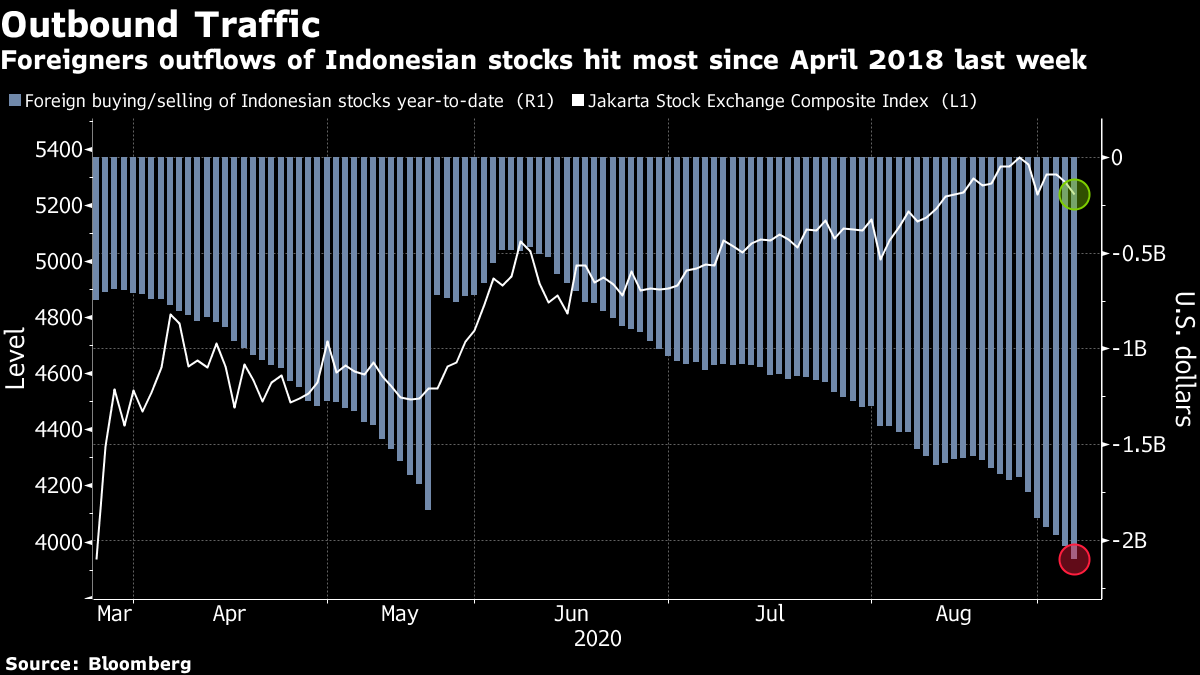

A global stock rout is set to extend to Asia after a selloff in U.S. tech shares accelerated. The U.S. bars some Chinese firms and plans more. And a vaccine trial setback. Here are some of the things people in markets are talking about today. U.S. stocks sank for a third day, with the selloff in technology shares picking up steam as investors fled the high flyers that fueled a historic five-month rally. Oil plunged, while Treasuries rose with the dollar. U.S. futures opened lower in Asia, indicating more pain is in store. Equity index futures in Asia pointed lower. Volatility roiled financial markets, sending the Nasdaq 100 down 4.8% and leaving it 11% off its record set last Wednesday. Tesla suffered the worst rout in its history and is now down 34% in September. Investors have been spooked by the last leg of a rally that drove valuations to levels last seen in the dot-com era. Few pockets of the market were spared, with 450 S&P 500 members lower and only five Nasdaq 100 components higher. The broader index hit the lowest since Aug. 11. West Texas Intermediate crude plunged almost 8% in New York. The Trump administration said it has banned imports from three companies in the Xinjiang region of China over Beijing's alleged repression of the Uighur Muslim minority group, and it plans to add curbs on six more firms and target cotton, textiles and tomatoes from the area. The orders against the six other companies — three that operate in the cotton, textile and apparel industries, one in computer parts and two in hair products — will come by the end of this fiscal year, the U.S. Customs and Border Protection said. The measures could have a broad impact on the textile industry, which relies heavily on Chinese cotton. AstraZeneca's U.S.-traded shares declined sharply Tuesday following a report that a study of the British drugmaker's Covid-19 vaccine had been put on hold. In late trading in New York, shares of AstraZeneca fell as much as 8.3% after STAT reported that the company had paused its coronavirus vaccine trial due to a suspected adverse reaction in a trial participant in the U.K. The nature of the hold wasn't clear and it's possible it could be minor, according to the report. AstraZeneca's vaccine, which it is developing with researchers from the University of Oxford, has been viewed as one of the leading candidates to reach the market. It comes as frontrunners in the race for a Covid-19 vaccine pledged to avoid shortcuts on science as they face pressure to rush a shot to market. Meanwhile, France's health minister called a surge in infections in the country "worrisome," and U.K. Prime Minister Boris Johnson banned social gatherings of more than six people in England. Temasek's holdings in China surpassed its home market of Singapore for the first time following gains in companies including Alibaba, according to the state investor's annual report. Temasek's exposure to China rose to 29% of assets as of March 31, compared with 24% for Singapore, the lowest percentage exposure for its home market since the company was formed in 1974. The firm's biggest local holdings, from Singapore Telecommunications to DBS, saw their valuations tumble this year as Covid-19 hit global markets. The investment giant has been adding to assets in China despite the rising risk of a political and economic decoupling from the U.S. Its exposure to China includes stakes in ICBC and Meituan, and compares with 17% in North America and 10% in Europe. Almost eight years after Shinzo Abe pledged to use the powers of the prime minister's office to help Japanese women "shine," he's leaving without a single female candidate in the race to replace him. The three contenders who officially registered Tuesday to replace Abe at the helm of the ruling Liberal Democratic Party are all men, and none are known as strong proponents of gender equality. The two women interested in running in the Sept. 14 election — former Defense Minister Tomomi Inada and ex-Internal Affairs Minister Seiko Noda — abandoned efforts after failing to gather the necessary 20 signatures to get on the ballot. What We've Been ReadingThis is what's caught our eye over the past 24 hours: And finally, here's what Cormac's interested in this morningDefying gravity is perhaps too strong, but the ongoing climb in Indonesian equities in the face of relentless foreign outflows is still nothing short of impressive. As my colleague Ishika Mookerjee pointed out Monday, foreign investors, spooked by the specter of the central bank's loss of independence, sold the biggest amount of local stocks in more than two years last week. In fact it's been one-way traffic since early June, yet since then the Jakarta Stock Exchange Composite Index has managed to grind out about a 4% gain through Monday, not far off the 6% rise in the MSCI AC World Index.  The fears behind the outflows will persist. A government turning to a central bank for deficit financing is not a unique feature of our post-pandemic world, yet there is a big difference when that support isn't backed by a reserve currency or a monetary union of 19 developed economies. Investors still haven't priced in the ramifications of that — for the bond market or for equities. And of more immediate concern is the ominous trend of coronavirus infections in Indonesia, amid calls for authorities to tighten curbs in Jakarta. The JCI posted its fifth straight monthly gain in August. It's going to get a lot harder to keep that streak going. Cormac Mullen is a Cross-Asset reporter and editor for Bloomberg News in Tokyo. |

Post a Comment