Reflation at Risk Since the March shock, it's been one of the smartest simple trades in the U.S. rates market. Buy inflation-linked bonds, because the economy isn't headed for another Great Depression and it's a cheap hedge against a pick up in price pressures. Some also thought, what with all this stimulus, inflation will be back in force as soon as the economy is back on its feet. Those more-ambitious reflation bets were always going to struggle while the pandemic's got the upper hand. It's hard to spot their next catalyst, with inflation expectations -- measured by breakeven rates -- already restored to their pre-March levels. And we're past the Federal Reserve's big announcement, that it's now targeting an average 2% inflation rate, meaning it will tolerate more than 2% for a while to make up for previous undershoots (which span much of the past decade.)

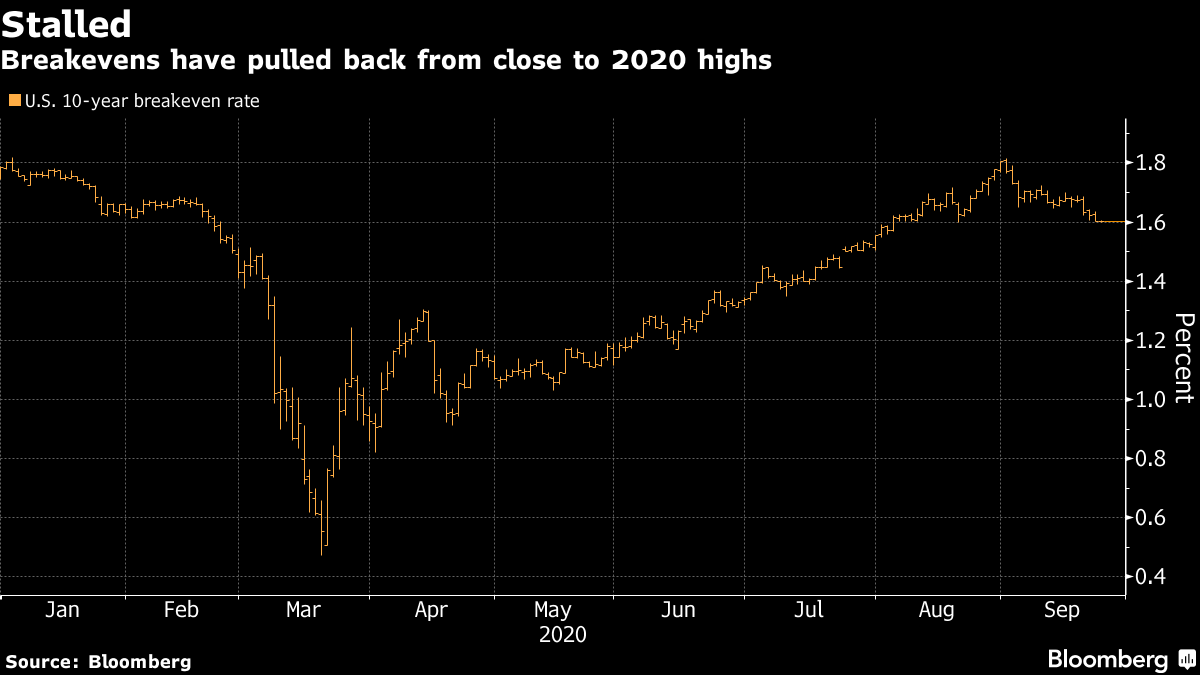

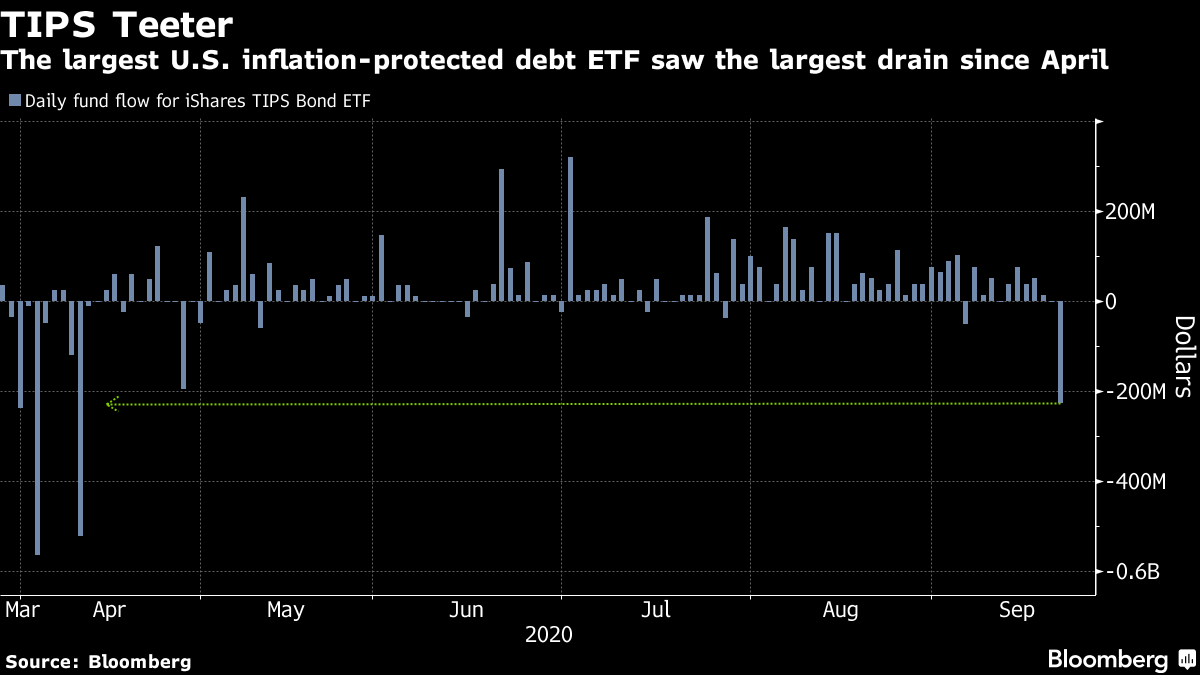

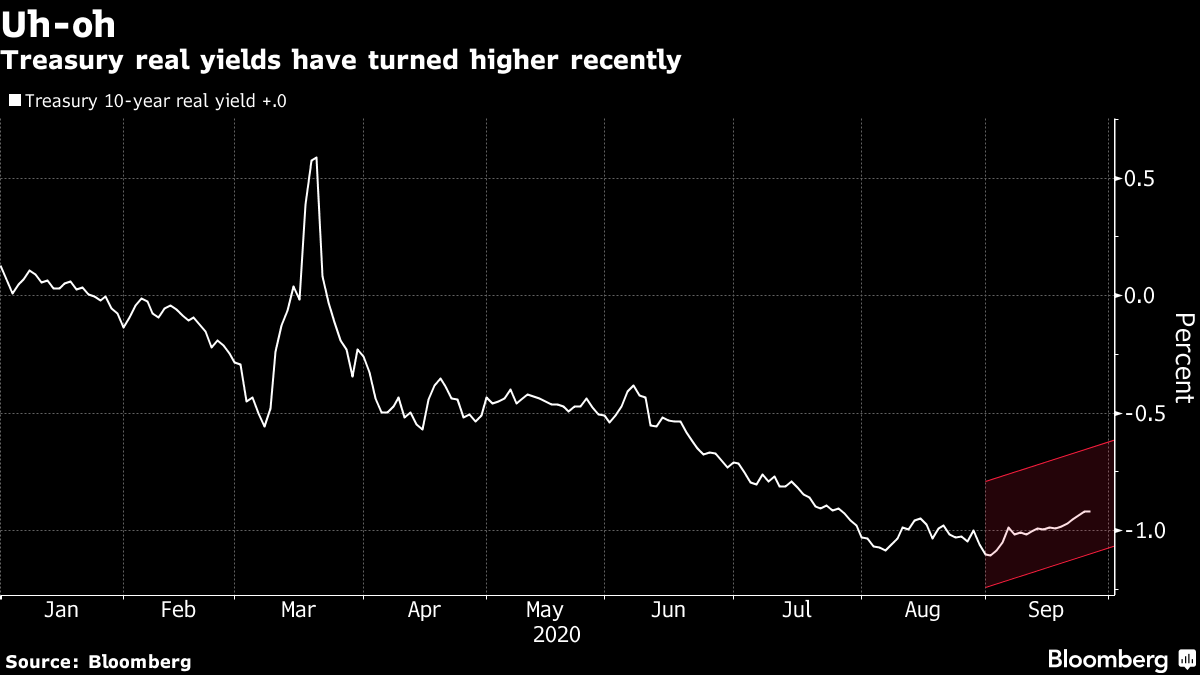

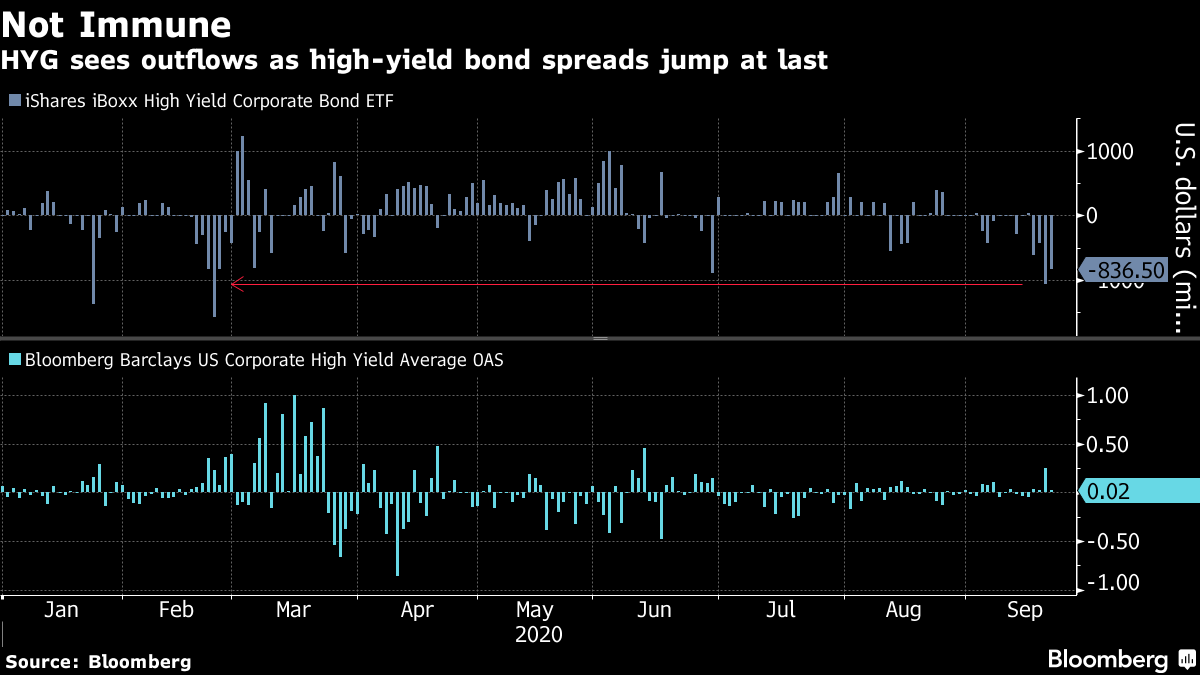

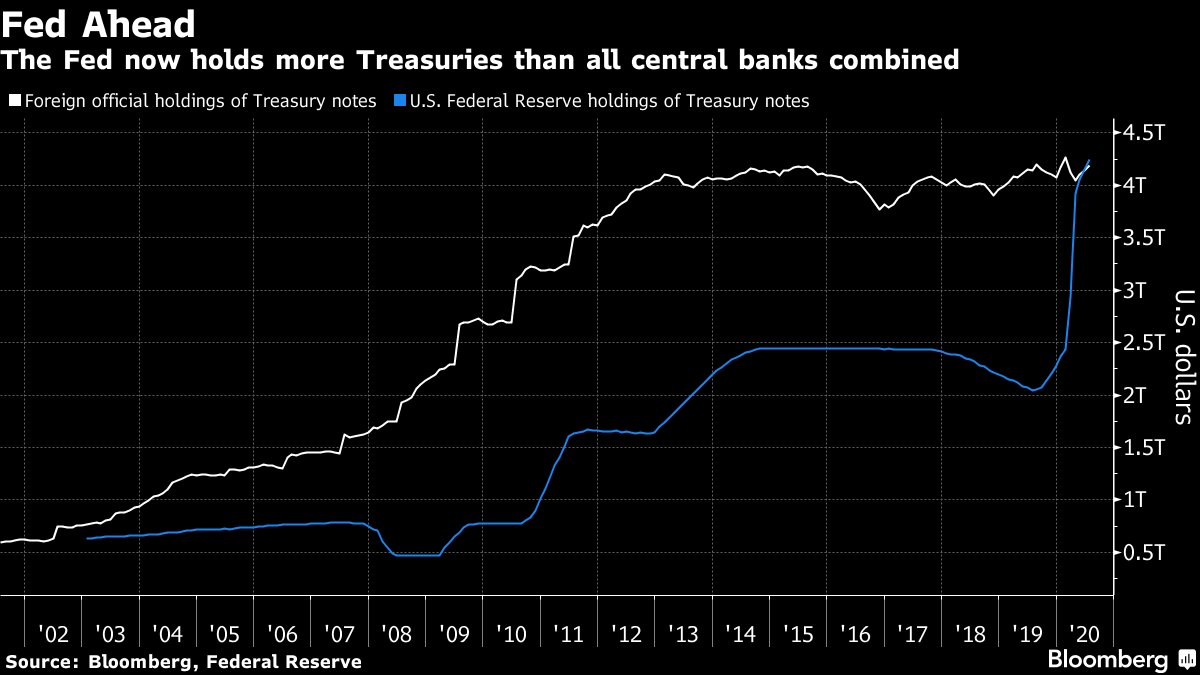

What the market needs to see now is either the economic recovery taking the baton, or further action to keep it from backsliding. Unfortunately, neither has happened so far in the U.S. A Citi Economic Surprise index shows U.S. economic data are no longer beating expectations as consistently as they did.  As for further action, the Fed isn't offering new stimulus, at least not yet. Chairman Jerome Powell made clear again in his testimony on Capitol Hill this week that the onus now lies on the government to spend more. An agreement from lawmakers on the widely-anticipated Phase 4 fiscal package looks less and less likely as GOP members recalibrate their priorities from economic support to filling a Supreme Court seat. The Fed probably still has the best shot among its peers in the largest developed economies of hitting its inflation goal, but that's not saying a lot.  And inflation markets don't seem to be keeping the faith. Breakevens have pulled back this month, and the largest exchange-traded fund for U.S. Treasury inflation-protected securities saw its heaviest daily outflow since April, after five months of pretty consistently reaping new investments.  For its part, BlackRock Investment Institute still thinks the market is underestimating inflation risks, and sees three forces pushing the average yearly pace of consumer price inflation into the range of 2.5%-3% between 2025 and 2030 (versus the market's expectation of close to 1.6%). One is rising global production costs as supply chains are reshaped, and another is the shift in central bank policy frameworks to allow overshoots of inflation targets. The third is "greater political pressure for keeping rates low in a high-debt environment," according to a note from BII strategists this week. "The blurring of fiscal and monetary policy means the decision to start tightening monetary policy will be more politicized. Significantly higher debt loads mean debt servicing costs will rise when monetary policy is tightened. The less tangible -- but no less real -- risk of loosening the grip on inflation expectations may be more politically appealing." That said, they're not ignoring the pitfalls directly ahead, in particular the roughly trillion-dollar gap between the stimulus plans on either side of the political divide. "On the flip side, a premature withdrawal of fiscal support -- a risk we see in the U.S. -- could forestall the reflationary path that is our base case." Everything That Goes Wrong When Real Yields Rise For anyone doubting that real yields are the middle can in the financial markets' stack, take a look at the sprawling wreckage of a busted reflation trade chronicled by our reporters Sarah Ponczek and Liz McCormick.  Alongside the decline in stocks, the dollar rallied -- with the Bloomberg Dollar Spot Index pulling off a two-year low -- and gold and copper slumped.  The Bloomberg Barclays Global High Yield Index flipped to an annual loss this week, and investors pulled cash from ETFs that track high-yield debt.  Pending further progress on government stimulus, the Fed is left reiterating its commitment to loose policy to help get inflation get back to target. Vice Chairman Richard Clarida was on Bloomberg TV doing just that Thursday. "The central bank won't consider raising interest rates from near zero until it actually achieves 2% inflation for at least a few months as well as full employment," he said. "Within about three years we're going to get back to a very low unemployment rate and inflation at our 2% objective." Election Fever The reality of a possible no-deal on further government aid, and the economic damage that could entail, seemed finally to bite the stock market this week. And as the S&P 500 slumped almost 2.5% Wednesday, the Treasury market's sideways shuffle reinforced concerns about how little cushion government bonds can offer with yields already close to historic lows. At the time of writing U.S. stocks had recovered somewhat on reports