| Trump's tweets move the market, Fed minutes due, and more oil market worries. Tweet stormPresident Donald Trump sent markets into a tailspin yesterday afternoon when he tweeted that he had issued instructions to "stop negotiating until after the election" on a new stimulus plan. Treasury Secretary Steven Mnuchin, who had been leading negotiations for the White House, formally told House Speaker Nancy Pelosi that the talks had been halted. Trump's tweet came only hours after Fed Chair Jerome Powell warned the economy needed more fiscal aid to strengthen the recovery. Markets recovered some ground overnight as the president went on a two-hour Twitter spree which, though sometimes contradictory, signaled support for some economic measures. Minutes It is unclear if there will be any further move to secure fiscal support ahead of the election, with lawmakers variously expressing alarm or support. Democrats have already largely rejected the piecemeal approach to stimulus that Trump suggested in his later tweets. With time now very short, there may be no new money before the election. Today's minutes from the most recent Federal Reserve meeting, published at 2:00 p.m. Eastern Time are expected to contain loud calls for fiscal measures, but with that taken off the horizon for now, analysts are suggesting that the central bank could do even more to support the economy. DeltaOil, which dropped yesterday after stimulus negotiations were halted, is facing more problems as Hurricane Delta, a Category 4 storm, churns through the Gulf of Mexico. It is expected to affect portions of the Yucatan Peninsula later today before making hitting the U.S. Gulf Coast at the weekend. While the shutdown in production may give some support to prices, government data due later today is likely to show that crude inventories expanded again. The market is also still trying to deal with the structural changes in demand from the pandemic. Markets mixedMuch of the world is catching up with Trump's surprise move which came late in the U.S. trading session. Overnight, the MSCI Asia Pacific Index added 0.3% while Japan's Topix index closed broadly unchanged. In Europe, the Stoxx 600 Index was 0.1% lower at 5:50 a.m. with banks and insurers among the biggest fallers. S&P 500 futures pointed to a small bounce at the open after yesterday's selloff, the 10-year Treasury yield was at 0.773% and gold gained. Coming up...Vice President Mike Pence and Kamala Harris face off in the only vice-presidential debate ahead of the election from 9:00 p.m., with both candidates separated by a plexiglass barrier. New York Fed President John Williams, Minneapolis Fed President Neel Kashkari, Atlanta Fed President Raphael Bostic, Boston Fed President Eric Rosengren and Chicago Fed President Charles Evans all speak today. What we've been readingThis is what's caught our eye over the last 24 hours. And finally, here's what Joe's interested in this morningYesterday I wrote about rising permanent unemployment, and asked whether the real labor market recovery has even begun or not. While temporary job loss due to virus-related furloughs is definitely down, at least some of the pain has yet to peak.

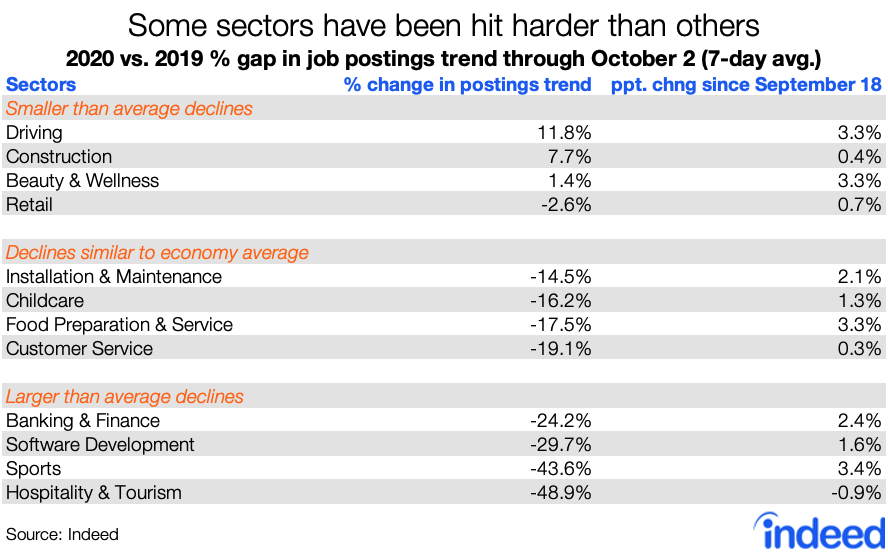

Looking further under the hood of the labor market reveals some other concerning signs. Jed Kolko, chief economist at at the job site Indeed, has been regularly tracking job openings by sector throughout this crisis. It's notable which sectors are bouncing back, and which ones remain depressed. In areas like retail and construction, which temporarily were forced to shut down in the spring, positions continue to rapidly open up. But in areas such as banking, finance, and software development, job openings remain extremely depressed.

