| Questions remain about Trump's condition, monetary heavy-hitters speak, and stimulus hopes hold out. Better?After President Donald Trump's discharge from hospital and return to the White House, questions remain over his condition and when he will return fully to work. His physician Sean Conley said that while the president was fit enough to go home, he "may not be entirely out of the woods." Officials in the White House announced measures to control access to the president and are offering protective gear to those who meet him. Trump promised he would be back on the campaign trail soon. Powell, Lagarde The heads of both the Federal Reserve and the European Central Bank are both speaking today. ECB President Christine Lagarde warned earlier that while virus containment measures pose a clear risk to the recovery, her biggest fear is a sudden end to fiscal support. Fed Chair Jerome Powell is expected to reiterate that the bank has done as much as it can and the recovery is in the hands of lawmakers when he speaks at 10:40 a.m. Eastern Time. ECB economist Philip Lane will share his views after Powell. Still talking.. Speaking of fiscal measures, hope still remains that House Speaker Nancy Pelosi and Treasury Secretary Steven Mnuchin can strike a deal for a new stimulus package with the pair set to resume negotiations today. While significant gaps remain between the Democrat's $2.2 trillion proposal and a $1.6 trillion offer backed by the White House, both sides have reported progress. Despite President Trump recently calling for both parties to "get it done" on stimulus, it is unclear if a deal struck by Mnuchin would have sufficient Republican support in the Senate, or even time to complete the legislation ahead of the election. Markets mixedThe lack of any new catalyst and continued uncertainty over both fiscal stimulus and the president's condition mean markets are a little directionless. Overnight the MSCI Asia Pacific Index rose 0.7% while Japan's Topix index closed 0.5% higher. In Europe the Stoxx 600 Index had slipped 0.2% by 5:50 a.m. with tech stocks leading the losses. S&P 500 futures pointed to a small loss at the open, the 10-year Treasury yield was at 0.765%. Oil rose and gold was little changed. Coming up...The U.S. trade balance for August is published at 8:30 a.m. with job openings data for that month at 10:00 a.m. As well as Powell, Philadelphia Fed President Patrick Harker, Atlanta Fed President Raphael Bostic and Dallas Fed President Robert Kaplan all speak today. A House panel holds a hearing on voting rights and election administration. Joe Biden speaks in Gettysburg. Levi Strauss & Co. is among the companies reporting earnings. What we've been readingThis is what's caught our eye over the last 24 hours. And finally, here's what Joe's interested in this morningThere continues to be a lot of debate about the so-called shape of the recovery (V, K, etc.) but it's worth asking whether the true recovery even started at all.

Remember, from the beginning of this crisis, it's been important to separate out two distinct phenomenon: the cessation and the recession. The cessation was simply the temporary halting of business activity in order to avoid the virus. The recession is the economic damage sustained from the lost income and disruption caused by the cessation. The cessation caused an extraordinary surge in temporary layoffs, which have fortunately come down faster than expected. However the recession has led to a rise in permanent layoffs, which unfortunately continue to climb.

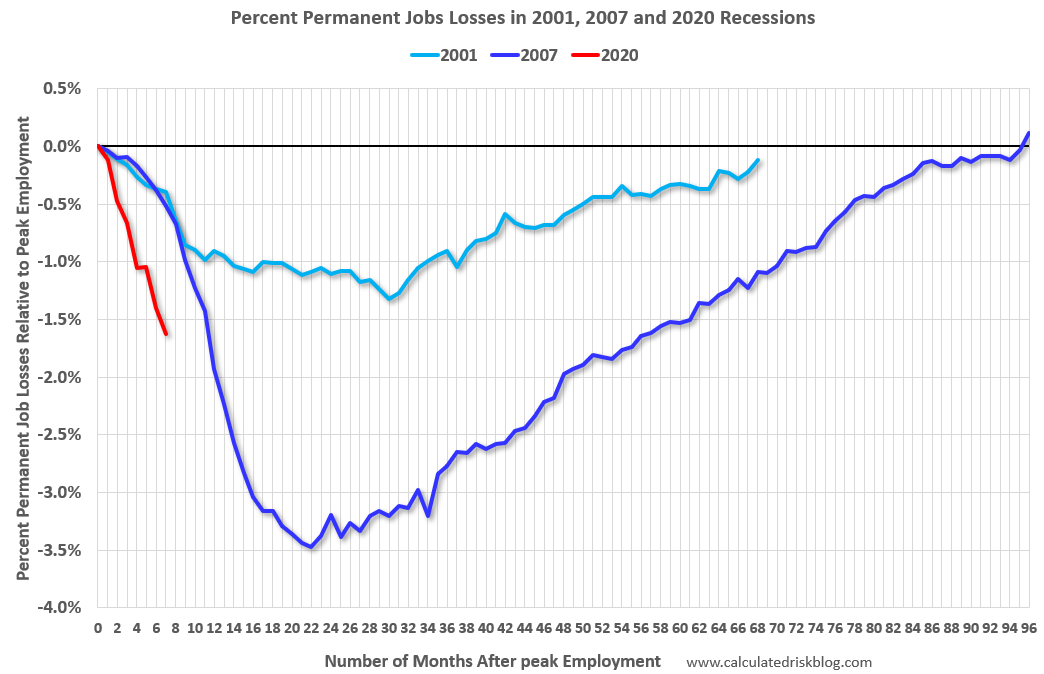

In a blog post yesterday, John Jay College economics professor JW Mason argued that the recession is really just beginning now. "The problem is that much of the federal spending dried up at the end of July," he wrote. "And that is shifting the economy from a temporary lockdown toward a self-perpetuating fall in incomes and employment." This can be seen, most clearly, in the ongoing rise of the permanently unemployed. Jed Kolko, the chief economist at Indeed, estimates that actual core unemployment, stripping out the noise from temporary layoffs, hit 6.1% in September. That's the highest level since the crisis started. Skanda Amarnath at Employ America, an organization that advocates for policies that promote a hot labor market, pegged the actual unemployment rate at around 6.5%, a greater than 1% jump in the last month. As he put it in a followup message to me: "if the actual unemployment rate jumped from 5.3% to 6.4%, we would be going insane." The good news on the labor market is that millions of the jobs that were lost in the spring were in fact temporary. The bad news is that we've had a faster-than-expected bounceback from the lockdown, extraordinary fiscal and monetary easing, and an unexpected housing boom -- and yet the rise in permanent unemployment is still happening at a faster pace than the runup to the Great Recession. This chart from Calculated Risk shows that nicely.

Joe Weisenthal is an editor at Bloomberg. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment