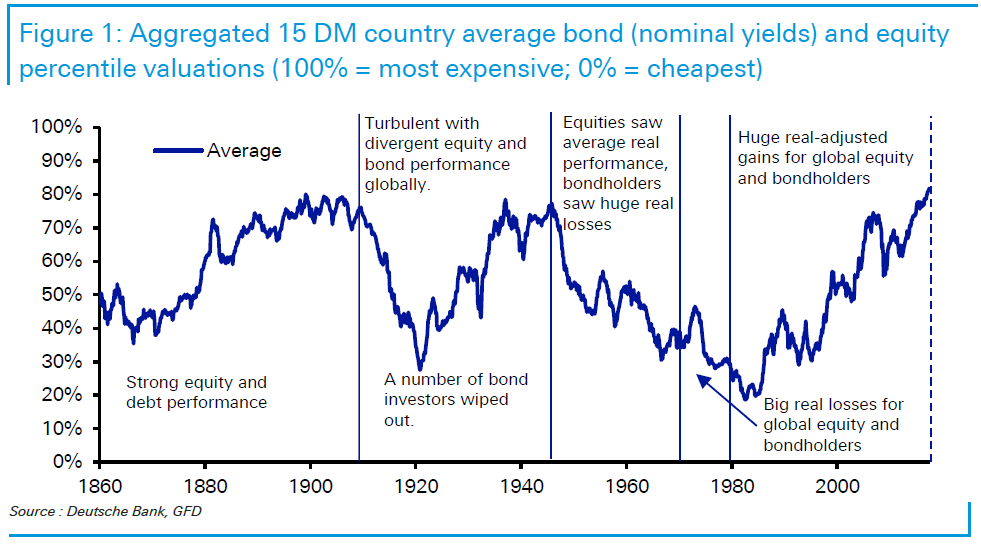

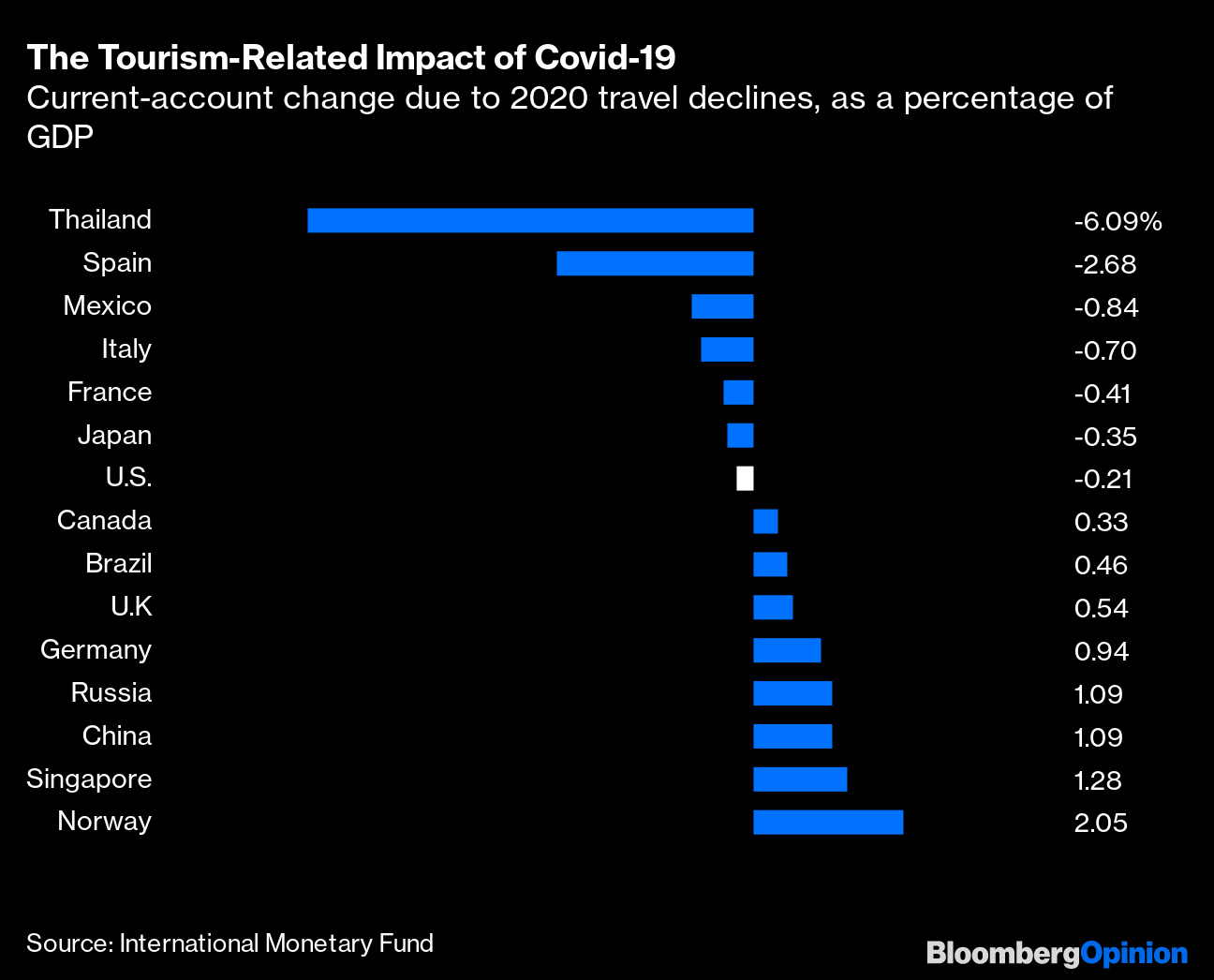

This is Bloomberg Opinion Today, a spin class of Bloomberg Opinion's opinions. Sign up here. Today's AgendaWhat the K-Shaped Recovery Really MeansMany of us talk about economics in bland abstractions that can obscure the real people and consequences involved. For example, we keep calling the pandemic recession "K-shaped," which is a handy way to describe how millions suffer while others thrive. It might be more appropriate to say it's the shape of a giant bear trap waiting to snap down on us all. Nowhere is this more evident than in the stock market, which soars while millions are sick and unemployed. Doing better still are the companies catering to relatively wealthy people who can afford not only to work from home but also to buy second homes for distanced working, learning and spin classes. Shares of Games Workshop Group, which makes fantasy games you play on a tabletop, are outpacing even Amazon and Tesla, notes Chris Bryant. But it caters to people who have the cash and free time to buy and paint bucketloads of little figurines to fight imaginary wars.Peloton Interactive, which sells stationary bikes and produced that ad we all made fun of last Christmas, has been turbocharged throughout this pandemic, writes Tara Lachapelle:  But while Peloton thrives, thousands of small gyms wither and die, Tara notes. And while sales of second homes and SUVs soar, lower-income people face evictions and higher transportation prices. And while those of us with disposable income salivate over the prospect of pricey new Apple products coming this fall, millions lack the basic Internet service they need to work or learn from home. And so on. The inequality leading up to and worsened by the Great Recession poisoned our politics and threatened our future prosperity. But just wait until you see what follows the pandemic. Underprivileged children have always been at an educational disadvantage, but distance learning and the financial straits of hundreds of non-elite colleges will set them even further back, warns Claudia Sahm. The resulting inequality could be so acute that it destabilizes the whole economy. There are solutions here, but they mostly involve Congress getting its act together to provide more relief to struggling people, businesses, and state and local governments. But Congress has already gone home for the weekend. What Took You So Long, Wall Street?Yesterday we praised Citigroup for being the first big U.S. bank to make a woman its CEO. Today we ask why no bank bothered to do this until the Year of Our Lord 2020, or 48 years after Katharine Graham became the first female CEO of a Fortune 500 company. As Bloomberg's editorial board notes, women have proved to be better managers and produce better shareholder returns than men. Not only for diversity's sake but also for the sake of economic growth and productivity, we need to put more women in positions of power. Citi's Jane Fraser brings the total number of women running Fortune 500 companies to just 39. We can do a lot better. What to Expect When You're Expecting Trump to WinMany Democrats may start looking hard at Canadian real estate if President Donald Trump wins re-election, some in the fear he'll become the unconstrained authoritarian they assume he has always longed to be. But there's another possibility that may be a little more realistic, writes Jonathan Bernstein: Trump may simply spend even more time watching Fox News, playing golf and trying to make a buck than doing his job, making him even less effective and possibly more vulnerable to impeachment. There's a third possibility, of course: that he'll finally become a dignified, unifying statesman. Any takers on that bet? No matter who wins in November, Trump can at least take some satisfaction in the fact that he has won the argument over whether free trade is good or not, with even Joe Biden embracing protectionism, Karl Smith notes. Trump's trade war did the country no favors, but that's a different question. Further Trump Reading: Both Trump and Eisenhower were wrong about the threat of the military-industrial complex. — Hal Brands Telltale ChartsIf we're really entering a new era of global economic disorder like the stagflation days, then commodities will far outshine stocks and bonds, writes John Authers.  The pandemic has been especially hard on countries that rely on tourism for economic growth, even if they have contained the virus relatively well, writes Justin Fox.  Further ReadingElizabeth Holmes will have a hard time convincing a federal court she's innocent because she's mentally ill. — Noah Feldman Expect more humanitarian disasters like the fire at the Moria refugee camp, because Europe refuses to fix its immigration system. — Andreas Kluth Narendra Modi's continued popularity despite disastrous decisions suggests people just want populists to do big things, even if those things are dumb. — Mihir Sharma India's richest man, Mukesh Ambani, keeps getting richer by persuading Western tech companies to invest in his ventures, which milk tiny amounts of money from large numbers of customers. — Andy Mukherjee It's not ideal, but Chicago could issue pension obligation bonds and then invest the proceeds in beaten-down stocks to goose pension returns. — Brian Chappatta ICYMIChina started testing a nasal-spray coronavirus vaccine. Tech companies are cutting pay for remote workers who leave Silicon Valley. What if they reopened Hudson Yards and nobody came? KickersFrank Frazetta's "A Princess of Mars" painting sold for a bargain $1.2 million. Azerbaijan rug is woven to look like it's melting. (h/t Scott Kominers for the first two kickers) At least 11 fish species are able to walk. (h/t Mike Smedley) Pringles cans are no longer quite so awful for recycling. Note: Please send melting rugs and complaints to Mark Gongloff at mgongloff1@bloomberg.net. Sign up here and follow us on Twitter and Facebook. |

Post a Comment