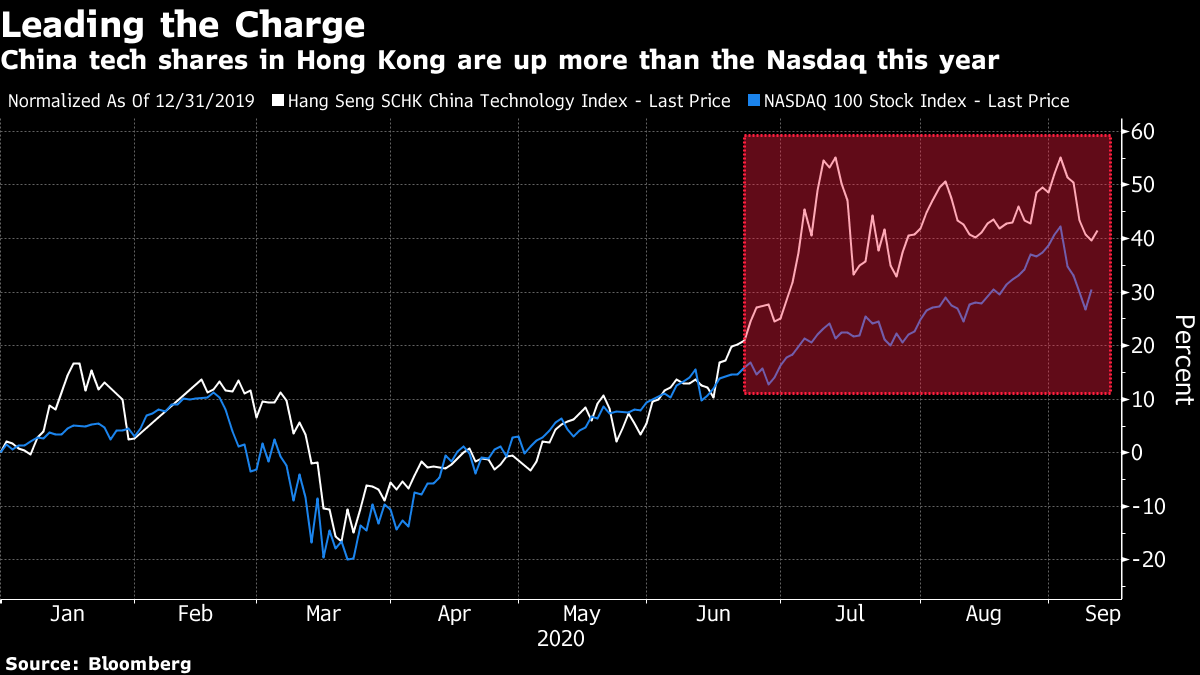

Trump denies Tiktok sale extension. Jane Fraser becomes CEO of a major Wall Street Bank. And Brexit takes a turn for the worse. Here are some of the things people in markets are talking about today. President Donald Trump said he will not extend his Sept. 15 deadline for Bytedance to sell the U.S. operations of its popular TikTok video-sharing app. "We'll either close up TikTok in this country for security reasons, or it will be sold," Trump told reporters Thursday before boarding the presidential aircraft for a campaign trip to Michigan. "There will be no extension of the TikTok deadline." TikTok is caught in a clash between the world's two preeminent powers, as Trump ramps up his pressure campaign on China ahead of what promises to be a hotly contested presidential election in November. U.S. officials have criticized TikTok's security and privacy practices, suggesting that user data collected through the app might be shared with the Chinese government. Asian stocks looked set to drop after a fresh selloff in megacap technology shares sent U.S. equities to their fourth loss in five days. Treasuries rose with the dollar. Futures pointed lower in Japan and Australia, though were little changed in Hong Kong. In a topsy-turvy U.S. session, the Nasdaq lost more than 2% on continuing concerns that valuations got stretched too far in a five-month rally. Energy companies plunged as crude dropped back toward $37 a barrel in New York. Treasuries reversed losses as the equity decline picked up speed. Gold turned lower, while copper tumbled. Citigroup picked Jane Fraser as its next chief executive officer, making her the first woman to become CEO of a major Wall Street bank. She will succeed Mike Corbat, who is retiring in February after more than eight years in the top job. Fraser has run the bank's consumer unit, private bank and Latin American operations in her 16-year tenure. Now, in the midst of a pandemic, her next challenge will be to achieve what eluded her predecessors: For years, the expansive consumer and investment bank has repeatedly missed its own targets for boosting profitability, leaving it as the worst performer among the five Wall Street giants. Meanwhile Morgan Stanley fended off JPMorgan to cement its as the most profitable foreign securities company in Japan last year. Talks between the U.K. and the European Union are fraying, leaving the two sides headed for a chaotic split without a new trade deal. During crisis meetings Thursday, Prime Minister Boris Johnson's government rebuffed an EU request to scrap his plan to re-write the Brexit divorce accord even after the bloc gave him a three-week ultimatum to do so and threatened legal action. The dispute risks jeopardizing already faltering efforts to secure a trade deal between the two sides by Dec. 31. The pound fell. "The U.K. has not engaged in a reciprocal way on fundamental EU principles and interests," EU chief Brexit negotiator Michel Barnier said in a statement. "Significant differences remain in areas of essential interest for the EU." Barnier's view was backed up by his U.K. counterpart, David Frost, who said in a statement that "a number of challenging areas remain and the divergences on some are still significant." M3, Japan's top-performing blue-chip stock this year, is poised to climb further in the long run thanks to rising demand for online healthcare services, investors say. The company's shares are up 88% in 2020 after rallying 124% last year, helped by its addition to the Nikkei 225 Stock Average on Oct. 1. The stock has surged more than 6,500% since listing in September 2004, at least eight times more than all others currently listed on the blue-chip gauge over that period. M3's drug-marketing platform saw orders jump 2.5 times year-on-year in the April-June quarter as social-distancing rules enforced to contain the spread of the coronavirus severely hobbled physical drug-sales activities. What We've Been ReadingThis is what's caught our eye over the past 24 hours: And finally, here's what Adam's interested in this morningMaking sure you have tried and tested valuation assessment criteria and models is vital to anyone's investment toolkit. Kate Jaquet — whose career spans spells analysing emerging-market credit and more recently helping to run an equity fund at Seafarer Capital Partners — says stock investors should be careful as the shocks from the pandemic continue to impact various pockets of the global equity universe. "I do have concerns that stocks around the world, and not just in developing Asia which is where most of our portfolio is, are ahead of themselves," Jaquet told Bloomberg Radio on Thursday. "My concern is particularly acute with stocks in mainland China. I see elevated multiples, miniscule dividend yield and, until this recent pullback, which I think was overdue, it is really just these tech thematic stocks that were seeing such a run."  To illustrate her point: As a group, mainland Chinese tech companies listed in Hong Kong are up more than the Nasdaq this year. With consensus estimates calling for earnings across the EM space to be down about 13% in 2020, she argues that it will take an unusual period to drive prices higher. Perhaps now might be an opportune time to sit tight. As Jaquet puts it: "Higher stock prices and poor expected corporate earnings is not a combination that usually results in even higher stock prices." Adam Haigh is an editor covering global markets for Bloomberg News in Sydney. |

Post a Comment