The split makes sense. A software development job isn't the type of thing you just post one day because a business reopens after a lockdown. It represents some kind of longer-term bet on future business prospects. You can think of a software hire as as being akin to a capital investment. As such, this should raise some concerns about economic productivity going forward, if companies are spending less on long-term investment and projects now.

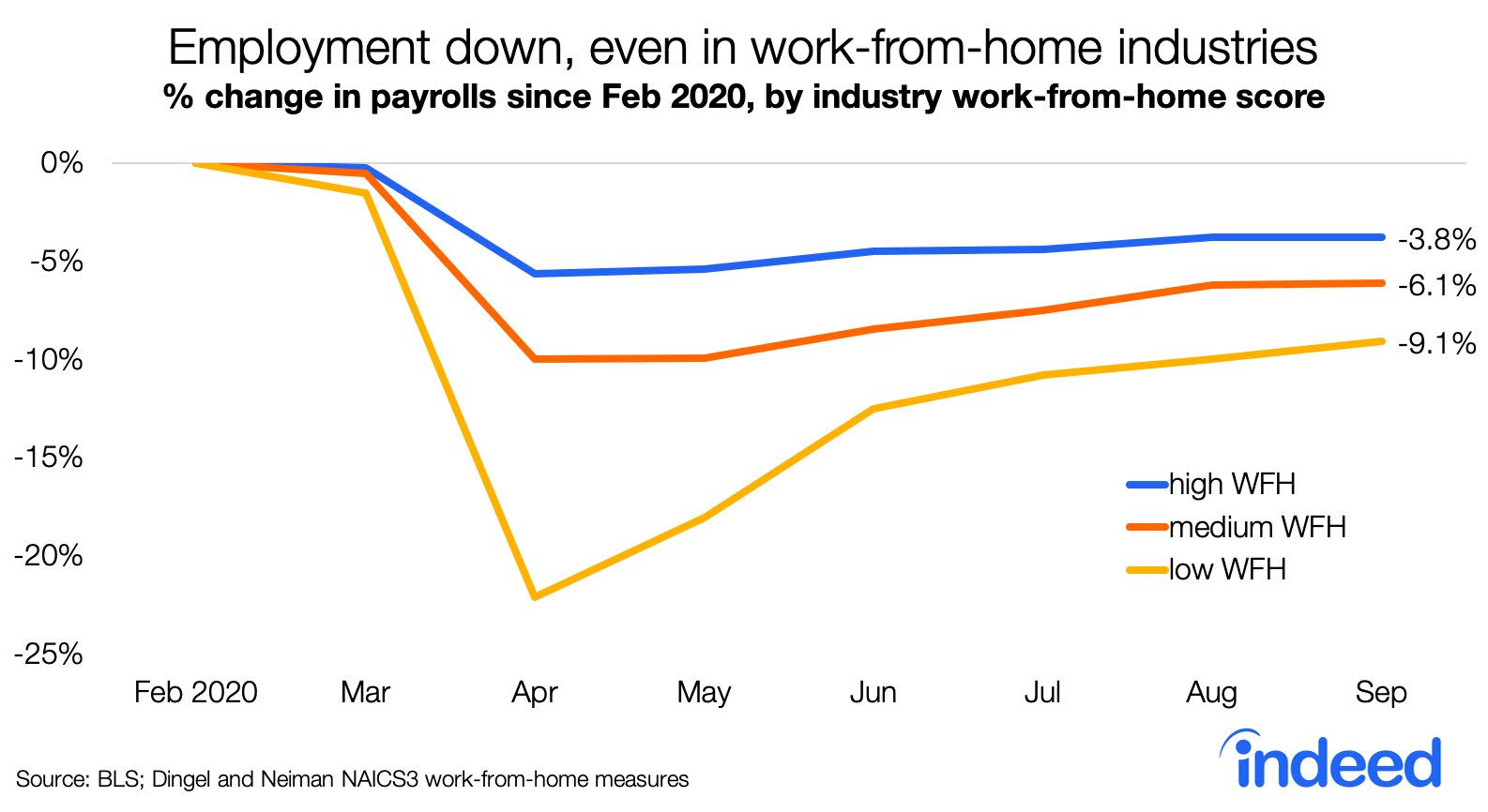

Meanwhile, another chart from Jed offers a different way of looking at a similar phenomenon. Job declines in industries where you can work from home haven't been as severe as in other areas, but there's also been virtually no rebound since the April trough. So again, in the parts of the labor market that represent a longer-term commitment, where hiring and firing decisions aren't immediately connected to, say, the virus or lockdown policies, we continue to see persistent weakness, and signs that longer-term investment is on hold.  Joe Weisenthal is an editor at Bloomberg. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment