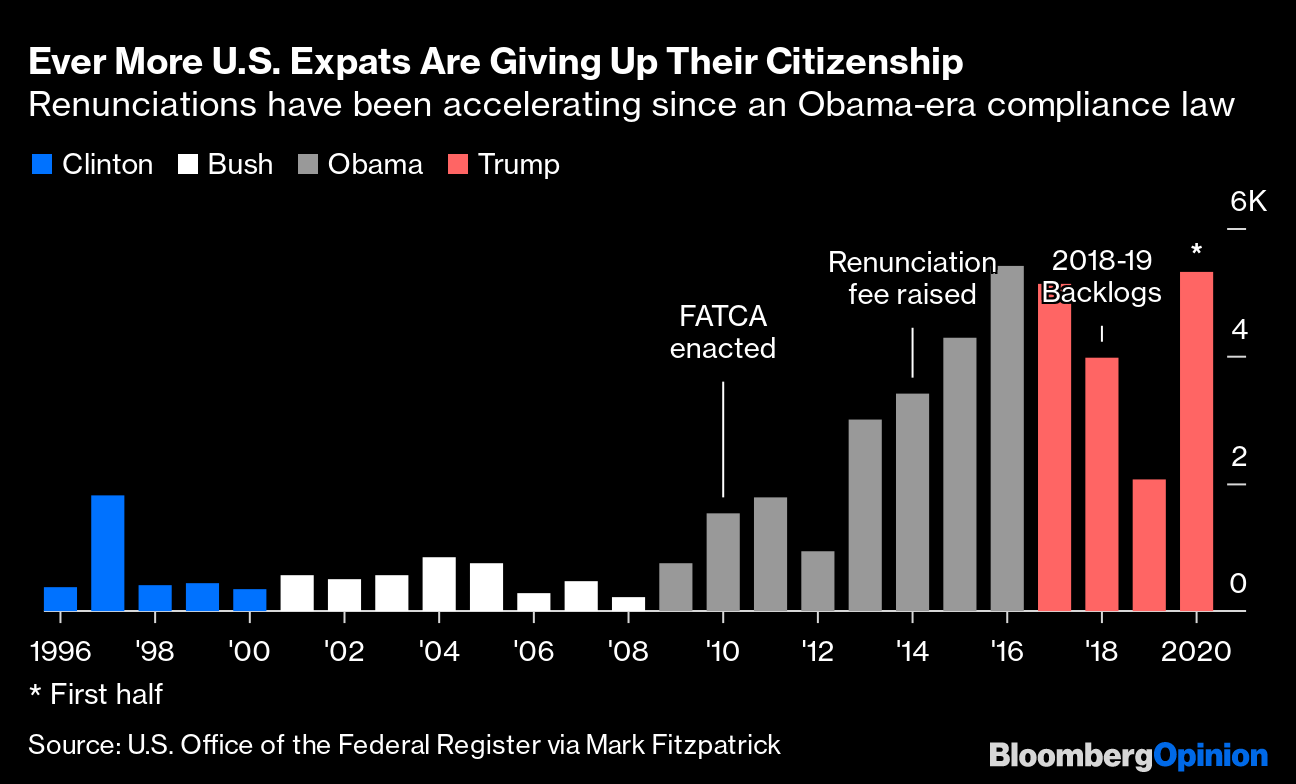

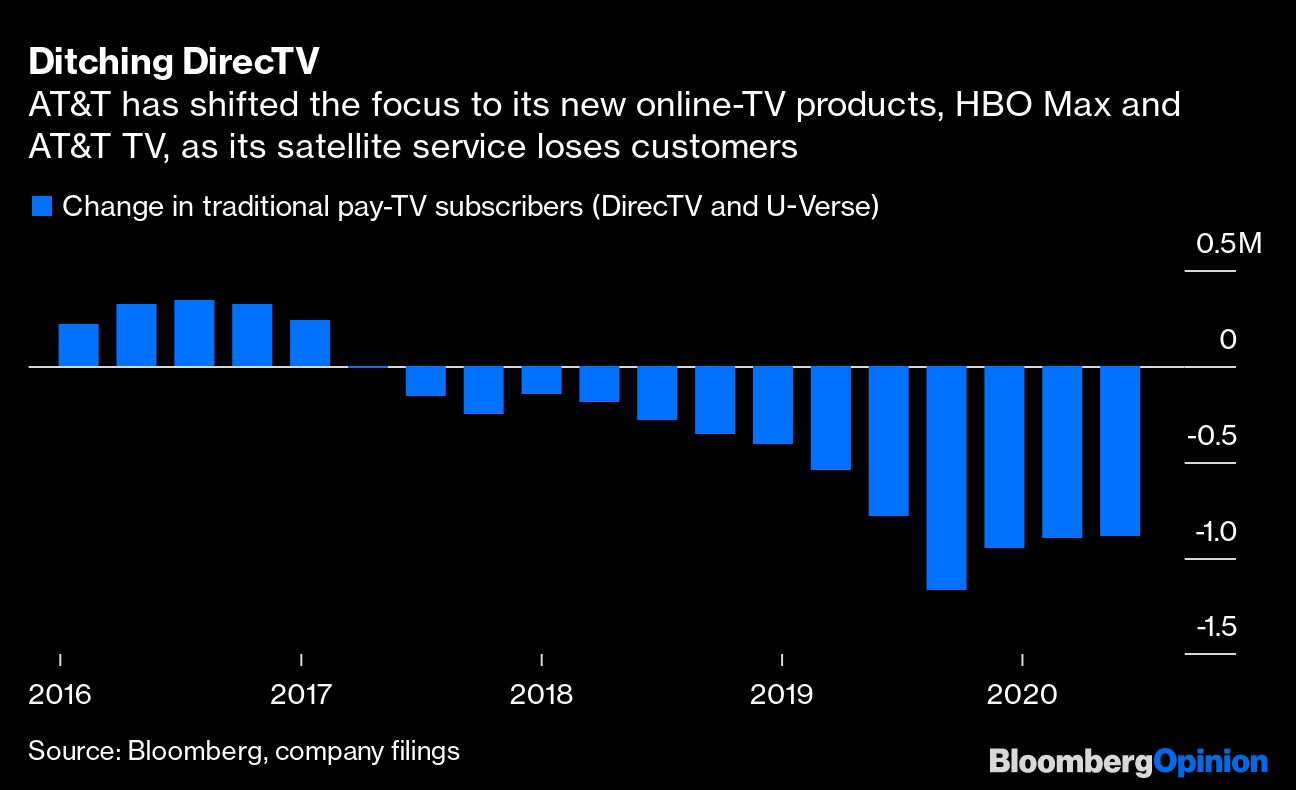

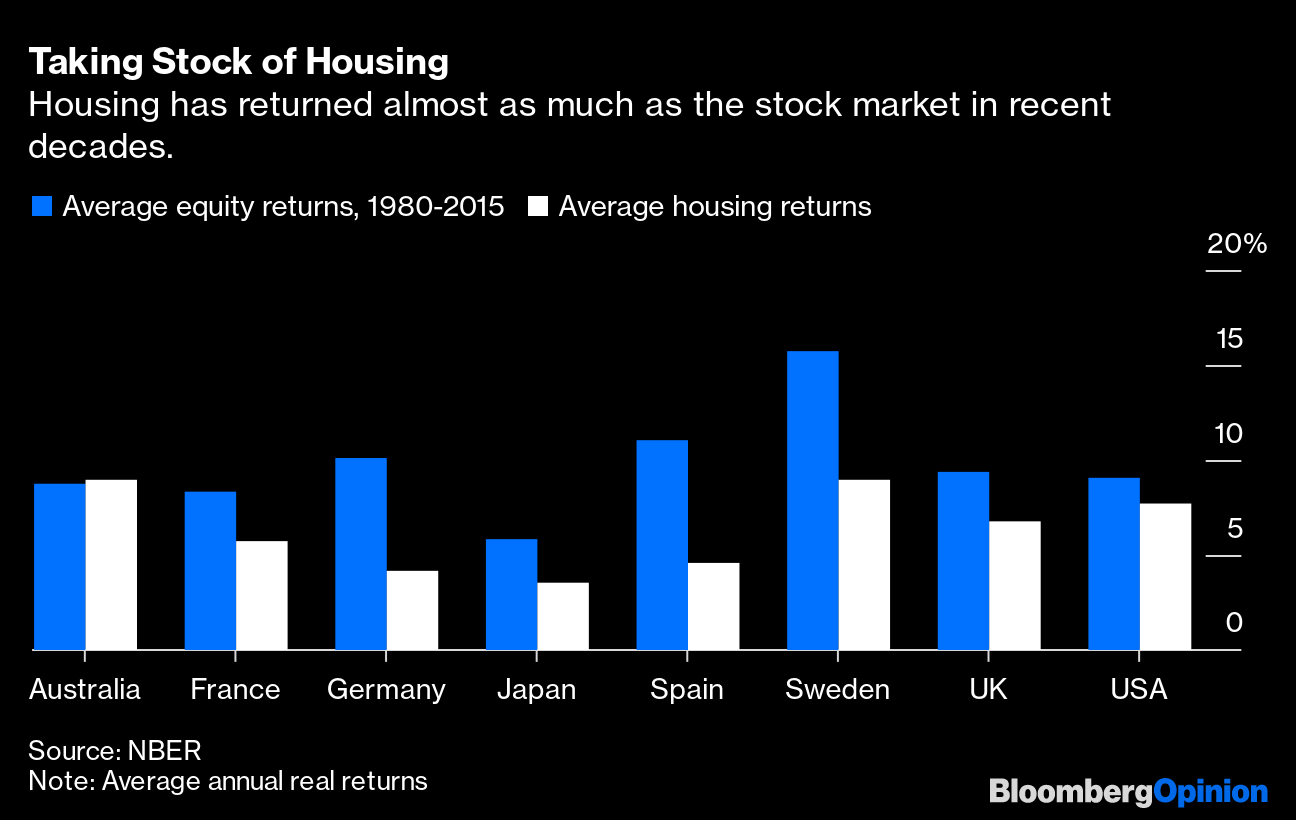

| This is Bloomberg Opinion Today, a sogo shosha of Bloomberg Opinion's opinions. Sign up here. Today's Agenda Buffett's 90 and Still Full of Surprises Warren Buffett celebrated his milestone birthday Sunday the best way he knows how: with a new headline-grabbing stock pick. His pal Bill Gates baked him a cake, too. Although Buffett is known to have a sweet tooth, big juicy deals are more his taste. The nonagenarian billionaire announced that his conglomerate, Berkshire Hathaway Inc., has acquired 5% stakes in five of Japan's storied trading houses — Itochu Corp., Marubeni Corp., Mitsubishi Corp., Mitsui & Co. and Sumitomo Corp. — in a wager valued at more than $6 billion. That is one pricey birthday gift. You may be thinking, "First gold, now Japan? Is Buffett feeling all right?" Yes, it was a bit strange, if not disconcerting, when America's No. 1 cheerleader dumped shares in a bunch of U.S. financial institutions last quarter and bought a position in gold-mining giant Barrick Gold Corp. instead. A bet on bullion certainly doesn't exude confidence in America's economic recovery. Now he's eyeing Japan Inc., which isn't exactly known for being the world's bastion of growth either. But Buffett is called the Oracle of Omaha for a reason, and so of course, there's a simple rationale for his interest in the Japanese trading houses: They're cheap relative to the cash flow they generate and screen well using Buffett's familiar investment criteria, David Fickling writes. In fact, Fickling found that