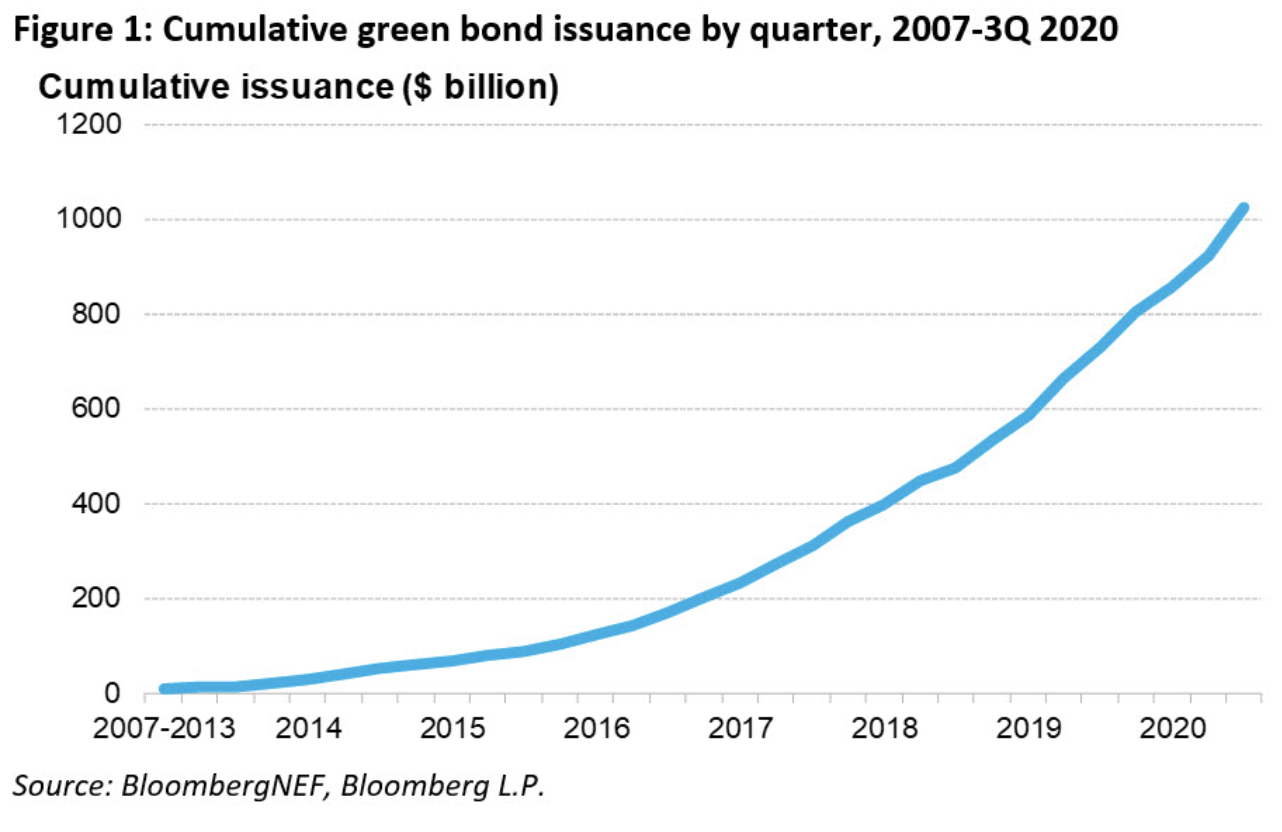

Trump's administration explores Tencent and Ant Group restrictions. Asian markets look to a Biden victory. And Brexit breaks down, again. Here are some of the things people in markets are talking about today. The Trump administration is exploring restrictions on billionaire Jack Ma's Ant Group as well as Tencent over concerns that their digital payment platforms threaten U.S. national security, according to people familiar with the matter. The move risks infuriating China and disrupting what could be the world's largest initial public offering. Debate over how and whether to restrict Ant Group's and Tencent's payment systems has accelerated among senior U.S. officials in recent weeks though a final decision isn't imminent, said the people, who wished to remain anonymous. U.S. officials are concerned that Chinese fintech platforms will come to dominate global digital payments, the people said, potentially giving Beijing access to banking and personal data of hundreds of millions of people. Asian stocks looked set for gains after renewed optimism that U.S. lawmakers could still reach an agreement on fiscal stimulus. The dollar slipped. Futures rose in Japan, Hong Kong and Australia, following the S&P 500's 1.7% overnight advance. Nancy Pelosi signaled openness to an airline-relief bill in talks with Steven Mnuchin after President Donald Trump scuttled broader negotiations. Treasuries declined, sending the 10-year yield up to 0.79%. Oil dropped after U.S. government data showed the first crude stockpile gain in four weeks, adding to concerns over a demand recovery. A Democratic win in next month's U.S. election would boost Asian equities, while reducing the allure of the region's bonds, according to money managers and strategists. If Democrats win control of both houses of Congress, it's likely to spark substantial fiscal stimulus, benefiting Asian stocks by reviving the U.S. economy and trade flows, according to BNP Paribas and Credit Suisse. Such a backdrop could push Treasury yields higher, curbing appetite for debt from countries such as South Korea and Thailand, historical patterns show. Democrats getting into both houses will be key, said Daniel Morris, senior investment strategist at BNP Paribas in London. Also vital will be a dilution of trade frictions under Biden, said Dan Fineman and Kin Nang Chik, analysts at Credit Suisse. The chances are starting to firm up, as Donald Trump is hit with a wave of grim poll results for battleground states. Trump was also back in the Oval Office on Wednesday for briefings, despite remaining under treatment for Covid-19 and potentially contagious. Brexit negotiations are at risk of breaking down within days after the U.K. government warned it will pull out of trade talks with the European Union if there is no clear deal in sight next week. Boris Johnson has said he wants the outlines of a deal to be clear by Oct. 15. EU officials have said they won't be pressured into making concessions and are prepared to call the prime minister's bluff if he doesn't compromise. A person familiar with the British position said Johnson's team would indeed pull the plug on talks if no clear landing zone for a deal has been identified by that date. The analysis adds to pressure on the talks, which are resuming in London Wednesday, where two key stumbling blocks to a deal remain — whether the U.K. will agree to apply restrictions on state subsidies in a similar way to the EU and the fishing rights for European countries in British waters. New Zealand's national elections are being held on Oct. 17, and polls predict a resounding victory for Jacinda Ardern's left-leaning Labour Party, despite a slumping economy and her failure to deliver on key pledges such as fixing a housing crisis and lifting children out of poverty. The opposition National Party is wooing voters with tax cuts and attacking Ardern for not making good on her promises. But so far, it hasn't dented Ardern's popularity. There's even a chance Labour could win an outright majority, which no party in New Zealand has done since the 1990s. As the pandemic decimated a tourism industry that was once its biggest foreign exchange earner, New Zealand still faces immense challenges. But with daily life mostly back to normal, that's a win for the much-loved Prime Minister. What We've Been ReadingThis is what's caught our eye over the past 24 hours: And finally, here's what Tracy's interested in todaySales of ESG bonds reached a record in the second quarter, according to Moody's data. Money is pouring into a space that remains ill-defined and many ESG bond buyers don't seem to realize that their money isn't officially hived off for "environmental, social and governance purposes." To wit, a Barclays review of outstanding ESG bonds found that only one company had set up a segregated account to handle proceeds from sustainable bond sales. Barclays analysts note that "we are surprised that only one corporate issuer that we reviewed has done this," given many investors have asked for separate accounts to safeguard bond proceeds.  It's true that most ESG issuers will undertake audits to ensure that money raised in the pursuit of sustainability is well spent, but the time in between raising those funds and actually spending them on environmentally friendly projects can be an awkward one. The Barclays analysts point out that money raised through ESG bonds can be used to pay off short-term debt or invested in commercial paper while companies identify promising sustainable projects. Such commercial paper might even be issued by non-ESG friendly companies. In other words, ESG sales can ironically and inadvertently help finance non-ESG companies, by ploughing more money into the system with little distinction or regard for environmental credentials. You can follow Tracy Alloway on Twitter at @tracyalloway. |

Post a Comment