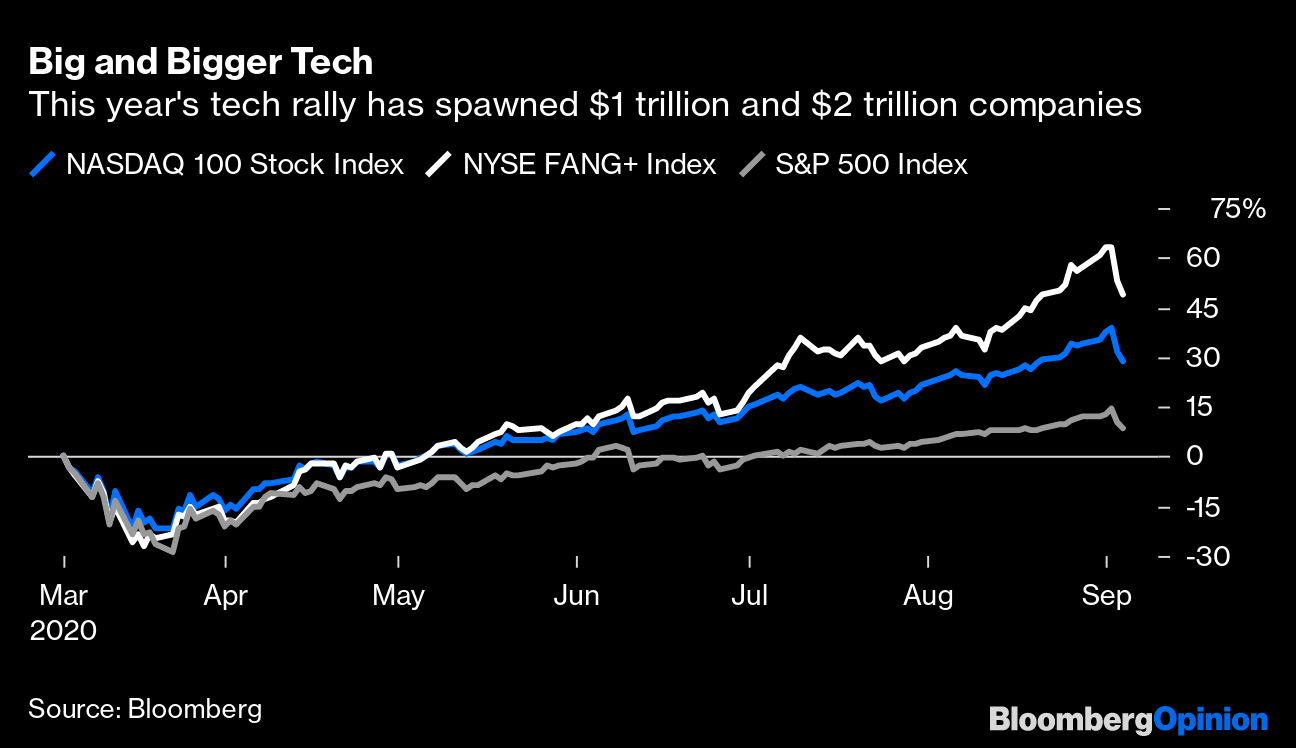

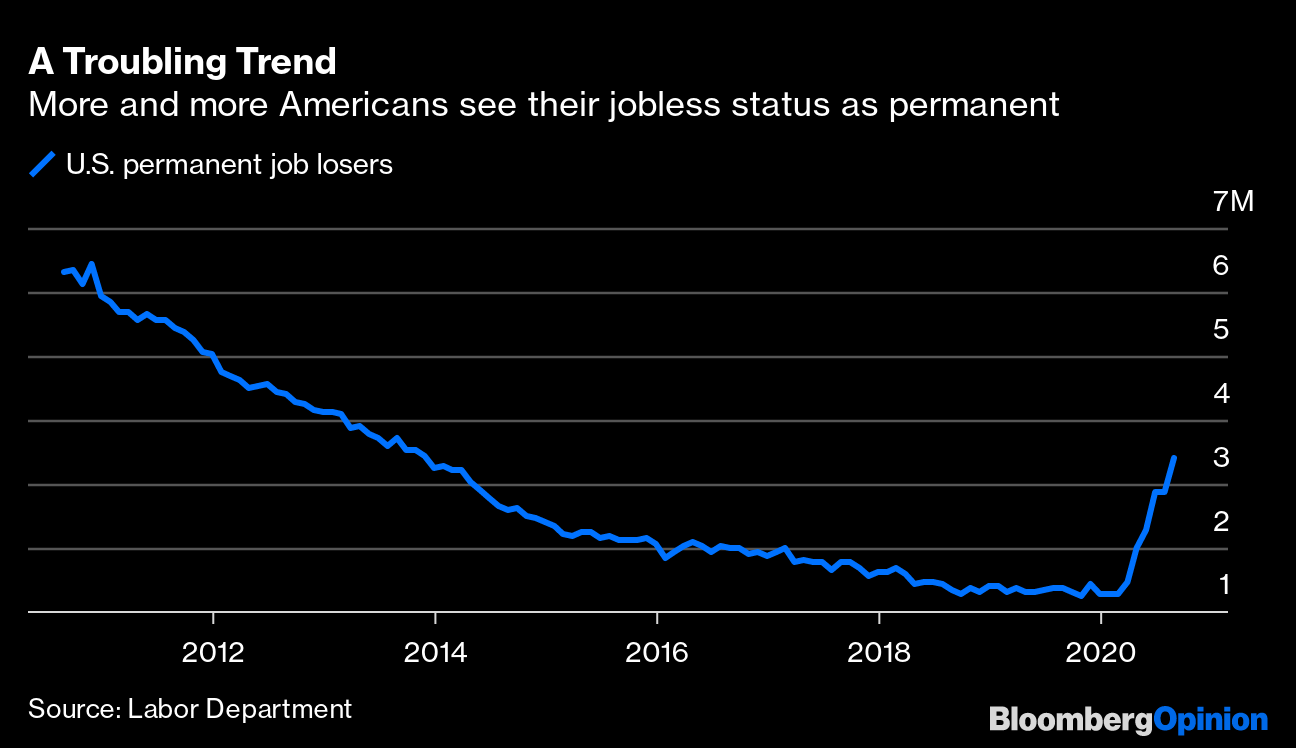

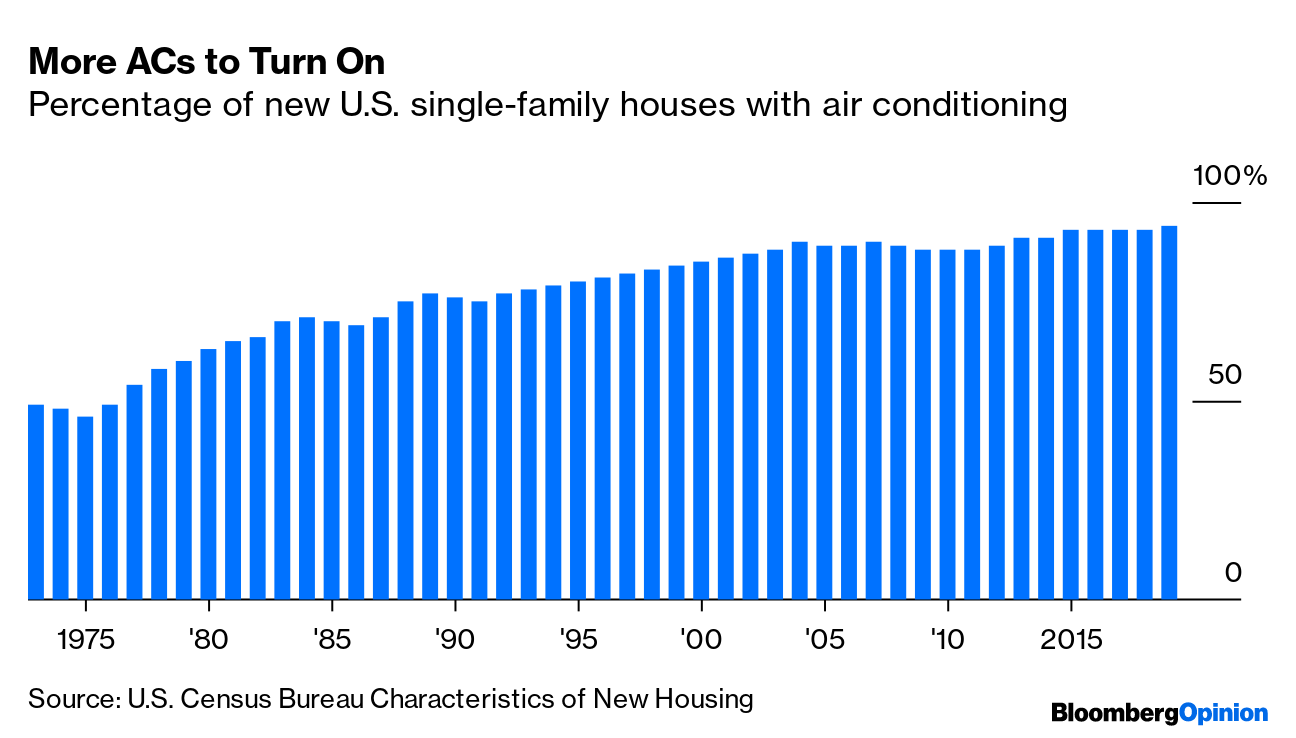

| This is Bloomberg Opinion Today, a multiplex of Bloomberg Opinion's opinions. Sign up here. Today's Agenda  Looking sharp. Photographer: Andrey Rudakov/Bloomberg The Vaccine Race The Covid-19 vaccines are coming, with U.S. Food and Drug Administration emergency use authorizations possible seemingly as early as next month. This would be terrific news in the face of a deadly pandemic, writes Noah Feldman, and in keeping with federal law that allows such authorizations if it's "reasonable to believe that the product may be effective." Many Americans will understandably greet such an announcement with great suspicion, though, given the Trump administration's record of overstating the efficacy of some Covid treatments and generally inviting skepticism about all its claims. More generally, the global rush to roll out vaccines could backfire, Lionel Laurent argues, if more isn't done to assure people that they are safe and effective. International polling indicates that it's not just anti-vaxxers who are worried. Large-scale testing and transparent approval processes are key to gaining public trust. So are liability arrangements for those harmed by vaccines that aren't seen as too stingy or favorable to pharmaceutical companies. If most people don't trust the vaccines, they may not stop pandemic. The Nasdaq Whale What fun times in the stock market, huh? Especially after it came to light today that Masayoshi Son of Softbank Group Corp., might have been accelerating the soaring gains of big U.S. tech stocks by buying options tied to about $50 billion worth of them. It's a risky bet, writes Tara Lachapelle, and may have begun to sour late this week. The disconnect between big tech and the rest of the market seems like one of those things that just can't go on forever.  The last spectacular tech-stock boom, in the late 1990s and early 2000s, ended in an equally spectacular bust. John Authers doesn't think we're in for a do-over of the dot-com era, though. One big difference from the dot-com years is that Apple Inc., Microsoft Corp., Amazon.com Inc., Google holding company Alphabet Inc. and Facebook Inc. make oodles and oodles of money. If there's a bubble it's not so much in their valuations as in the monopolistic market power they've been allowed to amass. Build Duplexes Not Skyscrapers Expensive cities like Los Angeles need more housing, and the best, least disruptive way to get it is to allow landowners to build more duplexes, triplexes and the like, argues Virginia Postrel. Legalizing such "missing-middle" housing is a way to increase density without destroying neighborhoods' human scale. Some places — such as Portland, Oregon — have recently made big changes to zoning rules and parking requirements to allow more of this kind of construction. A similar attempt in California's state legislature came up short this week, but it will be back. The Other TikTok Takeover In the U.S., President Donald Trump's threats to shut down short-video sensation TikTok if it remains under Chinese ownership have led to a bidding war among tech giants. In India, TikTok's biggest market by user numbers, it was already banned following a bloody India-China border clash in June. Now Softbank (yes, Masayoshi Son has been busy) is lining up a coalition deal to take over the Indian operation at a price that Tim Culpan thinks will be much more reasonable than the $30 billion or more TikTok could go for in the U.S. Further complex-international-transaction reading: Veolia Environnement SA wants to buy 29.9% of fellow French utility Suez SA from energy provider Engie SA, a smart move that comes with some risks, writes Chris Hughes. And