three of the 10 companies worldwide that meet Buffett's criteria are Japanese trading houses. The soga shosha, as they're known in Japan, also look less like a tangle of commodities-focused assets these days, and more like their own versions of Berkshire Hathaway itself, as Anjani Trivedi explained in a prescient 2018 column. Further Japan reading: Prime Minister Shinzo Abe made a good start in improving Japan's economic prospects and geopolitical standing through corporate governance reforms, free-trade deals and by bringing more women into the workforce. But his successor will need to make even bolder moves to effect lasting change. — Bloomberg's editorial board Crystal Balls Are in Rare Supply Speaking of Buffett, this is one dealmaker whose deals rarely ever leak. Part of the reason is that Buffett keeps a close circle, choosing to sidestep bankers and work directly with sellers. He also isn't much for computers or email, preferring a good old fashioned phone call. Even though traders constantly speculate on Berkshire's next pursuits, more often than not they're wrong. But something fishy keeps occurring with transactions involving other companies: Their stock prices are reacting to deal news before it happens. That was the case when Google took a stake in ADT Inc. this month, and when Google announced its takeover of Fitbit Inc. Likewise, shares of Tiffany & Co. behaved curiously before LVMH Moet Hennessy Louis Vuitton SE made its bid public. Last we checked, Silicon Valley's engineers haven't yet developed a desktop crystal ball, so it sure sounds like illegal insider trading is taking place. It's troubling that nobody seems to be doing anything about it, writes Matthew A. Winkler. He wants to know, where are the regulators? One prediction investors wish they could make is who will win the U.S. presidential election. Polls show Joe Biden is still ahead; betting sites, however, reveal that his lead over Donald Trump has collapsed. One explanation, John Authers writes, is that the mayhem after last week's shootings in Kenosha, Wisconsin, is lifting the Trump campaign. So far, the president's response to the deadly events has mostly amounted to vague "law and order" tweets. Even so, Authers observes, "bettors appear to believe that the disorder will help Trump throughout the country." Bonus election reading: The 'T' Word Americans Are Fleeing Trump? Perhaps for some. But what's really driving Americans to renounce their citizenship are taxes. More specifically, it's the misery that's been induced by the 2010 Foreign Account Tax Compliance Act:  There are an estimated 9 million Americans living abroad, a population so large that it ranks ahead of 40 U.S. states. For them, the FATCA has created a host of financial-disclosure headaches and even difficulty finding a place to stick their savings money, Andreas Kluth writes. And he's talking about middle-class people, not wealthy Americans stashing cash offshore. It's unfair, and politicians shouldn't keep ignoring the issue, Kluth writes. Telltale Charts The next step in AT&T Inc.'s makeover into a 5G-powered, HBO-streaming machine is to finally offload its drab DirecTV satellite division, Tara Lachapelle writes. The business may fetch just $20 billion, instead of the $49 billion AT&T paid in 2015.  As millennials look to invest in rental properties, it's important to weigh the pros and cons. The financial returns can be attractive, but being a landlord also forces lifestyle changes and decisions that may veer from one's moral compass, Noah Smith writes.  Further Reading If elected, Biden needs to rebuild the Justice Department's credibility by appointing a leader who can put it back on apolitical footing. — Noah Feldman China may be willing to sell TikTok's U.S. operations, but it won't let go of the app's secret sauce: the lucrative algorithms that predict user behavior. — Tim Culpan Luxury brands such as Louis Vuitton could partner with hotels to offer secluded, extravagant getaways to affluent customers during and after Covid-19. — Andrea Felsted When the coronavirus-driven boon in spending on durable goods eventually reverses, markets may not take it well. — Conor Sen The only thing that could reverse negative interest rates is a huge government infrastructure plan, but don't count on one. — Paul Podolsky ICYMI Amazon Prime gets approved to operate as a drone airline. City dwellers are heading to Florida, Idaho, Texas and Vermont. Trump has lost even more ground with female voters this election. Kickers Kite flies toddler — yes, you read that correctly. Rapper Master P launches food brand to bring diversity to industry. Get lost in these unusual maps. Two thousand years later, the dodecahedron reveals an infinite path. Note: Please send birthday cake and complaints to Tara Lachapelle at tlachapelle@bloomberg.net. Sign up here and follow us on Twitter and Facebook. |

Post a Comment