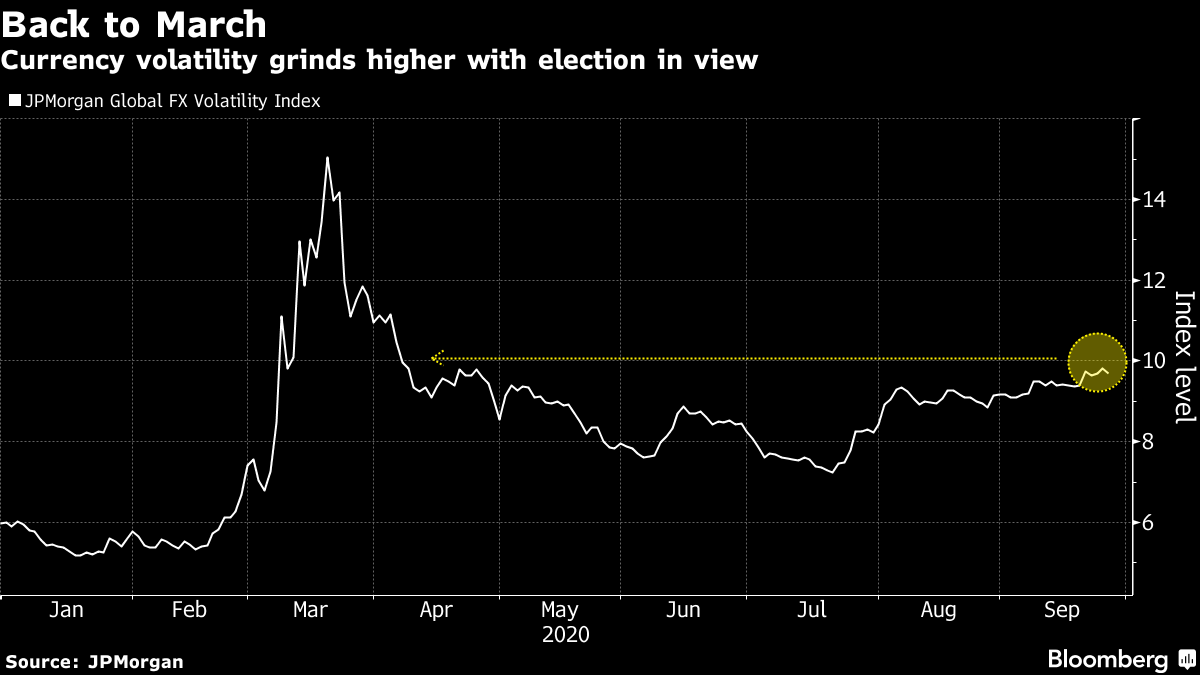

TikTok attacks U.S. ban. Trump reportedly paid just $750 in income tax in 2016 and 2017. Asian markets are set for a muted start to the week. Here are some of the things people in markets are talking about today. President Donald Trump paid just $750 in income taxes in both 2016 and 2017, reported losing millions of dollars from his golf courses and has hundreds of millions in debt that will come due in the next few years, according to a report in the New York Times. The U.S. president paid no income taxes in 10 of the 15 years before he was elected, because he generated large losses that offset any money that he made, according to the Times analysis. The documents show that many of Trump's businesses are struggling, with him putting more money into the firms than he is taking out, the report said. It also said he has earned $73 million abroad, despite a pledge that he would pursue no new foreign deals while president. Trump said at a press conference Sunday that the report is "totally fake news." TikTok's Chinese owner asked a federal judge to stop Trump from enforcing a ban that would remove the viral video-sharing network from U.S. app stores today. ByteDance filed on Wednesday for a temporary block on the ban even as it continues to pursue approvals from the Trump administration for a sale of its U.S. operations to Oracle and Walmart. ByteDance's request deploys many of the same arguments a group of WeChat users made to win their own preliminary injunction last weekend against a similar ban. Both TikTok and WeChat have been labeled national security threats by the Trump administration, which is seeking to stop their use in the U.S. — or, in TikTok's case, force a sale to U.S. companies — on the grounds they could allow China's government to gain access to personal data from millions of Americans. Currencies began the week with muted moves and stocks in Asia were on course for modest gains as investors weighed further signs of recovery in China against more virus outbreaks in some parts of the world. The dollar was steady against most G-10 peers early Monday. S&P 500 futures started the week higher. The S&P 500 rose on Friday, when equity-index futures in Japan and Australia edged higher. Global equities are on course for the first month of losses since March amid mounting signs that the pace of economic recovery will slow with an uptick in global coronavirus cases and a stall in further government aid. Data over the weekend showed profits at China industrial companies grew for a fourth consecutive month in August. Emerging markets are heading toward the end of the third quarter with more reasons to be cautious than optimistic. Developing-nation stocks, currencies and bonds had their worst week in the five days through Friday since the coronavirus pandemic rocked global markets in March. The gap between implied volatility in emerging-market currencies and their G-7 peers is at the widest since June amid concerns over renewed lockdown measures and delays to further U.S. fiscal stimulus. Manufacturing reports from China, India, Brazil and South Africa that are being published this week are potentially less decisive for investors than the global sentiment toward risky assets, and investors are bracing for higher price swings around the U.S. November elections. After the Covid-19 pandemic pulled down the curtain on dealmaking in the first half of the year, an unexpected bright spot emerged in the third quarter: Asia. At $390 billion, deal activity in Asia Pacific in the third quarter is already at a record, according to data compiled by Bloomberg. The volume of deals involving Asian companies this year has climbed nearly 11% from a year earlier, while those in Europe and the Americas have plunged. Coronavirus remains a towering obstacle, and geopolitical tensions between the U.S. and China have made some transactions harder to execute, if not impossible. Still, dealmakers are hardly sitting idle. What We've Been ReadingThis is what's caught our eye over the past 24 hours: And finally, here's what Adam's interested in this morningMarkets are bracing for volatility across stocks, bonds and currencies in the lead-up to, and aftermath of, November's U.S. presidential election. But Goldman Sachs economists say traders should temper those concerns. The fear is that results from the Nov. 3 vote won't be clear enough that a winner emerges without a protracted legal battle. You can see in this chart how the currency market is seeing an uptick in volatilty.  Goldman argues that a combination of early results, voter turnout, county-level data and the high correlation of polling errors across states suggest investors will indeed have enough information on election night to determine the likely victor. For now, investors seem prepared to pay up for extra hedges as this key event risk looms. Adam Haigh is an editor covering global markets for Bloomberg News in Sydney. |

Post a Comment