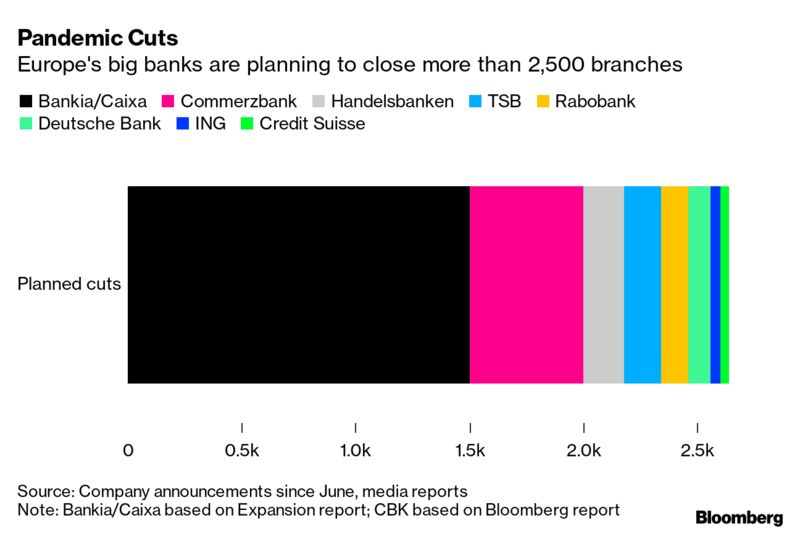

| Welcome to the Brussels Edition, Bloomberg's daily briefing on what matters most in the heart of the European Union. If the aim was to salvage some of EU's foreign policy credibility, then this summit proves a success. Leaders managed to overcome Cyprus's objections and will today impose sanctions against dozens of Belarusian officials involved in August's contested election and the violent crackdown that followed. They also made a point that most of them don't want further escalation with Turkey in the Eastern Mediterranean, not least because they rely on Ankara for stemming migration flows. It's unclear though whether the incentives they're willing to offer will appease Turkey (just as it was doubtful that any sanctions would deter President Recep Tayyip Erdogan). The Turkish leader wants a settlement in the area, and it won't come cheap for either Greece or Cyprus. If he doesn't get it, the EU will find itself facing the same dilemmas that kept leaders awake late last night. — Nikos Chrysoloras and Viktoria Dendrinou What's Happening Getting Closer | The final round of scheduled talks between the U.K. and EU over their future relationship concludes today with the two sides making limited progress, setting up a frantic few weeks of last-ditch negotiations and volatility. The two chief negotiators will meet this morning to discuss whether they think they are in a position to enter a final intensive stage of talks that would signal a deal is within touching distance. Finance Boss | EU lawmakers will get to grill Mairead McGuinness this morning after her nomination to succeed Valdis Dombrovskis as commissioner in charge of financial-services policy. Expect questions on Brexit and the impact of the coronavirus recession on the financial system. Dombrovskis, meanwhile, will face questions on his new appointment as the bloc's trade chief. Green Pioneer | Where Europe leads, the rest of the world often follows. And one area where the region is making strides is in turning financial markets greener. Today, an EU consultation on how green bonds should be judged comes to and end, paving the way to making a global market worth almost $1 trillion less opaque. Week Ahead | Euro-area finance ministers will next week settle on their pick for the ECB's soon-to-be vacant executive board seat. But they'll have to choose between two male candidates, something likely to draw pushback from EU lawmakers who've long agitated for gender balance at the central bank's top posts — or at least among the shortlisted candidates. In Case You Missed It Got News | Google will start paying select media outlets to display curated stories on its news app in a concession to the industry that has for years accused it of unfairly using its content. It follows pressure from news executives and regulators around the world who've urged platforms like Google and Facebook to pay for the rights to host news articles. Hungarian Opt-Out | Viktor Orban offered to opt out of the EU's 750 billion-euro coronavirus fund to escape stronger scrutiny as the bloc prepares to tie aid to democratic criteria. The proposal, if taken up, threatens to blow open a deal that EU leaders sealed in July. Record Cash | The ECB's emergency stimulus has propelled excess cash sloshing around the euro area's economy past 3 trillion euros for the first time. Financial institutions have increased the amount of money parked with the ECB by 1 trillion euros in under six months, a spike that comes after policy makers issued cheap loans and snapped up bonds to offset the pandemic's economic damage. Looking Up | Manufacturing in the euro area expanded at the fastest pace in more than two years thanks to a strong upturn in Germany, with a sharp pickup in trade helping to pull the economy out of a recession. The latest data come as growth momentum in Europe has slowed, with resurgent infections raising the risk of more restrictions on movement. Chart of the Day  European banks are cutting branches like never before as the pandemic pushes clients away from bricks-and-mortar. Containment restrictions have accelerated usage of online banking after many physical locations were shuttered and consumers sought distance from public places to mitigate the risk of virus exposure. With many branches now costing more than they earn, lenders are accelerating the shift online. Today's Agenda All times CET. - 9 a.m. EU Parliament hearings of McGuinness, the commissioner-designate in charge of financial services, and of incoming EU trade chief Dombrovskis

- 9:30 a.m. Special EU leaders Summit to discuss single market, industrial policy and digital transformation, as well as external relations, in particular relations with Turkey, China and Belarus, and the poisoning of Alexey Navalny

- 11 a.m. Eurostat releases September inflation flash estimate

- Informal video-call of EU health ministers to discuss WHO reform

Like the Brussels Edition? Don't keep it to yourself. Colleagues and friends can sign up here. We also publish the Brexit Bulletin, a daily briefing on the latest on the U.K.'s departure from the EU. For even more: Subscribe to Bloomberg All Access for full global news coverage and two in-depth daily newsletters, The Bloomberg Open and The Bloomberg Close. How are we doing? We want to hear what you think about this newsletter. Let our Brussels bureau chief know. |

Post a Comment