that stimulus talks may be revived, but clearly this isn't the only story weighing on the investors' minds. Reluctantly we return to the market's view of the race for the White House. It's impossible to avoid -- as the slew of research notes from Wall Street this week attests. And, let's face it, this 59th presidential election is almost surreal. The candidates can't even go near babies, whether or not to wear a facemask is a hot-button issue, the postal service is in uproar and the north is, apparently, anarchic. And the passing of Justice Ruth Bader Ginsburg on the first evening of Rosh Hashanah has tragically inflamed an already rancorous campaign as the GOP races to fill the Supreme Court vacancy. Moreover, should the incumbent lose, a peaceful transfer of power is apparently no longer a given. That headline, based on President Trump's "we're going to have to see what happens" response to a reporter, did nothing to stabilize markets after a tough U.S. session, though a handful of Republicans have since offered their own assurances. It goes without saying, then, that volatility remains a solid theme in markets, as previously discussed. So much so that JPMorgan Chase & Co.'s Henry St John and Josh Younger have put the spotlight back on "Volfefe" -- a rates volatility model that's focused on the market response to Trump's Twitter feed. The model finds that "Presidential tweeting remains a statistically significant driver of volatility and options pricing in interest rates." His Covid-19 themed missives have been the biggest market movers. While many strategists, including Goldman Sachs Group Inc., reckon Treasury yields will jump on the expectation of more spending should Democrats take both houses, JPM sees more prospects for lower yields. Strategist Jay Barry says deficits are likely to stay historically high no matter who wins, "but while rising deficits matter for yield levels, policy and inflation expectations matter more, and they should not significantly impact longer-term Treasury yields following the election." He sees a possible risk-off move on a Democratic victory, on the view that the administration's tax cuts may be unwound, "resulting in lower yields and a flatter curve." Yields would also probably slide on a contested election result, based on the 2000 election experience, according to Barry. As for the money managers' take, it's pretty common now to see them adopting the brace position -- dialing back risk, and retreating to cash. Says Jason Brady, CEO of Thornburg Investment Management: "We're telling our clients now what we told them in March: we're maintaining an above-average level of cash given likely higher volatility leading into the election -- buying opportunities will be bountiful." Bonus Points Vale, RBG, a giant among us all Brad Setser of the Council on Foreign Relations spotted a significant milestone for the Fed, which now holds more Treasury notes or bonds than all the world's other central banks combined. "The Fed, not China or anyone else, ultimately can set U.S. long-term rates."  Italy's learnt from its brutal Covid-19 experience how to avoid a second wave For the Fed's disaster junkie, pandemic was one of 99 bad scenarios And the Bank of England's on-again, off-again flirtation with negative rates is off again The Fed makes the case for private-sector intervention |

Post a Comment