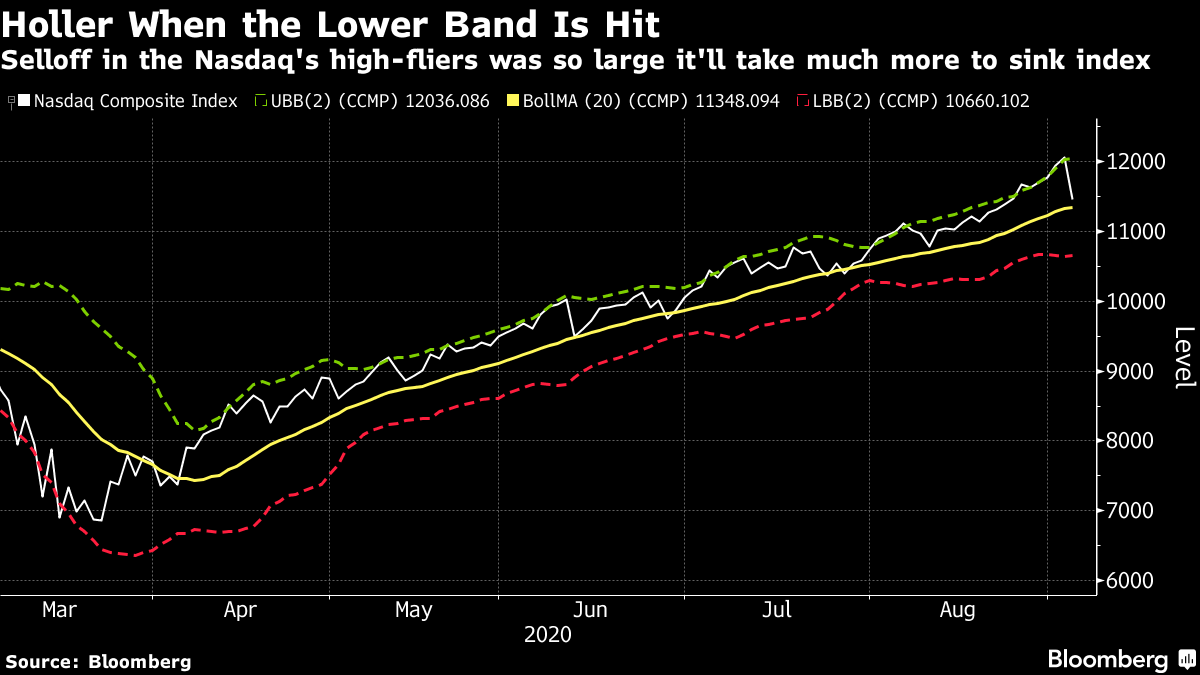

Markets start the week on edge after last week's tech sell-off. Hong Kong police make sweeping arrests as demonstrations return. The outlook for the world economy looks uncertain. Here are some of the things people in markets are talking about today. Stocks were heading for a cautious start on Monday after the biggest two-day slide for global equities since June left investors on edge. Currencies began the week with little fanfare. S&P 500 and Nasdaq 100 futures started the week little changed with U.S. markets shut Monday for a holiday after the worst week for the Nasdaq since March. Futures signaled a muted open in Japan and Hong Kong. The dollar was steady in early foreign-exchange trading, while the euro ticked higher. Oil opened weaker. Volatility remains elevated for equities as investors continue to chart the path for the global economy with the pandemic. Federal Reserve Chairman Jerome Powell responded to Friday's U.S. employment data positively, but reiterated his view that the economic recovery has a long road ahead and that interest rates will remain low for a while. One big event later this week is the European Central Bank's policy meeting. Hong Kong police arrested hundreds of people including key activists as protests again flared up on the city's streets Sunday after weeks of relative calm since the implementation of a national security law. A total of 270 people were arrested for illegal assembly as of 9 p.m. local time, and another 19 held for charges including disorderly conduct, obstructing and assaulting police, the Hong Kong police said in a Facebook post. Tension is rising amid plans by the city to institute a health code that would allow travel between Hong Kong and nearby cities in mainland China, which has raised ethical concerns among medical professionals and fears over increased surveillance among activists. Chinese regulators vowed to accelerate the opening up of the nation's capital markets and deepen reforms to attract more foreign investors. The regulator will expand the scope of investments allowed in the stock connect program link with Hong Kong, and allow foreign investors to trade more commodities futures products, China Securities Regulatory Commission Vice Chairman Fang Xinghai said Sunday. Officials are planning to announce revised rules on qualified foreign institutional investors as soon as possible to increase their "willingness and confidence" to invest in China, he said. Foreigners currently hold only 4.7% of Chinese stocks in circulation, way below the more than 30% in markets like Japan and South Korea, he said. The world economy's rebound from the depths of the coronavirus crisis is fading, setting up an uncertain finish to the year. The concerns are multiple. The coming northern winter may trigger another wave of the virus as the wait for a vaccine continues. Government support for furloughed workers and bank moratoriums on loan repayments are set to expire. Strains between the U.S. and China could get worse in the run-up to November's presidential election, and undermine business confidence. "We have seen peak rebound," Joachim Fels, global economic adviser at PIMCO, told Bloomberg Television. Back in January, a bunch of chat-room denizens got it in their heads that they could rev up returns in a stock portfolio by corralling options dealers to their side. It's starting to seem like they were on to something. While not new and a long way from risk-free, the strategy celebrated in the Reddit forum r/wallstreetbets is at least fairly simple. Spend some money on bullish calls on shares you own in hopes of forcing the sellers to purchase the same stock as a hedge. An ensuing feedback loop drives everything higher, or so the theory goes. Now, by happenstance or design, something like this appears to be happening on a grand scale in U.S. technology shares, dialing up a blistering rally — and possibly worsening last week's decline. What We've Been ReadingThis is what's caught our eye over the past 24 hours: And finally, here's what Adam's interested in this morningIt's a marathon, not a sprint. The Nasdaq 100 ended last week with its biggest two-day slide since March, and it's easy to get caught up in the drama of a more-than-5% plunge in one day. Of course, the index was up 42% this year prior to Thursday. As the Bloomberg Markets Live team have pointed out, the tech-heavy stock gauge would need to sink to 10,660 to reach its lower Bolinger Band. That's a technical indicator that attempts to bracket what's typical from atypical. In uptrending markets, the "average" line — in yellow on this chart — is normally where the selloffs end.  The longer-term prospects for many tech giants remain favorable, but at what valuation? Perhaps a small reset for prices to focus the mind isn't a bad thing after all. Adam Haigh is a Cross-Asset reporter and editor for Bloomberg News in Sydney. Are recent gains in emerging market currencies about to end? Join us virtually on September 9 at 1 p.m. GMT+8 for insights on FX's future from J.P. Morgan, Westpac, Royal Bridge Capital and more. Register here to be a part of this live, interactive conversation. |

Post a Comment