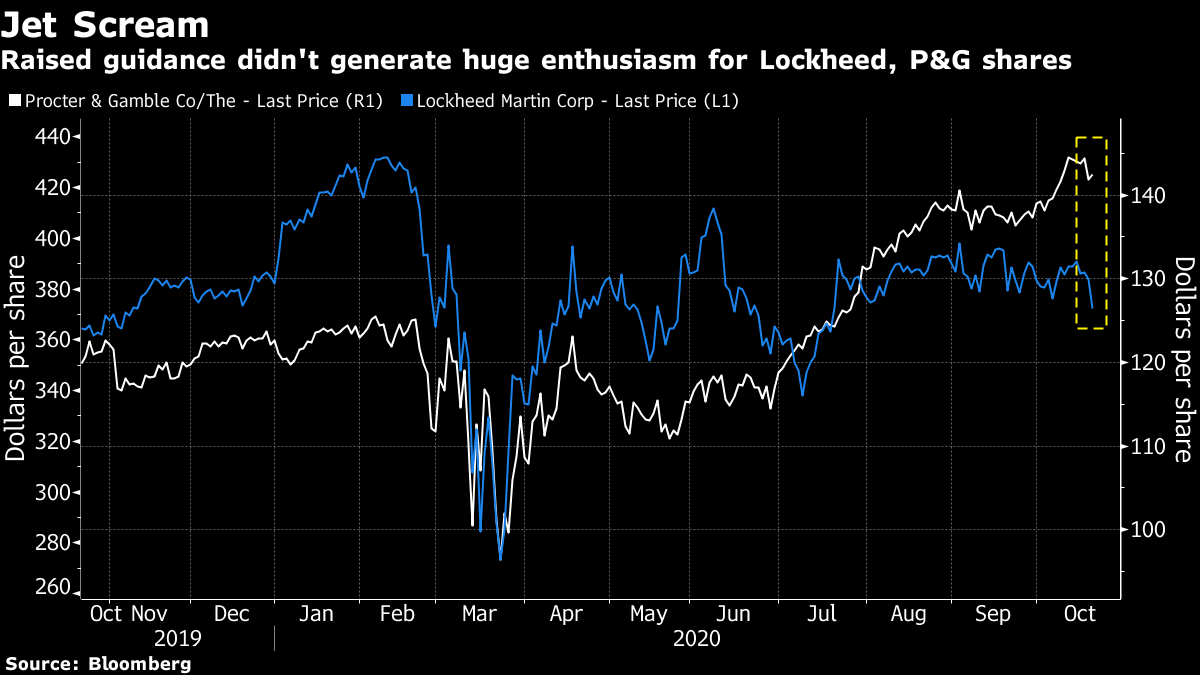

| Want the lowdown on what's moving European markets in your inbox every morning? Sign up here. Good morning. Some optimism on U.S. stimulus, a landmark antitrust case against Google and caution on virus vaccines. Here's what's moving markets. Stimulus HopeU.S. House Speaker Nancy Pelosi said Tuesday she's hopeful for a stimulus agreement this week, which would be crucial to getting a bill passed by Election Day. The White House also expressed some optimism, with Chief of Staff Mark Meadows telling CNBC that work on an agreement by the weekend continues, but warning that there is still a way to go. ``We're not just down to a difference of language and a few dollars," Meadows said. Even if remaining differences can be bridged, Senate Republicans remain a key roadblock. In Europe, talks on Britain's post-Brexit relationship with the EU have remained mired in a stalemate. Without a trade deal, consumers and businesses will face the cost and disruption of tariffs and quotas in just 10 weeks' time. UnrealisticIt is "completely unrealistic" to expect a Covid-19 vaccine to be widely available by the end of this year, and most people probably won't have access to a shot until the second half of 2021, Severin Schwan, CEO of Swiss pharma giant Roche Holding AG, warned on Tuesday. Novartis AG CEO Vas Narasimhan cited a similar late-2021 timeline in an interview last month. Later on Tuesday, media reported that AstraZeneca Plc may resume its U.S. vaccine trial as early as this week. Meanwhile, U.S. drug-safety inspectors found continuing quality-control problems problems at a New Jersey plant Eli Lilly & Co. is using to help produce its Covid-19 antibody therapy. Europe's outbreak has continued to spread, with daily case records in Germany, Greece and the Netherlands. Mammoth Tech CaseAlphabet Inc.'s Google engaged in a variety of anticompetitive practices to maintain and extend its monopoly, the U.S. government said in a landmark complaint filed Tuesday. Exclusive agreements with wireless carriers and phone makers like Apple Inc. deny rivals the scale and distribution they need to compete against Google in search, the U.S. said. Google monetizes its dominance in search by selling advertising, which it uses to pay for the exclusive deals. Those payments create a strong disincentive for distributors to switch to another service, according to the complaint. Google called the government's case "deeply flawed." With analysts seeing ``limited risk'' to Google from the suit, shares closed 1.4% higher. Are you still watching?Netflix Inc. shares tumbled in late U.S. trading after missing Wall Street's estimates for subscribers, renewing doubts about its ability to maintain growth as pandemic lockdowns end and competition intensifies. The world's largest paid streaming service added just 2.2 million new subscribers in the third quarter, well short of the 3.32 million predicted by analysts, as well as the company's own more conservative projection. Many viewers -- especially in Europe and Asia -- have returned to something closer to normal day-to-day life, reducing the amount of time they can spend on Netflix binges, while pro sports have returned to Americans' TV screens. All of that hampered subscriber gains last quarter. Coming Up…Chemicals group Akzo Nobel NV and 5G gear maker Ericsson's third-quarter profits beat estimates, and food giant Nestle S.A. boosted its guidance after posting nine-month sales growth ahead of estimates. Up next, get ready for production updates of British miners Antofagasta Plc, Centamin Plc and Hochschild Mining Plc, as well as updates from bookie William Hill Plc and Spain's Iberdrola SA. After markets close, French home electronics firm Fnac Darty SA and office landlord Gecina SA are due to report. What We've Been ReadingThis is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morningIt's a sign of the times we live in that Tuesday's earnings wrap featured a manufacturer of fighter jets and a maker of soap both boosting their full-year guidance. Aerospace giant Lockheed Martin and consumer-products titan Procter & Gamble both raised forecasts, but tellingly one slumped and the other saw just a modest gain that didn't even beat the benchmark. As we suggested it might be last week, that seems to be the theme so far about 14% of the way through U.S. earnings season. A whopping 86% of companies who have reported to date have beaten profit estimates, and over 73% have surpassed sales forecasts, yet price reactions have been by and large negative. That the S&P 500 has managed to grind out a modest gain over the fortnight is testament to the power of U.S. stimulus hopes. And as Netflix shareholders found out in late trading Tuesday, when a company does miss expectations, the reaction is swift and sharp.

Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment