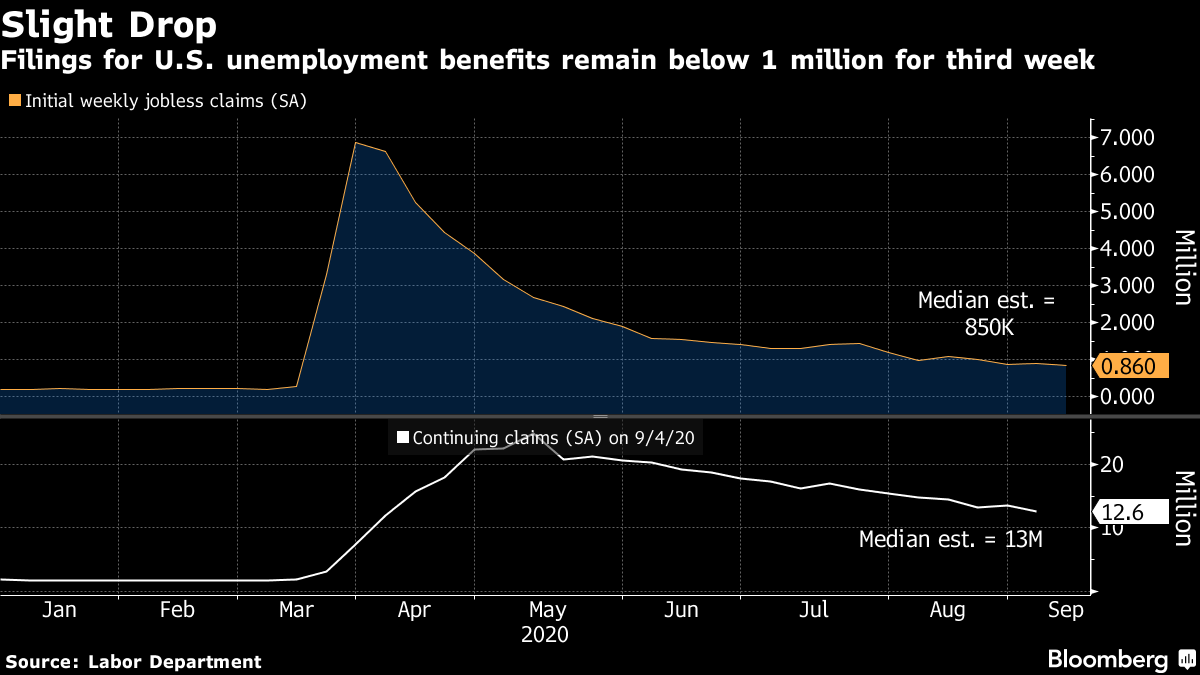

Oracle and ByteDance tentatively agree to the Treasury's TikTok terms. Wall Street struggles to keep up in China's mutual fund boom. And Hong Kong draws critics who say more stimulus is needed. Here are some of the things people in markets are talking about today. The Treasury Department, TikTok owner ByteDance and Oracle have tentatively agreed to terms for Oracle's bid for the U.S. operations of the social-media service, according to people familiar with the matter. Treasury Secretary Steven Mnuchin sent Bytedance a revised terms sheet late Wednesday and the company and Oracle accepted it, the people said. They described the changes as addressing national security concerns about the transaction and asked not to be identified because of the sensitivity of the matter. Meanwhile, the Trump administration has asked gaming companies to provide information about their data-security protocols involving Chinese technology giant Tencent, people familiar with the matter said. The Committee on Foreign Investment in the U.S. has sent letters to companies, including Epic Games, Riot Games and others, to inquire about their security protocols in handling Americans' personal data, said the people, who asked not to be named. Tencent, the world's largest gaming company, owns Los Angeles-based Riot and has a 40% stake in Epic, which is the maker of the popular video game Fortnite. Asian stocks looked set for modest gains on Friday amid a dollar retreat and after U.S. equities pared the worst of their losses. Treasuries edged higher. Futures in Japan, Hong Kong and Australia pointed higher. The S&P 500 dropped for a second day, though it found some support after bouncing off its 50-day moving average. Technology shares were the biggest decliners, with Apple, Facebook and Microsoft weighing on the Nasdaq Composite. Data showed the number of Americans applying for jobless benefits resumed its decline. Crude oil climbed above $40 a barrel. Elsewhere, natural gas prices tumbled the most in almost two years after a bigger than expected increase in stockpiles revived concerns that the glut of the fuel will increase. Gilts climbed after the Bank of England policymakers said they were exploring negative rates. From BlackRock to Vanguard, global asset managers are now learning just how fierce the local competition will be in China's $3.4 trillion mutual fund industry. Funds backed by international firms raised $470 billion from retail investors in the first eight months of the year, less than half the $967 billion haul of their 100-plus Chinese rivals, according to data compiled by Morningstar and Bloomberg. Of the top 10 biggest funds raised this year, only two were backed by foreign companies. Foreign companies are having to grapple with how little their size and global reputation matter in a market infamous for investors jumping from fund to fund in search of the next big thing. Domestic rivals have pressed their home-field advantage, picking up a lion's share of almost $6 billion in fees generated in the first-half alone. The locals are more adept at tapping star stock pickers who live-stream on platforms such as Alipay, giving fund picks and explaining basic investing concepts and social-media influencers who can boost a fund manager's popularity with a single endorsement. That's turning into a fledgling distribution network rivaling that of banks. Hong Kong's government is drawing fresh criticism from economists and business advocates who say a third round of virus relief stimulus don't go far enough. While Chief Executive Carrie Lam's latest spending plan will draw from the city's fiscal reserve of $976.6 billion ($126 billion) in July, that cash pile is still seen by economists as large enough to support still more stimulus. The urgency for more fiscal support was underscored Thursday by data showing Hong Kong's unemployment rate sitting at 6.1% in August, with joblessness continuing to rise in the hard-hit consumption and tourism sectors. Yet the latest signals from Lam's administration, including the comparatively small round of virus relief announced this week, suggest a reluctance to further deplete Hong Kong's war chest. "Stimulus has been smaller than expected so far," said Alicia Garcia Herrero, chief economist for Asia Pacific with Natixis. "More — and more clever stimulus — is needed." As Nissan struggles to recover from a boardroom scandal surrounding Carlos Ghosn and a sales slump that threatens its alliance with Renault, China is emerging as its best bet for a turnaround. Thanks to an early mover advantage and strategic partnership with Dongfeng Motor in 2003, Nissan is one of the strongest Japanese passenger carmakers in China. It ranked fourth — excluding multipurpose vehicles — in June with a 6.7% share after Volkswagen's two joint ventures and General Motors's tie-up with SAIC Motor. Former Chairman Ghosn, who was arrested in 2018 on financial misconduct charges and fled in a dramatic escape to Lebanon at the end of last year, called China a "new frontier" when he unveiled Nissan's push into Asia's largest economy almost two decades ago. Now, the world's biggest automobile market is looking more like a key line of defense as China's economy returns to growth. What We've Been ReadingThis is what's caught our eye over the past 24 hours: And finally, here's what Adam's interested in this morning"Cash on the sidelines" is an often-heard refrain in market circles. For the folks over at LGT Capital Partners, that pile of cash is helping spur their enthusiasm to bet on further gains for equities. They calculate that institutional investor cash positions peaked at about $3.3 trillion in May and since have been reduced only marginally by $285 billion. The firm has added to stock positions, trimmed fixed-income allocations, while retaining a large overweight in gold. They say most investors are not positioned for the economic recovery to continue to pick up. This, coupled with the high levels of cash waiting to enter the market, boosts the chances of a positive reaction in equity market, they argue.  Thursday's data was encouraging, showing a gradual improvement in the U.S. labor market, as the chart shows. We'll be keeping a close eye on how that cash is being deployed going into the final quarter of 2020. Adam Haigh is an editor covering global markets for Bloomberg News in Sydney. |

Post a Comment