Elisa Martinuzzi says the planned merger of Spanish banks CaixaBank SA and Bankia SA is just plain smart. Telltale Charts Today's jobs report revealed that the headline U.S. unemployment rate fell more than expected in August, to 8.4%. But as Brian Chappatta points out, the number of people who have permanently lost their jobs (as opposed to being on temporary layoff) rose by another 534,000.  And yes, I have made another chart exclusively for readers of this newsletter! It's a Labor-Day-weekend, unofficial-end-of-summer special based on Census Bureau Characteristics of New Housing data that was updated earlier this summer.  Further Reading Manufacturing is roaring back in the U.S., but a lot of the work will be automated. — Brooke Sutherland An exploding federal debt is no cause for panic, but may turn out to be a pain. — Michael R. Strain The U.S. should ignore the International Criminal Court rather than sanctioning it. — Eli Lake The dollar may keep weakening regardless of who wins November's election. — Marcus Ashworth There's still no stimulus package, but at least the government won't shut down. — Jonathan Bernstein ICYMI Stocks plummet to … about where they were two weeks ago. Elon Musk just got another $2.8 billion worth of Tesla Inc. options. Drive-in movie theaters are back. Kickers Why the French love to complain, according to the BBC. Some things you might or might not have wanted to know about the history of rice farming. How to be indistractable. Wanna see a baby encountering her first waterfall? Of course you do. Note: Please send TikToks and complaints to Justin Fox at justinfox@bloomberg.net. Hot news tips should however go to Mark Gongloff at mgongloff1@bloomberg.net, who will back in possession of the keys to this newsletter on Tuesday, after the U.S. Labor Day holiday. Sign up here and follow us on Twitter and Facebook. |

Post a Comment