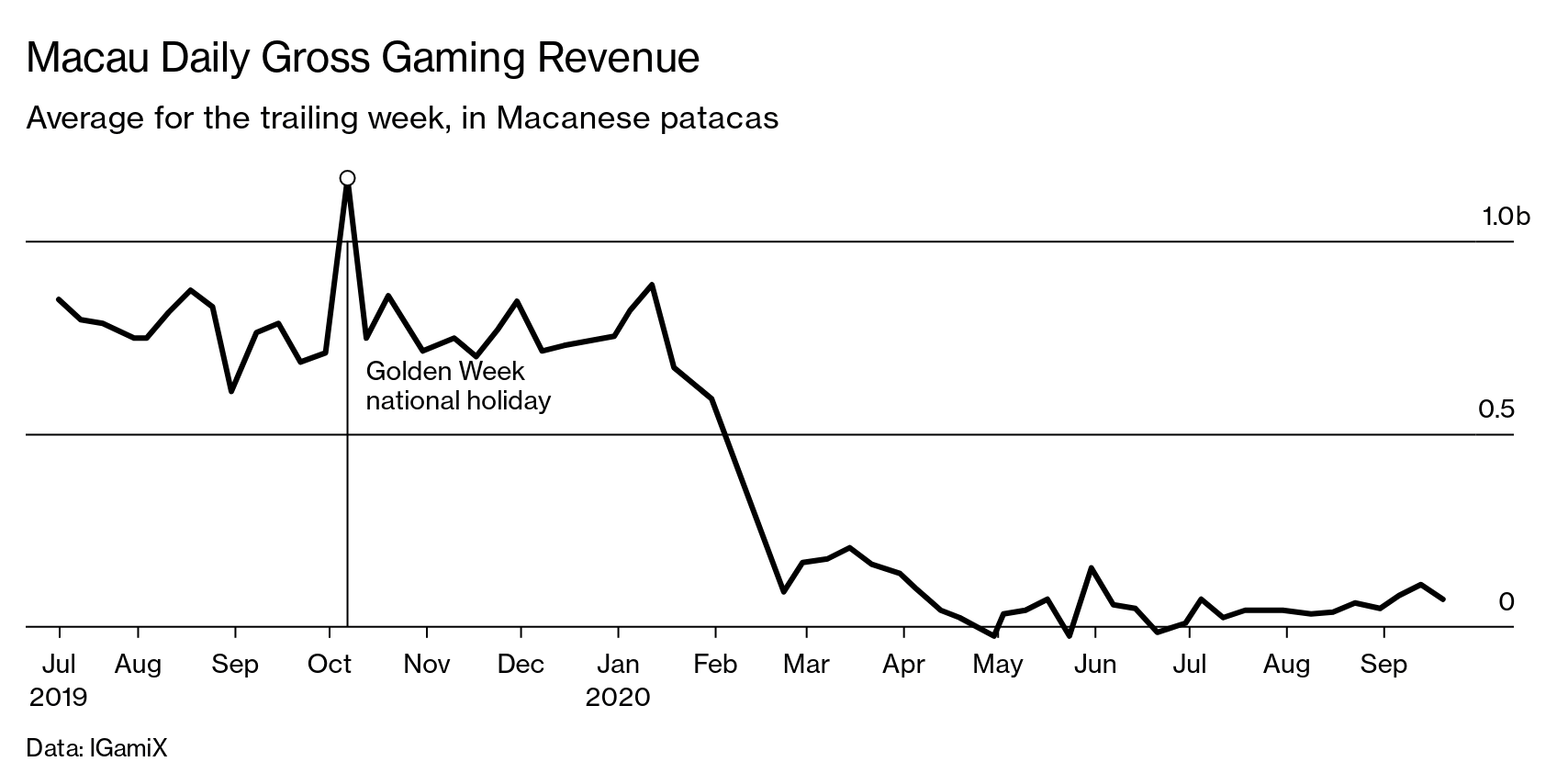

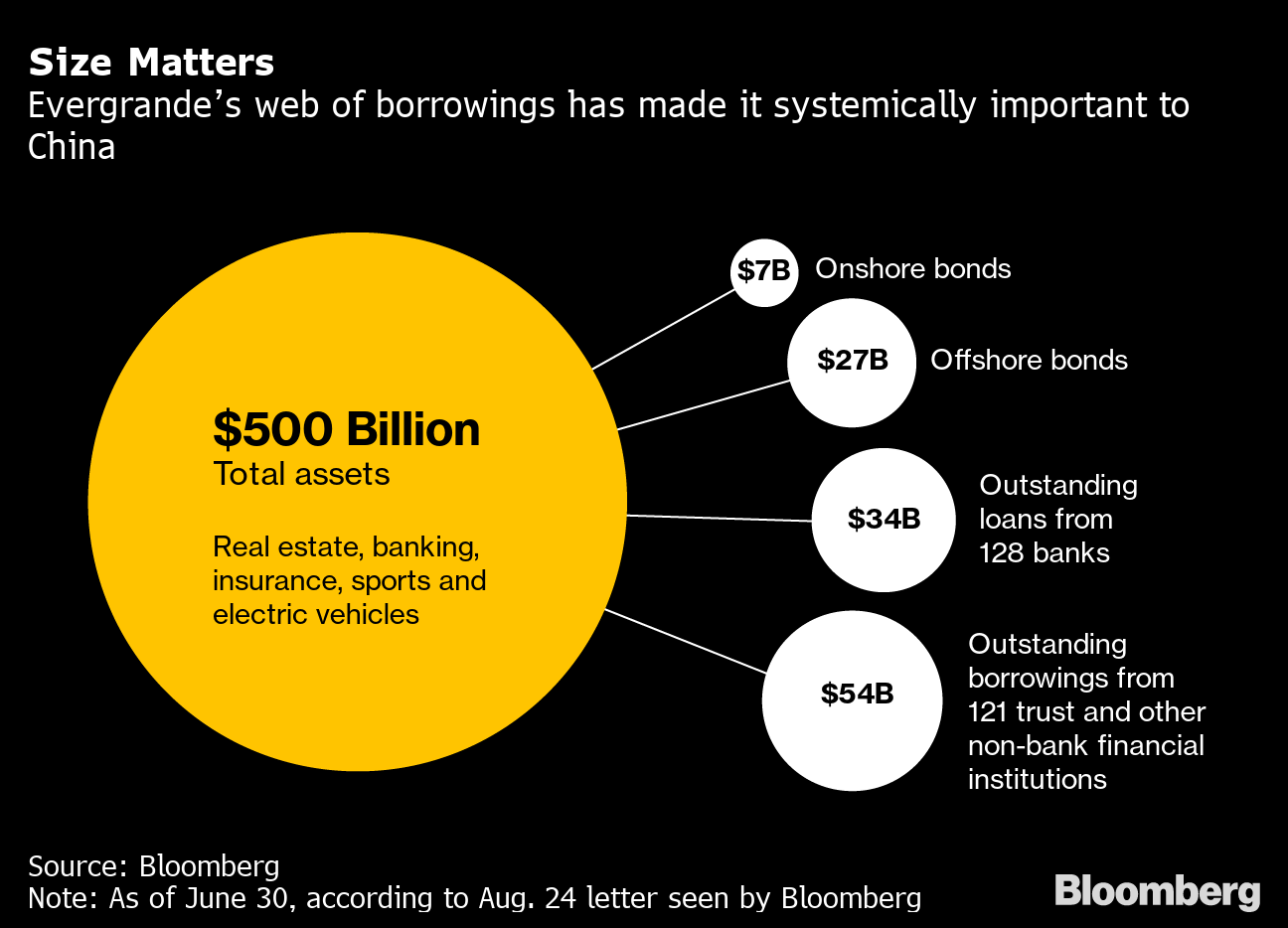

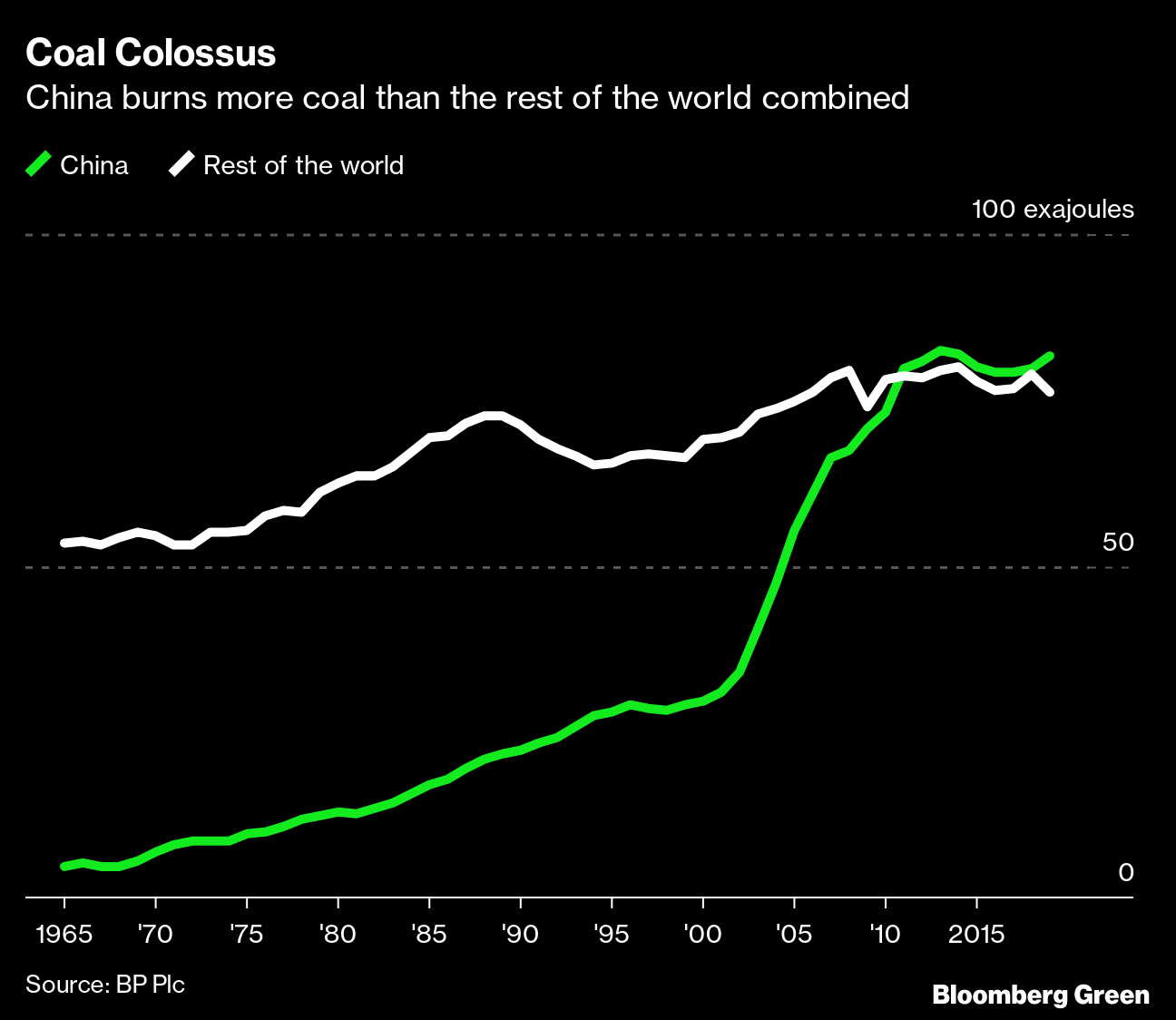

| A remarkable thing is happening across China right now. Millions of people are going on vacation. They're taking time off from work for the Mid-Autumn Festival and National Day, two annual holidays that happen to coalesce this year into an eight-day stint from Oct. 1-8. Hotels are getting booked, train stations becoming crowded and airplanes being boarded. The busiest travel day of this period, often referred to as Golden Week, is expected to be Oct. 7, when more than 13,800 domestic flights are already scheduled. That's almost 10% more than Oct. 6, 2019, the busiest day of last year's Golden Week. By contrast, forward flight bookings in the U.S. for November, when holiday travel begins with Thanksgiving, are just a quarter of last year's levels for American Airlines and United Airlines, according to OAG Aviation Worldwide. For Delta Air Lines, it's just 12%. China's success at containing the coronavirus and reviving economic activity has been notable. Indeed, a government compiled gauge of manufacturing published this week showed the economy is recovering better than expected. That's not to say things are getting back to normal. The country's hordes of tourists, famous for flooding attractions and shopping centers around the world, are staying home. Even closer destinations such as Macau, which while governed separately from the mainland is still part of China, are feeling the repercussions.  Macau, the only part of Chinese territory where gambling is legal, usually sees a surge in visitors during Golden Week, so much so that its population more than doubles. This year, the city's casinos are bracing for far fewer, with the most optimistic predictions being that Golden Week will deliver just half of 2019's 1 million tourists. Beijing has tried to help by easing travel restrictions to Macau, but to little effect. Travel agents say that potential visitors are worried any resurgence in infections could lead to abrupt border controls, leaving them stranded. It appears that even with Covid as much under control as China has gotten it, the virus continues to cast a long shadow. Evergrande Worries Evergrande is many things. It's one of China's largest property developers. It has spent billions to become a leading maker of electric cars. Its chairman is China's fourth richest person. Recently though, the fact that has been in special focus is its distinction as the world's most indebted real estate company. Worries about that debt surged late last week following reports Evergrande had sent a letter to Chinese officials warning it faced a cash crunch that could pose systemic risks. The problem stemmed from the right of some investors to demand their money back if Evergrande fails to win approval for a backdoor listing in Shenzhen by Jan. 31, a repayment that could have taken up 92% of its cash and cash equivalents. Evergrande's shares and bonds plunged, yet by late Tuesday this week, the company seemed to have at least bought itself more time when it announced an agreement with those investors to avoid that repayment. But with more than $120 billion in debt, the clock is always ticking.  Hong Kong Order Hong Kong Chief Executive Carrie Lam, speaking at an Oct. 1 ceremony celebrating the founding of the People's Republic of China, used the occasion to declare that stability had returned to the Asian financial center. With some 6,000 riot police on standby, the display offered a stark contrast from a year earlier. National Day, as the anniversary is known, was marked in 2019 by numerous clashes between police and demonstrators, including the first shooting of a protester by a police officer. Much has changed since then, with the institution of Hong Kong's national security law chief among them. That legislation has enable local authorities to crackdown aggressively on those organizing demonstrations. Just this week, police in Hong Kong arrested five activists on allegations that they incited people to attend unlawful gatherings. Chinese authorities, meanwhile, moved to prosecute a dozen people matching the description of a group of Hong Kong activists who were intercepted while trying to flee to Taiwan by speedboat. A year on, the tide has indeed changed. Coal Addiction To meet its goal of becoming carbon neutral by 2060, China will first have to reckon with its dependence on coal. The country relies heavily on the dirtiest fossil fuel for energy, burning more of it each year than the rest of the world combined. But according to a top Chinese climate research institute, that will start to change drastically after 2035, when the country's total energy demand will begin to decline. Indeed, researchers at Tsinghua University's Institute of Energy, Environment and Economy expect China to eliminate all coal-fired electricity by 2050. To make that and the 2060 goal a reality, the country may need to spend as much as $15 trillion.  What We're Reading A few other things that caught our attention: And finally: There won't be a Next China newsletter next week because of the Golden Week break. We'll be back with a new edition on Oct. 16. |

Post a Comment