Trump halts stimulus talks. China faces rebuke at the UN. And iPhone makers may be headed to India. Here are some of the things people in markets are talking about today. President Donald Trump ended talks with Democratic leaders on a new stimulus package, hours after Federal Reserve Chair Jerome Powell"s strongest call yet for greater spending to avoid damaging the economic recovery. "I have instructed my representatives to stop negotiating until after the election when, immediately after I win, we will pass a major Stimulus Bill that focuses on hardworking Americans and Small Business," Trump said Tuesday in a tweet. Stocks tumbled after Trump's posting called an end to months of hard-fought negotiations between the administration and Congress. Democrats had most recently pushed a $2.2 trillion package that failed to garner Republican support in the House, while the White House had endorsed $1.6 trillion. Asian stocks looked set to follow U.S. equities lower after Trump said he is ending stimulus talks until after next month's election. Treasuries gained. Futures in Japan and Australia declined and the S&P 500 fell over 1%. Treasury yields fell and the dollar jumped against most of its major peers. An exchange-traded fund that tracks the largest tech stocks fell further in after-hours trading after a House panel proposed a series of far-reaching antitrust reforms to curb the power of U.S. technology giants including Amazon.com and Alphabet. China remains closed for the Golden Week holiday.

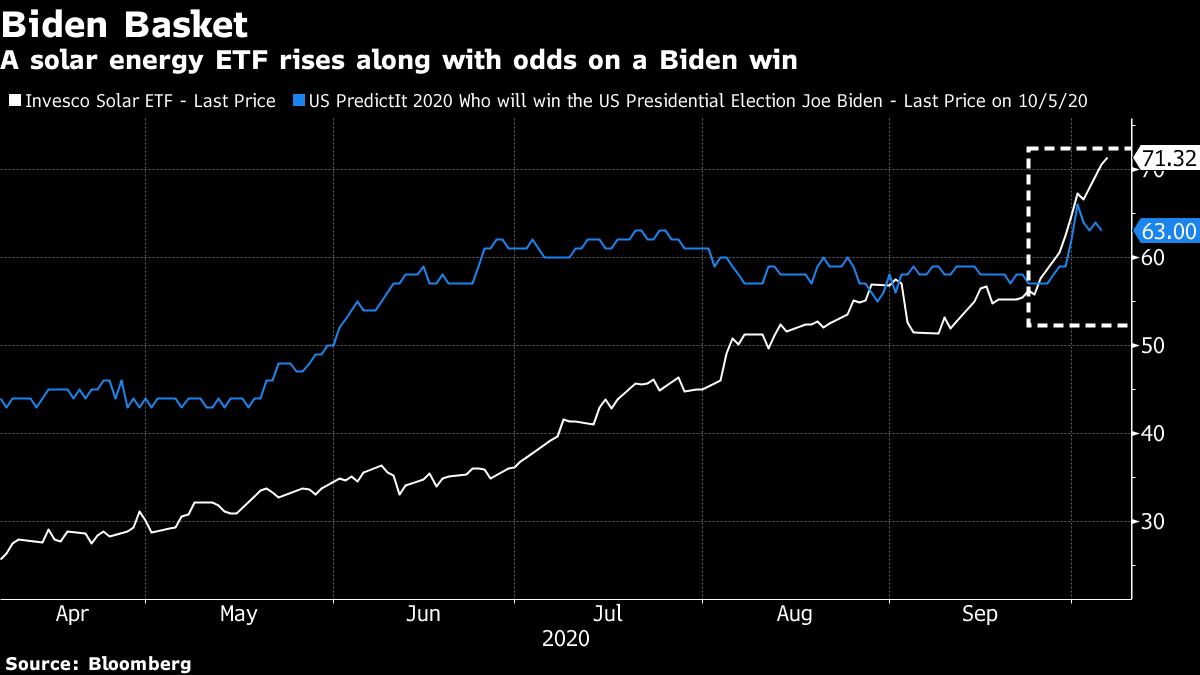

A group of 39 countries including Germany, the U.K. and the U.S. stepped up criticism of China's human rights record, denouncing Beijing at the United Nations for its treatment of ethnic minorities and for curtailing freedoms in Hong Kong. But China's allies at the UN shot back. Pakistan read out a statement on behalf of 55 countries, opposing interference "in China's internal affairs under the pretext of Hong Kong" and expressing support for "China's implementation of 'one country, two systems.'" Cuba presented a statement on behalf of 45 countries "supporting China's counterterrorism and deradicalization measures in Xinjiang." Zhang Jun, China's ambassador to the UN, said in a briefing on Monday about Xinjiang, "The nature of the issue is counterterrorism." Meanwhile, negative opinions of China have reached record highs among major economies, according to a new survey. Major iPhone assemblers for Apple were among 16 companies that won approval to manufacture products in India under a plan aimed at attracting investment of more than 10.5 trillion rupees ($143 billion) for mobile-phone production over the next five years. Apple's primary suppliers —Foxconn, Wistron, Pegatron — and Samsung Electronics were part of a list of global firms cleared by India's Ministry of Electronics and Information Technology, according to statement on Tuesday. About 60% of the total production, or 6.5 trillion rupees, is expected to be exported in the next five years, it said. Following clashes with China along its disputed Himalayan border earlier this year, New Delhi is seeking to woo companies looking to diversify their manufacturing bases away from China. Meanwhile, Apple announced that its biggest product launch event of the year, featuring 5G phones, will be held Oct. 13. Australia released a fiscal blueprint that pushes debt and deficit to a peacetime record just hours after the central bank signaled a willingness to ease policy further. Treasurer Josh Frydenberg delivered a budget Tuesday evening in Canberra that forecast a shortfall of A$213.7 billion ($153 billion), or 11% of gross domestic product, in fiscal 2021. The jobless rate is expected to peak at 8% late this year, a level last seen in 1998 amid fallout from the Asian financial crisis. "There is great uncertainty, unprecedented uncertainty in the economic environment not just here in Australia but globally right now," Frydenberg said after handing down the budget. "What we have sought to do is create a series of incentives and make a series of investments that are designed to create more jobs." What We've Been ReadingThis is what's caught our eye over the past 24 hours: And finally, here's what Tracy's interested in todayAs Biden's chances of securing the U.S. presidential election rise, it seems sell-side analysts are getting more comfortable with the Democratic nominee as a bull case for stocks. My Bloomberg colleague Justina Lee reports that strategists from Citigroup to JPMorgan are now talking about the possibility of a Democratic sweep giving comfort to investors who have long dealt with political uncertainty. Meanwhile, analysts are monitoring the market's pricing of Biden and Trump's chances by watching baskets of different financial assets. The makeup of these baskets is informative. On the one hand, the "Biden basket" tends to feature renewable energy and infrastructure indices, predicated on the assumption that the Democrats would push through stimulus and green spending. Sometimes it includes emerging market currencies and overseas equities based on expectations that the new administration would not go after China as much as its predecessor.  On the other hand, the "Trump basket" is almost always a macro concoction of a stronger U.S. dollar, long the S&P 500 and short U.S. Treasuries — basically a replay of the reflation trade that played out after Trump was elected in 2016. The weird thing is that it's far from clear that a "Trump bump" would happen again, given that the president has already enacted his tax cuts and it's hard to see support for further deregulation in the post-Covid economic environment. It kind of puts a question mark over the usefulness of monitoring a Trump basket of exceedingly macro market factors in the first place. You can follow Tracy Alloway on Twitter at @tracyalloway. |

Post a Comment