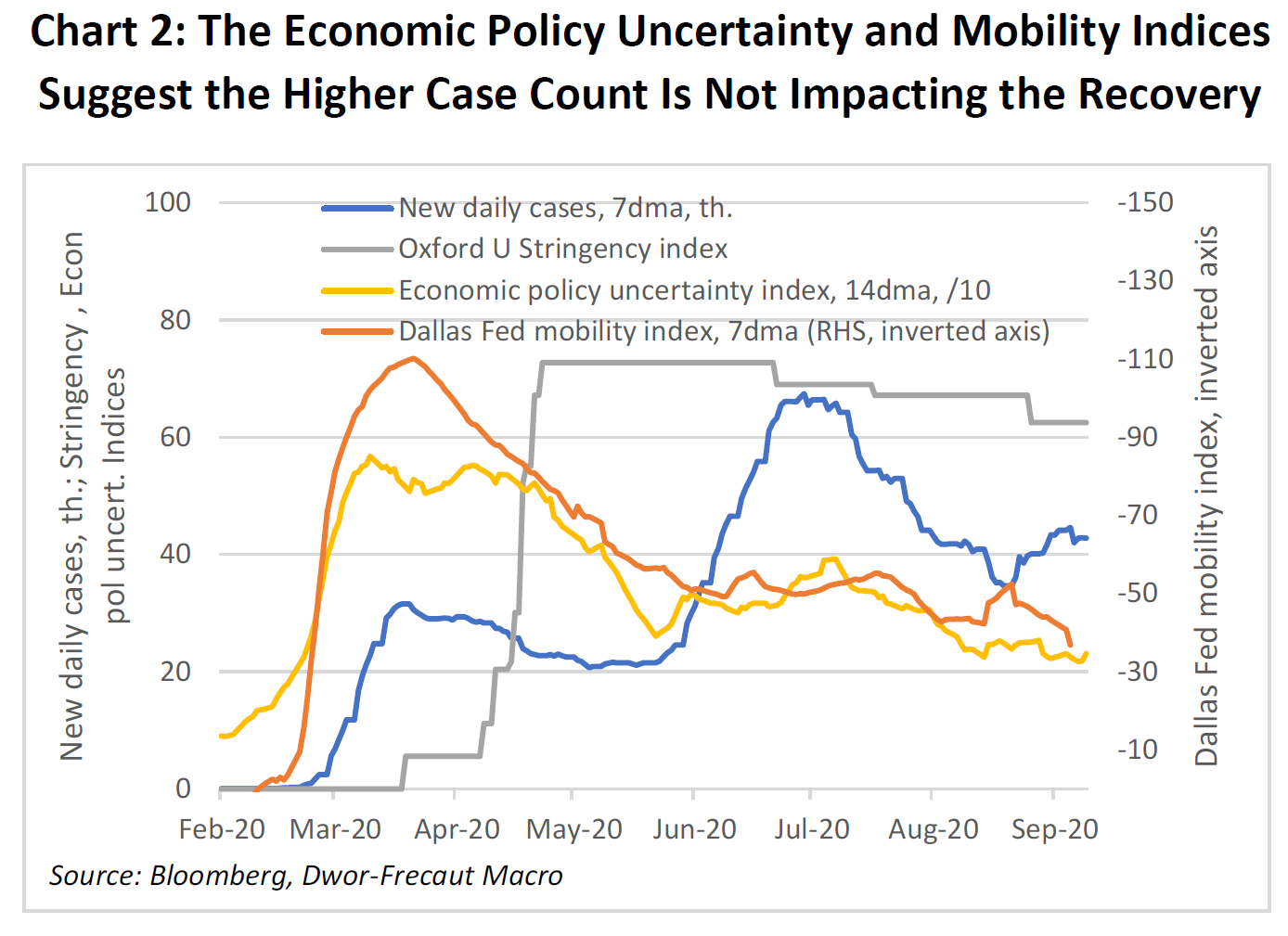

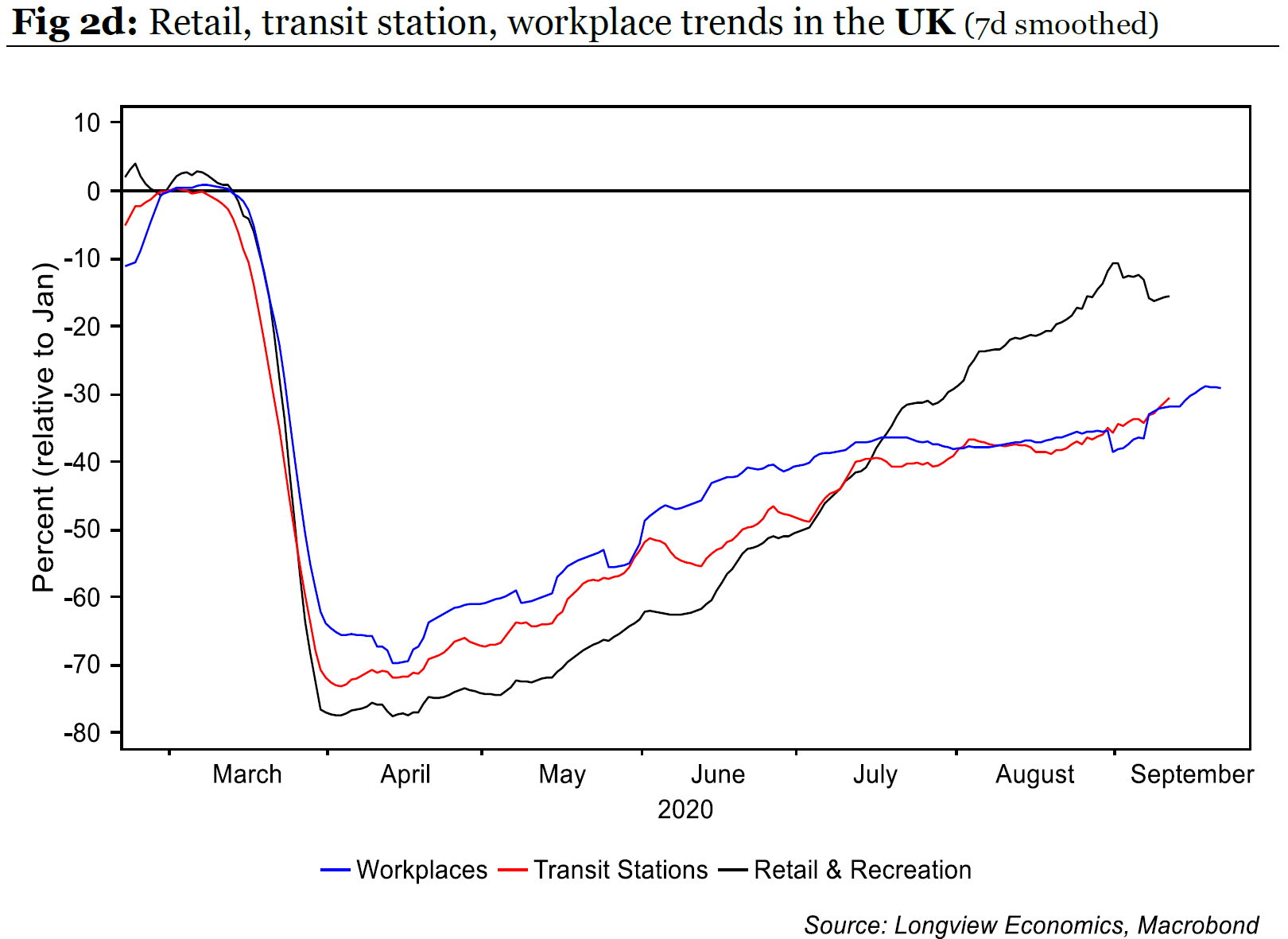

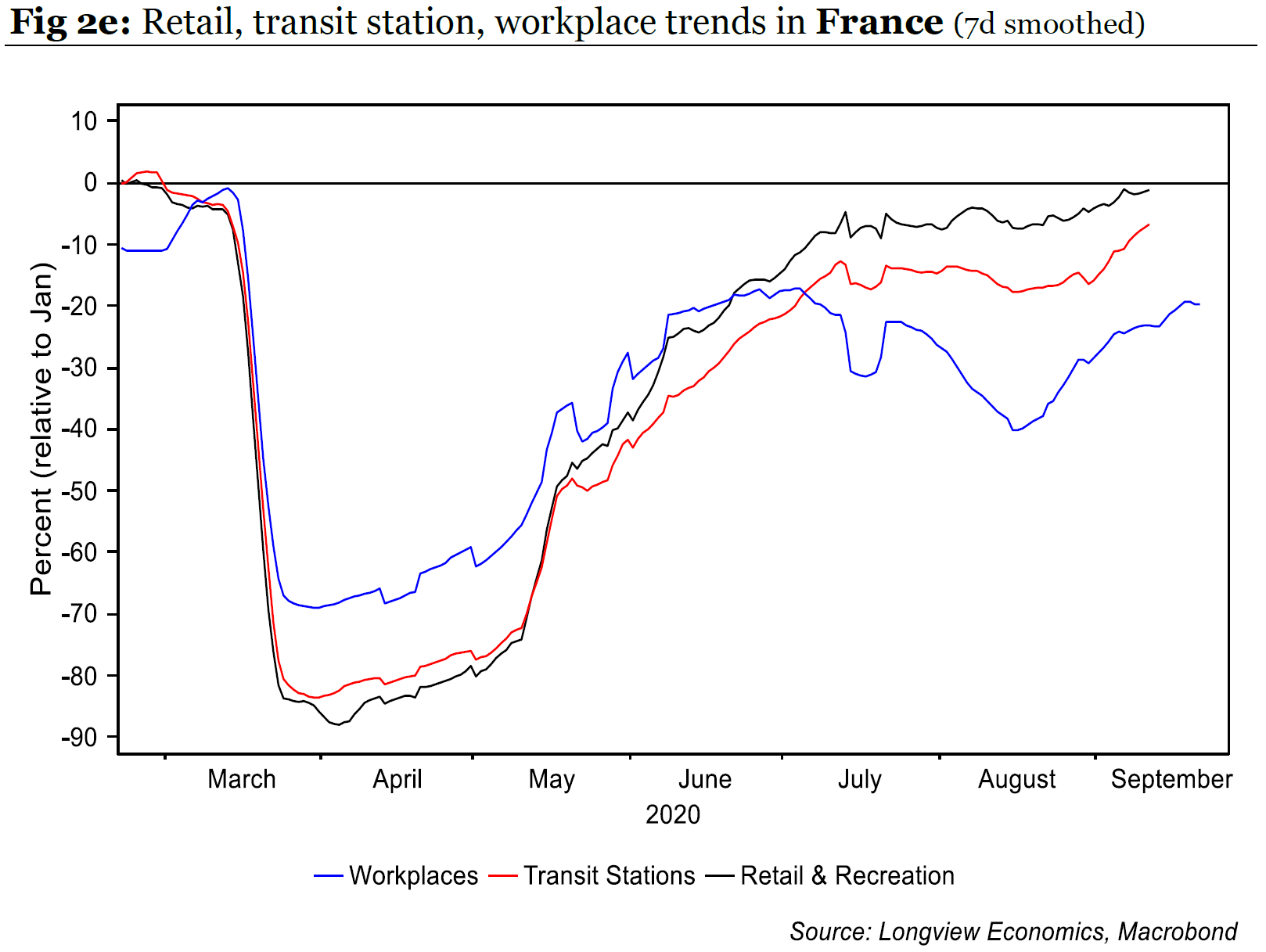

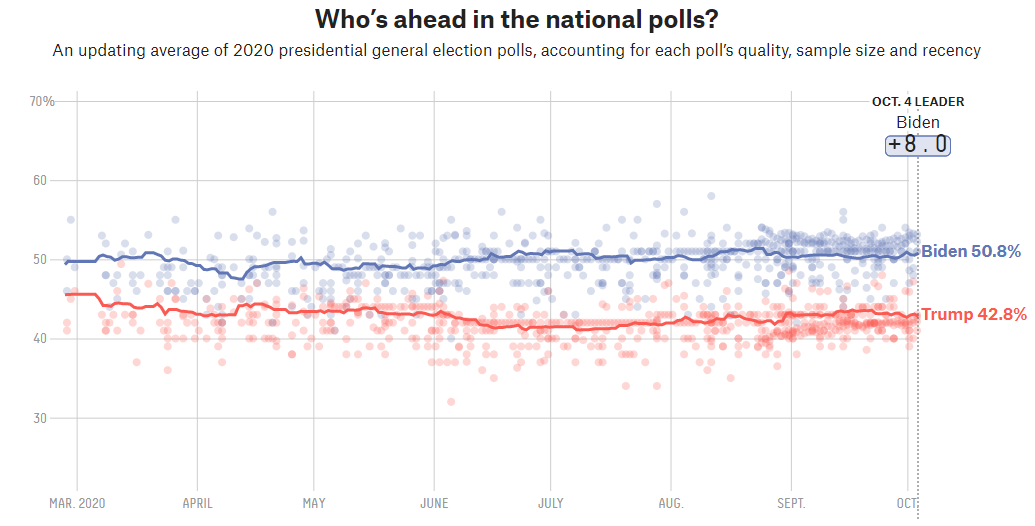

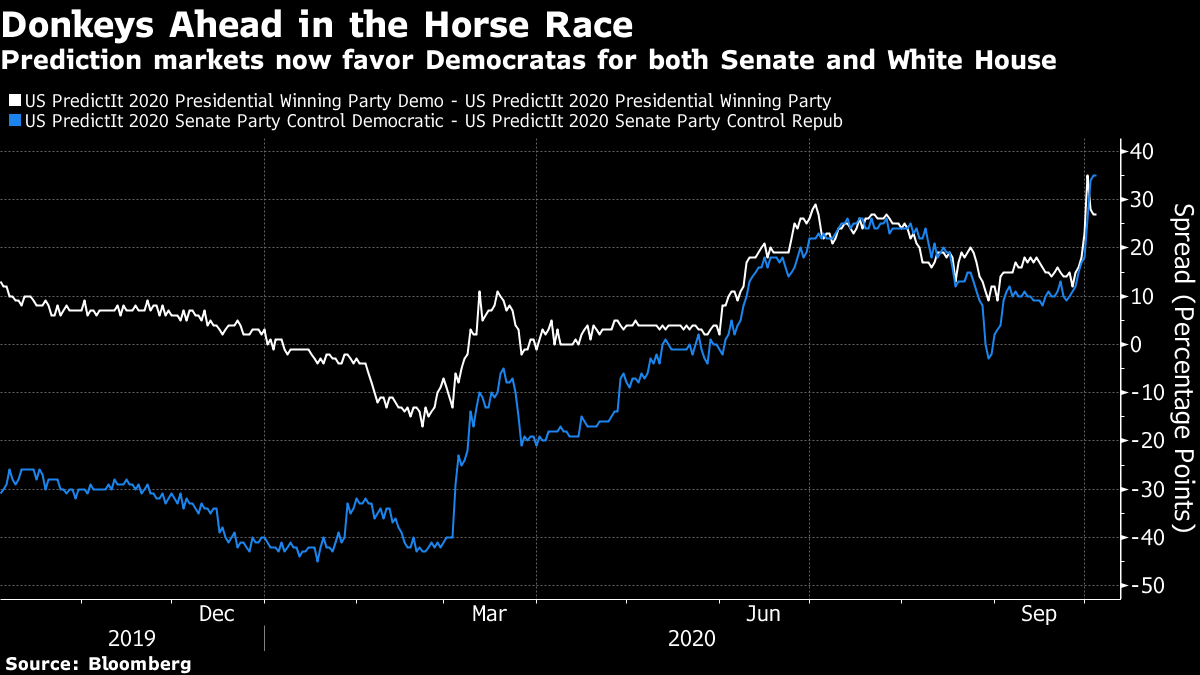

After an abnormal weekend that the leader of the free world spent in hospital suffering from a dangerous virus, it is now time for markets to try to make sense of the whirl of unsettling developments. A number of imponderable questions still need to be answered: most importantly, how great will the impact of Covid-19 be on the president, and how many of his political allies will also fall ill? The answers to these questions will in turn affect the two most important issues for markets: the economic effect of the Covid-19 pandemic, and the outcome of the U.S. elections in a month's time. No sector will be more affected than healthcare. The Economy What matters most is the narrative. What is the prevailing story that people tell to explain the pandemic? In recent weeks, a fresh narrative has been gaining force. This holds that the pandemic is finally blowing itself out, and that "herd immunity" has almost been achieved without needing to wait for a vaccine. This was true even though cases (meaning positive tests) in the U.S. had started to rise again. That narrative in turn affects how people behave, and is arguably more important than the course of the disease itself, or government policies. As this chart from economist Dominique Dwor-Frecaut shows, using Bloomberg data, the Dallas Fed's index of mobility has recently reached its strongest level since the first outbreak of the pandemic, despite the rise in cases, while economic uncertainty has remained much lower than in the earlier months of the pandemic:  Will this continue? Partisanship is so strong in the U.S. that people on both political sides have tended to interpret the president's illness through their own ideological lens. But it is at least reasonable to suppose that the reaction will be similar to the British response when Prime Minister Boris Johnson had the same experience earlier this year. While many factors are at work in this, the U.K.'s Covid trajectory has diverged from that of similar western European countries since Johnson's illness, which nearly killed him. As the following charts from London's Longview Economics show, Britain is farther from returning to its levels of January, in terms of traffic in retail and recreation, workplaces, or in transport, than either Italy or France. Both those countries had lockdowns that were initially more severe than Britain's, and France has also seen a worrying recurrence of infections. Nevertheless, it does look as though the Johnson hospitalization may have contributed to more conservative behavior by Britons in the months since, and hence to a greater impact on economic activity:    A more troubling narrative about the pandemic in the U.S. doesn't rely on the illness of the president and other senior Republicans. Americans must also contend with the news that the mayor of New York City wants to close down some neighborhoods again, to combat a rise in infections. As these are areas, concentrated around Hasidic Jewish communities in Brooklyn, that have already suffered serious outbreaks, this could call into question the hopes that herd immunity has already been achieved. In sports, the postponement of the high-profile football game between the New England Patriots and the champion Kansas City Chiefs because of a Covid-19 outbreak also rams home that the disease hasn't been silenced. If this is all negative for the economy, it does have a counterbalance in the attitude of politicians and central bankers. It now grows far harder for anyone to contend that there is no need for more stimulus to tide the economy through. Last week's U.S. unemployment data, which showed a slowing pace of recovery, will have added impetus for Democrats and Republicans to thrash out something:  So the base case, with our current (limited) state of knowledge is that the president's confinement will at the margin slow the return of economic activity in the U.S., but hasten the arrival of some extra fiscal stimulus. Politics Then there is the issue of how this will affect the election. There is no polling evidence as yet on the impact of the illness on public perception. The president is trying to demonstrate that he is still in good health, with enough success to help buoy Asian markets, which sold off when news of his infection came through Friday. Such an approach seems to reduce the chance of any major wave of public sympathy, and it remains unclear how his illness will affect public opinion in the U.S. While he remains in hospital, or in quarantine, the campaign will necessarily have to be subdued, which may be a disadvantage for the candidate who is behind. The latest batch of polls do, however, show the effects of last Tuesday's embarrassing first presidential debate. They appear to confirm the intuition that the debate did more good for Joe Biden than for the president. According to the running poll of polls kept by FiveThirtyEight, Biden's national lead is a very solid eight percentage points:  A lead of this magnitude with only a month to go matters more, as the president's chances to catch up are beginning to run out. That said, the notorious Access Hollywood tape, which caught Trump boasting of his assaults on women, wasn't released until Oct. 7 in 2016, and we know the result on that occasion. There is still a month for events to unseat Biden, though he does remain slightly further ahead in the polls than Hillary Clinton was at the same stage four years ago, as illustrated by this chart from RealClearPolitics:  Note that only a month ago the president was running ahead of his standing at the same point in 2016. Note also that Biden is only three percentage points ahead of where Clinton was. As for betting and prediction markets, they see Biden's chances as sharply higher because of the debate, although they seem unclear what to make of the political impact of the president's coronavirus diagnosis. What matters more for markets is that bettors now appear more convinced that the Democrats can take the Senate than that they can take the White House:  A Democratic clean sweep would, as far as the market is concerned, be good news on extra fiscal stimulus and a more constructive trade policy, but bad news on regulation and tax. It has grown more likely in the last week. Healthcare The sector that stands to be most directly affected by politics is, of course, healthcare. Managed healthcare stocks were buffeted last year by the prospect that one of Senators Elizabeth Warren or Bernie Sanders might win the Democratic nomination and pursue "Medicare For All." They recovered with Joe Biden's victory in the Democratic race, and subsided again as his chances of beating Trump improved through the summer. Meanwhile hospital stocks, which had been recovering after the blow of the pandemic in the spring, sold off anew on news of the supreme court vacancy caused by the death of Justice Ruth Bader Ginsburg last month. The court will be considering a case to strike down the Affordable Care Act in the coming term. As the ACA is very helpful for hospitals' business model, this would be a problem for them:  It is in the Senate that the immediate impact of Washington's latest Covid outbreak could be most potent. With three Republican senators currently testing positive, the majority party may not be able to muster enough senators to vote in person to approve the Supreme Court nomination of Amy Coney Barrett. Predictit has over the last few days reduced her chance of confirmation before election day from 86 to 62%. Meanwhile, if the Democrats really can take the Senate, they can inoculate themselves against the possibility of a court ruling overturning Obamacare. The current objection to the law is that it no longer includes a penalty for those who do not pay premiums, which was essential to the court's earlier decision to rule the law constitutional. But Yanmei Xie of Gavekal Economics makes this point: If, however, Democrats win control of the White House and both chambers of Congress on November 3—possible based on polling—they can preempt a court ruling by reinstating a nominal tax (say US$1 for every person without insurance) on the "individual mandate". Such a move would undermine the central argument of the legal challenge to the ACA.

For the future of U.S. healthcare, much is riding on the health of a few individuals over the next month. Survival TipsAside from a shared initial letter, what do the words run, redux, rich and rest have in common? Of the top five airlines in North America (by passenger miles), Southwest Airlines is the only one not to have done what during its history? What 1871 masterpiece is subtitled A Study of Provincial Life? Virginia Woolf declared it "one of the few English novels written for grown-up people." If further periods in lockdown lie ahead, it may be time for more trivia and quizzes, online or in the bosom of the family. So I'd like to recommend what appears to be a very good idea. TriviaRelief is an attempt to raise money for cultural institutions that have been grievously hurt by the pandemic. You also get to organize your own trivia nights, with the aid of a book called Philomath, which can be downloaded for free and includes 3,000 questions. Three of them appear above. It's a nice way to stay sane, and to keep the arts solvent. Worth a try. Have a good week. Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment