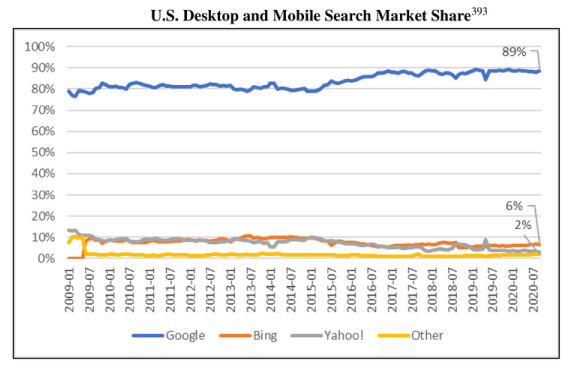

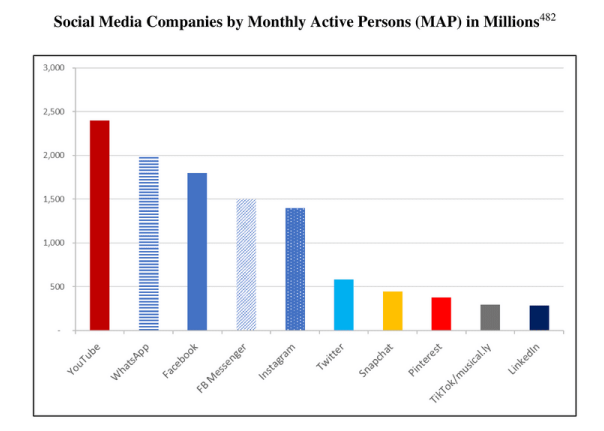

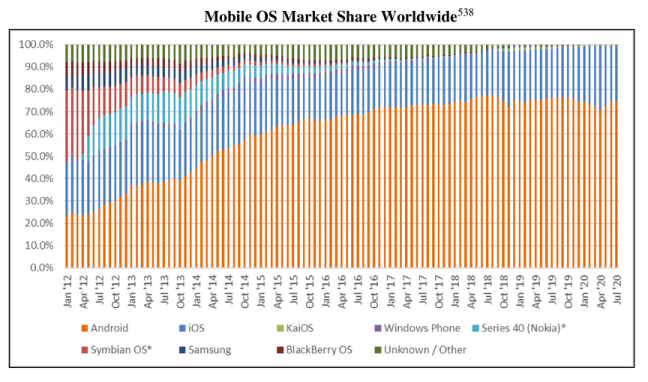

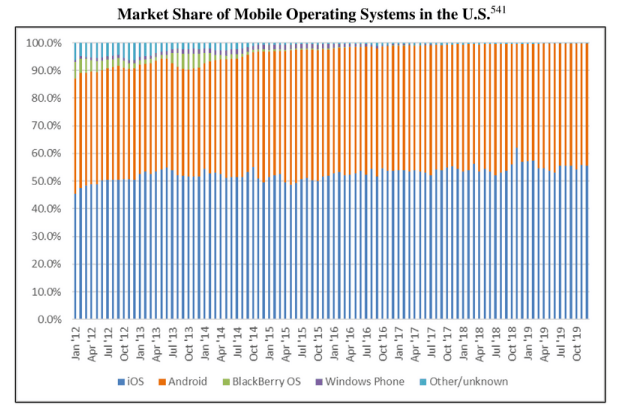

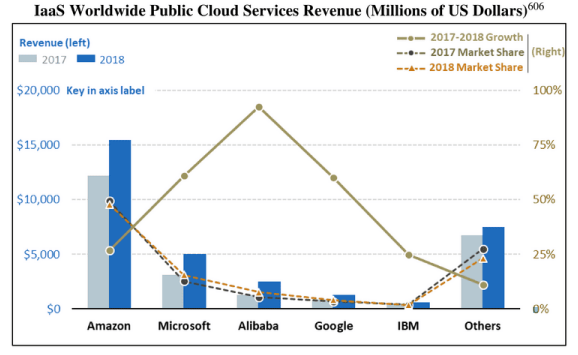

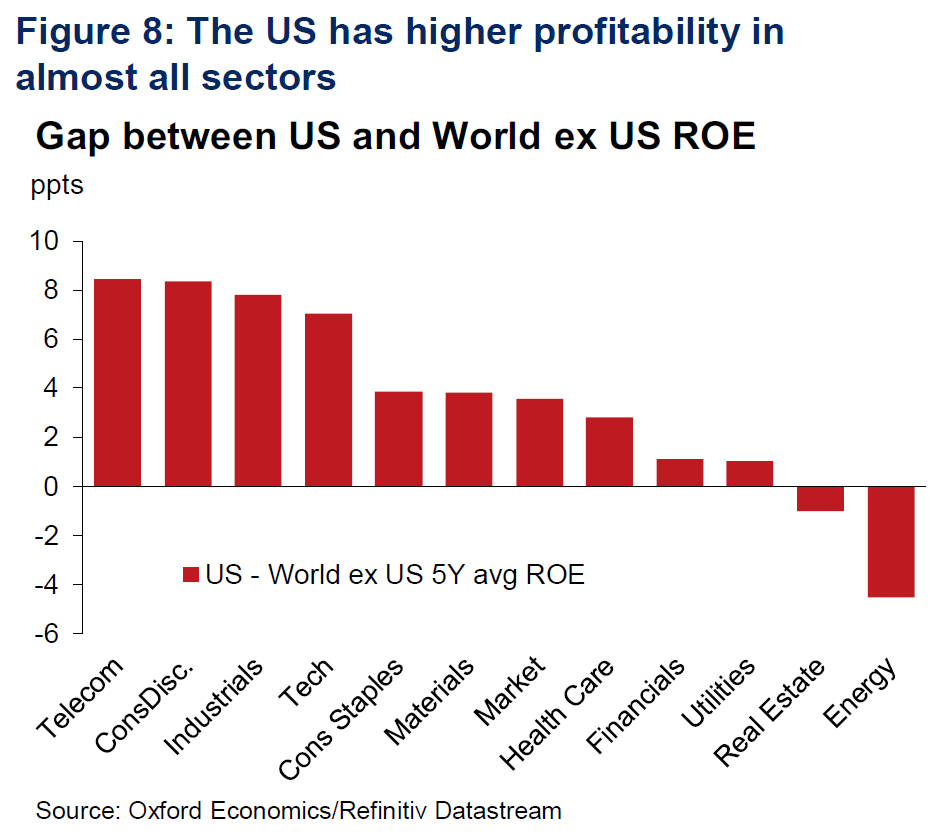

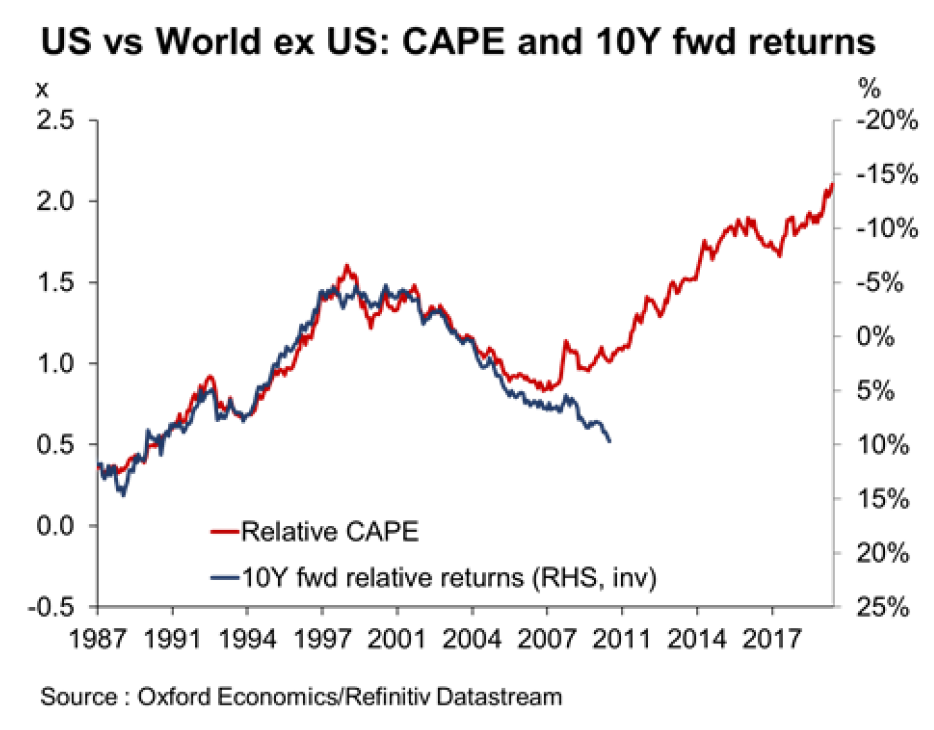

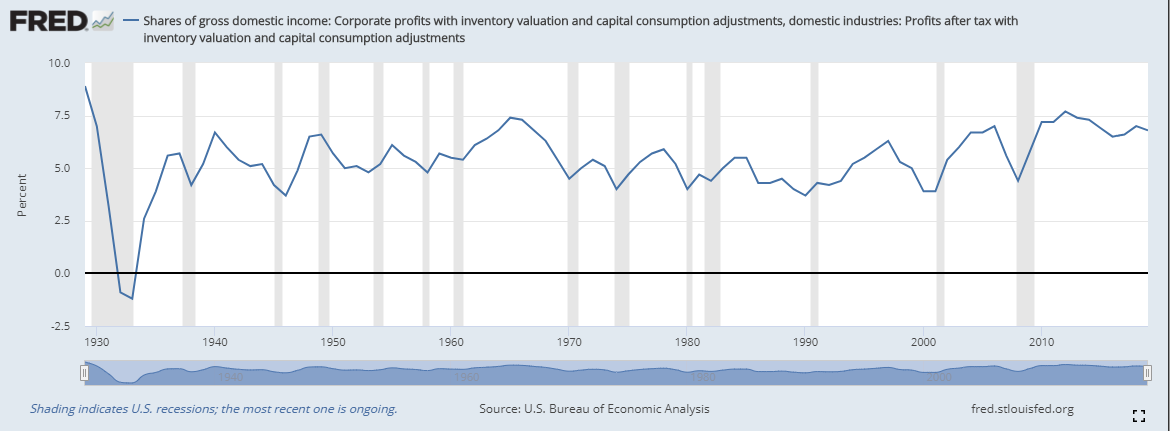

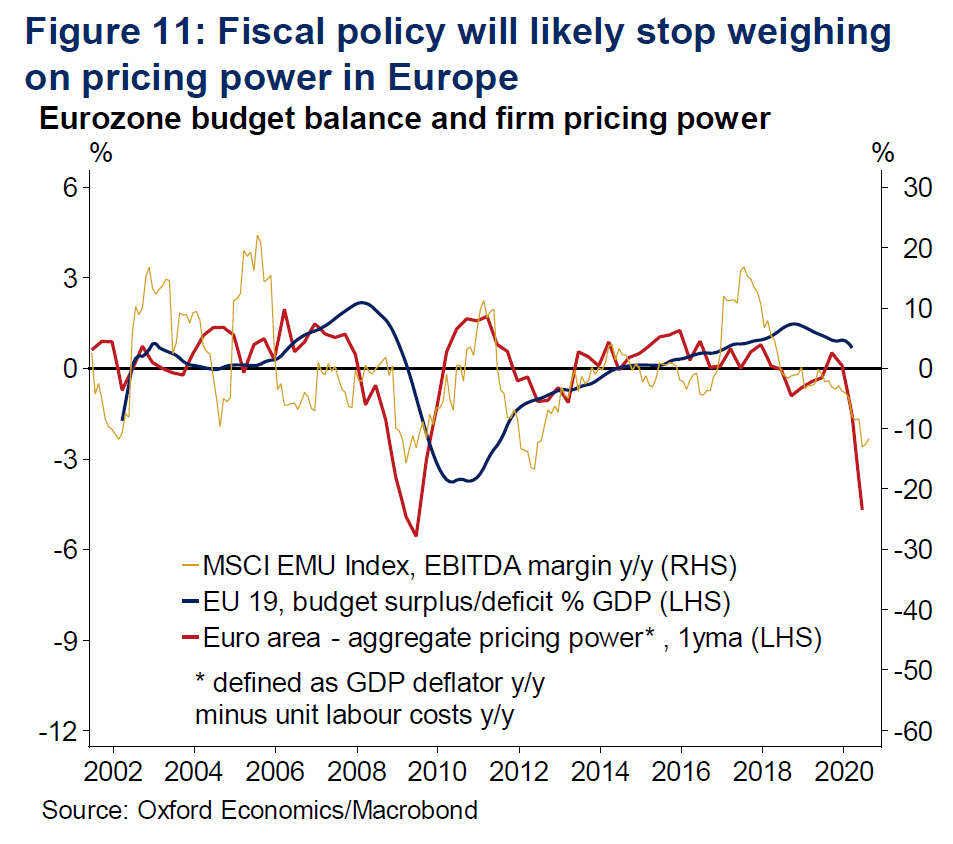

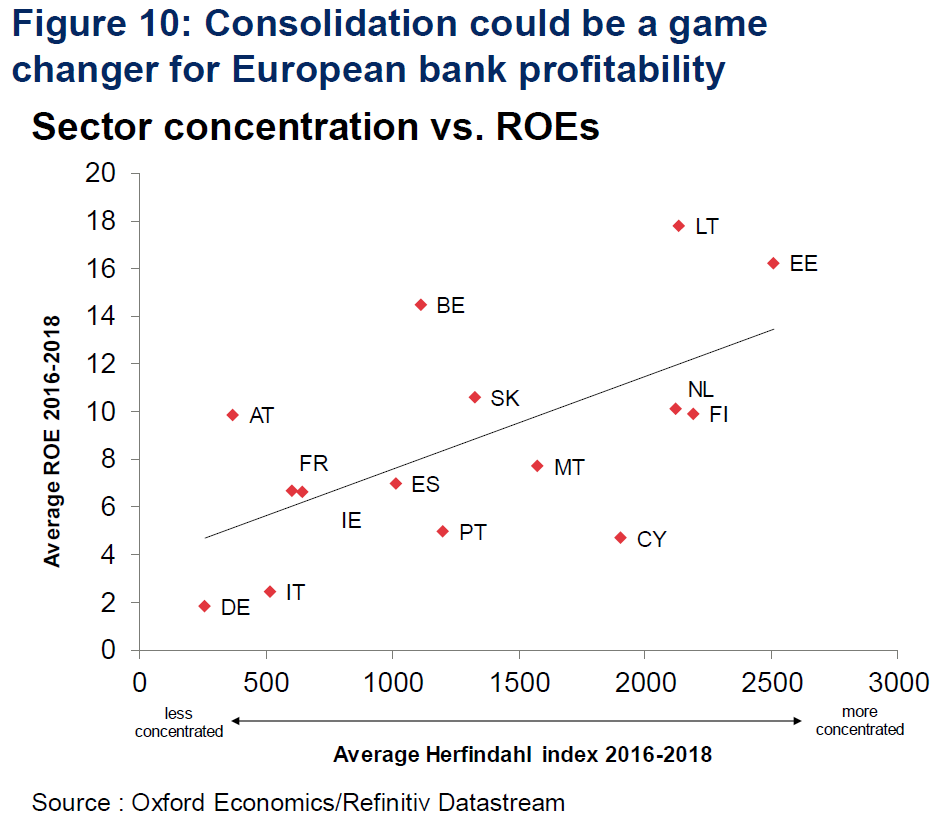

We have almost run out of October surprises, before the first week of the month is over. Tuesday's latest shock to the system came, as usual these days, in a presidential tweet. All negotiations to agree on another dose of fiscal stimulus to tide people and companies through the effects of the Covid-19 pandemic are to be discontinued until after the election. Monday's excitement was based in large part on the belief that a president out of hospital would be able to use the extra sense of urgency that his illness had caused to push through a decent compromise. As the economy's recovery was slowing, that was exactly what markets wanted. And as it would improve his chances of re-election, it was taken as read that he would try to achieve it. So nixing any chance of a deal this side of the election came as a nasty shock. Money poured back into bonds, and yields fell, continuing a wild ride for the last week which can be explained almost entirely in terms of the president's Twitter account:  One further reason for surprise at the president's announcement is that he cares a lot about the stock market, and it should have been completely predictable that calling off stimulus talks would cause stocks to fall. Which is what they did:  Trump's tweet seemed all the more outlandish as it came after the Federal Reserve's Jerome Powell had given a speech in the morning warning that "the risks of overdoing it" seemed smaller than the risks attached to eschewing stimulus, which would include a weak recovery and unnecessary hardship. The president even tweeted the Fed chairman's words on this, with the one word comment: "True!" Patrick Harker, governor of the Philadelphia Fed, said that the economy needed at least $1 trillion in stimulus, as soon as possible. "We really could use that additional fiscal stimulus to get through this period." The Fed couldn't have gone much further in its attempt to push the politicians into action. The danger is that another delay in relief payments will prompt companies to throw in the towel and make lay-offs permanent, and small companies to give up and close. Once such actions have been taken, it takes that much longer for the economy to spring back. Optimism over fresh stimulus had prompted market optimism on reflation, shown distinctively in the price of gold. Retail interest in gold has been intense of late, but the price has dipped as negotiations over an extended stimulus have dragged on. Gold fell sharply again after Tuesday's presidential announcement, reflecting the return of worries about deflation:  Trump attributed his decision to congressional Democrats who "just wanted to take care of Democrat failed, high crime, Cities and States," which implies a concerted attempt to put the blame on his opposition. However, as he personally announced the end of negotiations, this could be a difficult trick to pull off. The reaction of the well-known analyst Nate Silver was typical: "Wait, so Trump not only rejects stimulus funds that would probably have helped his re-election chances, but also does so in a way to make sure that he personally will take blame for it?" The Trump strategy is now evidently to mobilize his base, even if this comes at the cost of a hit to the stock market. This may well be his best option at this point, as polling now shows the Democrats' Joe Biden in a far stronger lead than Hillary Clinton ever enjoyed during the 2016 campaign. The RealClearPolitics poll of polls now shows Biden ahead by 9 percentage points, with a number of surveys suggesting that the elderly — worst affected by the pandemic — have switched strongly against the president. Polls taken since Trump's diagnosis show him trailing by double digits in crucial swing states such as Pennsylvania. Over the last few days there have been new stories whizzing around Wall Street, suggesting Biden can win so easily that there is no chance of a protracted contest over the results after election day, and that a Democratic victory could be market-positive. The decision to end the stimulus negotiations suggests that these hopes were off-base. The president intends to go down fighting, and that could well mean more surprises and volatility before the month is over. You ain't seen nothing yet; the best is yet to come. AntifangFor the long term, the most consequential development in Washington on Tuesday may have had nothing to do with Covid-19. After the market closed, a House panel released a 449-page antitrust report with potent allegations against Facebook Inc., Apple Inc., Amazon.com Inc. and Google's parent Alphabet Inc. It read very much like the draft of a complaint for an antitrust action against the dominant internet companies under a Biden administration. It's worth reading the report in full. For now, a few charts tell the story eloquently. The way the panel chose to represent the data, all of these companies look like dastardly monopolists. This is the market for internet search:  Google's dominance has grown even greater over the last decade. Then, this is the global social media market:  As Facebook also owns WhatsApp, FB Messenger and Instagram, while Google owns YouTube, there is a good case that they have a duopoly. Now we come to the market for mobile phone operating systems. Globally, there was still some competition a decade ago, when Nokia Oyj and Blackberry Ltd. still enjoyed some market share. Now, it's a duopoly controlled by Google and Apple:  In the U.S., of greater interest to Congress, it has been a duopoly for a decade. Apple is considerably bigger within its home market than in the rest of the world:  Then there is the market for "Infrastructure as a Service," or IaaS, cloud computing. There are a number of players in the market, with Alibaba Group Holding Ltd. growing in China; but effectively it's a duopoly between Amazon and Microsoft Corp.:  All of this is very reminiscent of the antitrust action against Microsoft two decades ago, which failed to force a radical restructuring, but did lead to years of relative market underperformance by the company. As Bloomberg Opinion's Joe Nocera points out, the congressional investigators even have "smoking gun" emails like the ones used against Microsoft. There is also limited political risk. The Trump Justice Department is already preparing a case against Alphabet. Democrats are significantly keener than their Republican colleagues, but antitrust is one of the rare issues where politicians of left and right can often find common cause. And enough work has already been done that it should be an easy issue for a new Biden administration to take on. This evidently matters for the companies themselves, and caused their shares to fall in after-hours trading, but it has ramifications that go far beyond them. The performance of the NYSE Fang+ index continues to be barely believable. It has outperformed the equal-weighted version of the S&P 500 by almost exactly 100% over the last 12 months. There is a long way to fall:  Now that the biggest five stocks in the S&P account for 22% of its market cap, a problem for them could also mean a problem for the S&P itself. But it goes beyond that. A fascinating report from Gaurav Saroliya of Oxford Economics shows that U.S. companies are far more profitable than their counterparts in the rest of the world, as judged by return on equity, in almost all sectors. Energy is the only significant exception:  He suggests that this is because of industrial concentration. American companies enjoy pricing power in their home markets that businesses in the rest of the world, in more competitive environments, do not. This helps to explain why U.S. stocks have become so much more expensive than the rest of the world over the last decade, in terms of price-earnings ratios. That valuation imbalance in turn implies American underperformance ahead:  Over-concentration is an issue that spreads beyond technology, then. It bedevils the entire American economy. Academic research shows that numerous sectors are now dominated by a few players. For evidence of the effects, look at the "profit share" — the proportion of gross national income that goes to profits. Over history, this tends to be classically mean-reverting. As the following chart from the St. Louis Fed's FRED service shows, over the last decade the share has been high, and stayed there. That contributes to the sense of rising inequality:  Getting serious about antitrust requires a shift in political attitudes. A Democratic clean sweep might lead to a new wave of antitrust enforcement, which could be good for the economy if executed well, and would be awful for stock markets in the short term. It could also contribute to a shift in the geographic balance of power. Saroliya points out that companies' pricing power derives from macroeconomic conditions, as well as competition policy. In the euro zone, pricing power (defined by the GDP year-on-year deflator with the rise in labor costs subtracted) has tended to move in the opposite direction to fiscal policy. When policy in the euro zone is tight, as has been the case for much of the last decade, then pricing power and profitability decrease. That makes European stocks less attractive than their U..S. counterparts, and strengthens the dollar:  Now, with the European Union finally appearing to get serious about fiscal expansion, there appears to be a possibility for the region's companies to gain in profitability. Meanwhile, the EU has been rather more aggressive than the U.S. in antitrust enforcement. Most blatantly, Saroliya points to banks, where the least concentrated markets also have the least profitability, led by Germany:  Banking mergers come with big macroprudential issues. Regulators are rightly leery about creating banks that are too big to fail. But the point remains. Congress's damning report on the FANGs could well be a symptom of the trends that will at last end the prodigious outperformance of U.S. stock markets. Survival TipsMusic has charms. My latest suggestion for when you hit the panic button is some Schubert chamber music, as recommended by my father. This is the Beaux Arts trio playing Notturno. Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment