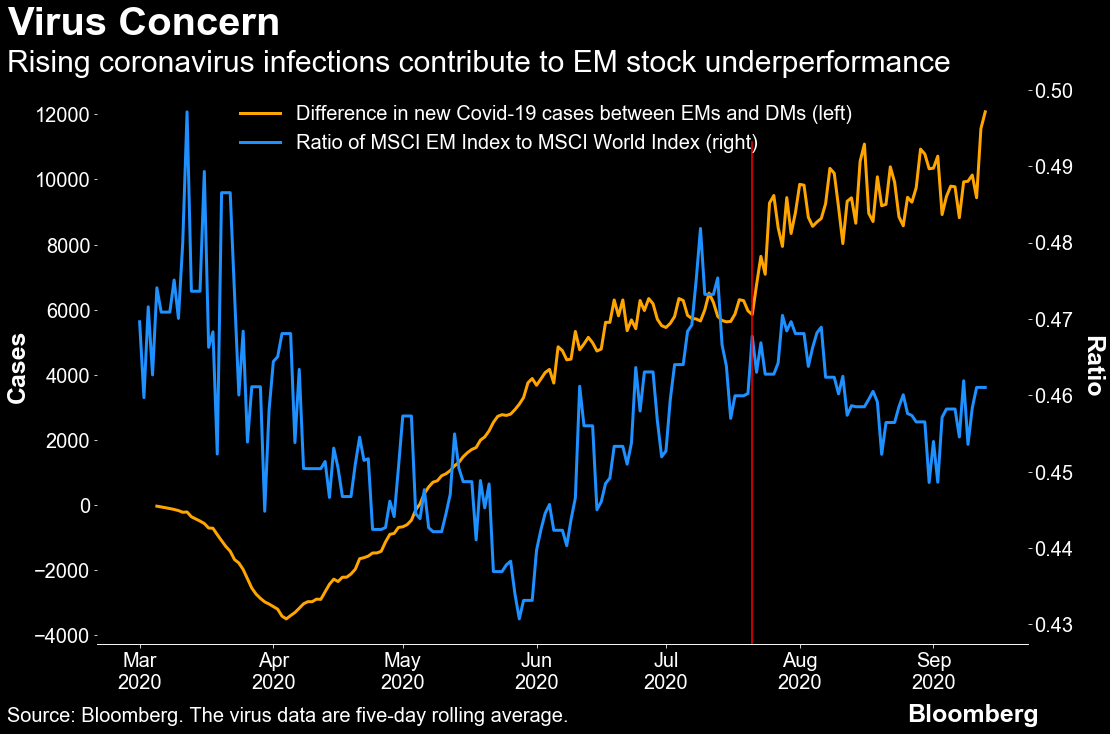

Oracle's bid for TikTok needs Trump's blessing. Tencent picks Singapore as its new hub. And China's stocks traders are warming to fund managers. Here are some of the things people in markets are talking about today. Oracle's closely watched bid for TikTok's U.S. operations will not only have to pass a U.S. national security review, it's also going to need to win the blessing of President Donald Trump. The deal, if finalized, would create what Treasury Secretary Steven Mnuchin called "TikTok Global." He added that the unit would have its headquarters in the U.S. and create 20,000 jobs — a move that could sweeten the deal as Trump faces a hotly contested presidential election in November. Instead of buying the business outright, Oracle would make an investment in a newly restructured TikTok, and at least two shareholders in TikTok's Chinese parent company, General Atlantic and Sequoia Capital, would take stakes in the new business, said people familiar with the proposal. The details could be worked out in the next 48 hours, one person said. Oracle rose 4.3% to $59.46 in New York. Asian stocks looked poised to drift Tuesday after snapping two weeks of declines Monday. U.S. shares rose for a second day amid a flurry of deal activity, while the dollar weakened. Futures dipped in Japan and Australia and were little changed in Hong Kong. The S&P 500 touched a week high before paring gains, while the Nasdaq 100 Index broke a two-day slide. Positive vaccine comments from Pfizer's CEO, which boosted Asian shares Monday, helped sentiment. Treasuries were little changed. Elsewhere, the pound strengthened as U.K. Prime Minister Boris Johnson faced a rebellion in Parliament against legislation that would override key elements of the divorce treaty signed with the European Union. Oil was little changed around $37 a barrel. Tencent has picked Singapore as its beachhead for Asia, joining rivals Alibaba and ByteDance in the race to build up their presence closer to home after setbacks in the U.S. and India. Management at China's largest social media and gaming company had been discussing Singapore as a potential regional hub and geopolitical tensions accelerated its plans, according to people familiar with the matter. Tencent has been considering the shift of some business operations — including international game publishing — out of its home country, according to the people, who asked not to be identified. China's tech behemoths are increasingly turning to Southeast Asia in the face of growing hostility from the U.S. and other major markets, setting up the region — with its 650 million increasingly smartphone-savvy population — as a key battleground. China's 170 million individual stock traders are doing something unusual in 2020: They're entrusting their money to the professionals. Retail investors bought 487.7 billion yuan ($71.4 billion) worth of stocks through managed funds the first half of this year, more than the 340 billion yuan they invested directly in the market, according to data from Kaiyuan Securities. That's in stark contrast to 2015, when individuals helped stoke a massive bubble by funneling 2.2 trillion yuan through their trading accounts. The shift shows a change in how professional investors are perceived in China. Funds there are often called out for their preference for lower-risk blue chips that generate lower returns. But in the first half of this year, stock funds beat the large-cap CSI 300 Index by 21 percentage points, according to data from Industrial Securities calculated by Bloomberg. That follows outperformance in 2019, lending the funds further credibility. East Money Information, founded by a 49-year-old former stock commentator, is one of the big winners in China's wildest stock frenzy in half a decade. Shares in the online broker and market data provider have rocketed 78% this year, giving it a market value of more than 200 billion yuan ($29 billion). That puts it among the world's biggest traded institutional brokers, making it more valuable than even Credit Suisse. Like the popular Robinhood app in the U.S., East Money has found a sweet spot with tech-savvy youth as millions, stuck at home amid the coronavirus, turned to stock trading. Its revenue swelled 67% in the first half of 2020 and its net income more than doubled. Unlike the crowded U.S. scene, where Robinhood and E*Trade are slashing fees to zero, the company has been able to keep charging customers on trades, but at a lower rate than the traditional brokers. What We've Been ReadingThis is what's caught our eye over the past 24 hours: And finally, here's what Cormac's interested in this morningThe acceleration in emerging market coronavirus infections has pushed them to a fresh peak relative to developed countries. That could reignite a period of underperformance in EM equities. After holding steady for much of the summer against developed peers, average daily cases in nine emerging markets — including India, Brazil and Russia — jumped higher again from late July, according to data compiled by my Bloomberg colleague Masaki Kondo. That coincided with a reversal in the relative performance of the MSCI Emerging Markets Index, which since the end of that month lagged the MSCI World Index of developed market shares by over 4 percentage points through August.  Bloomberg Bloomberg Among the 10 countries that have the highest number of confirmed coronavirus cases, eight of them are emerging economies, including India and Brazil. And while global equity traders may have moved on to betting on a vaccine, the reality is that all countries will not be equal when one is eventually approved. Even something as simple as a two-shot rather than one-shot vaccine is likely to disadvantage developing nations, complicate deployment and slow down the benefits. EM stocks have had a better start to September, outperforming their DM peers — which are more weighed down by tech stocks — by almost 3 percentage points. The latest jump in relative virus cases and a focus on the logistics of any vaccine deployment risks undoing that good work and kicking off a fresh leg lower against developed peers. Cormac Mullen is a Cross-Asset reporter and editor for Bloomberg News in Tokyo. |

Post a Comment