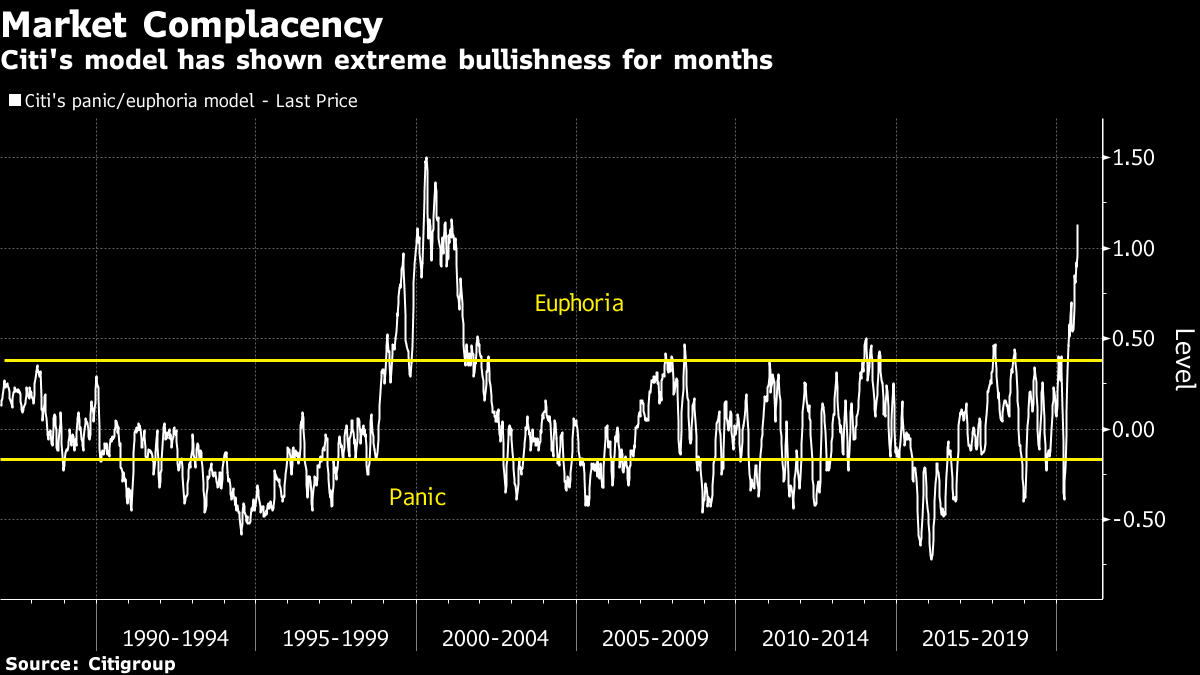

Xi outlines areas where China will "never" accept foreign interference. The Nasdaq takes a nosedive. And the slumping U.S. dollar fuels speculation about currency wars. Here are some of the things people in markets are talking about today. President Xi Jinping said nothing will come between the Chinese people and the Communist Party, setting a combative tone at a difficult moment in U.S.-China relations. Speaking at an event marking the anniversary of China's victory over Japan in the Second World War, Xi outlined areas where China will "never" accept foreign interference. He took aim in particular at threats to the Chinese Communist Party's continued one-party rule. "The Chinese people will never allow any individual or any force to separate the CCP and Chinese people, and to pitch them against each other," Xi said. "The Chinese people will never allow any individual or any force to distort the CCP's history, and to vilify the CCP's character and purpose." Xi didn't specifically mention the U.S., but his comments are likely to be interpreted as a message about the relationship. Asian stocks looked set to end the week with declines after U.S. equities tumbled by the most in almost three months, with the rotation away from high-flying tech stocks gaining steam as investors questioned the sustainability of lofty valuations. Futures in Japan, Hong Kong and Australia retreated, though signaling smaller losses than the 3.5% slide in the S&P 500 Index. The Nasdaq Composite sank 5%, its largest decline since June. Treasury yields dipped and the dollar edged higher, with moves into haven assets muted despite the pronounced drop in equities. Elsewhere, oil declined. The Cboe Volatility Index, often described as Wall Street's "fear gauge," rose to the highest level since June. Bitcoin fell as much as 7.6%. Thursday's Nasdaq nosedive dispensed painful lessons in how options-market leverage can blow up in an investor's face. Losses in benchmark indexes were brutal enough, getting to 6% in the Nasdaq 100, or about $730 billion erased. In single-stock equity contracts they were downright existential, with some instruments wiped out in the space of a few hours. Volumes in puts and especially calls has been exploding in recent weeks, much of it in the tiny lot sizes denoting individual traders. While it's never hard to pick out staggering options losses when markets tumble, today's were particularly harrowing. A call with a $125 strike price on Apple shares, expiring tomorrow, plunged 89% as shares sank 8% to $121. A bullish wager for Tesla to reach $500 by Friday's expiry lost 90% as the stock dropped 9% to $407. And a call on Zoom with a strike price of $420 became essentially worthless as shares hit $381. The hazards of a badly timed options trade are severe, but how well understood they are by newbie traders is a point of debate on Wall Street. Growing unease among global central banks about the slumping U.S. dollar has ignited speculation that a fresh currency war might be on the horizon. European Central Bank official Philip Lane this week fired a warning shot, explicitly drawing attention to the exchange rate as the euro topped $1.20 for the first time in two years. Reserve Bank of New Zealand boss Adrian Orr was more circumspect about exchange rates, but nevertheless signaled he would ease monetary policy as necessary to stimulate growth. And other central banks from the U.K. to Japan also appear willing to loosen the spigots. "When the U.S. dollar is on the move, there comes a point where central banks will react because a substantially weaker or stronger dollar has implications for global monetary policy," said Ben Emons, managing director at Medley Global Advisors. On the other hand, Beijing is allowing faster gains in the yuan as it seeks to cheapen imports and bolster weak consumer spending. There's a new king of actively managed exchange-traded funds. The JPMorgan Ultra-Short Income ETF surpassed the long-reigning PIMCO Enhanced Short Maturity Active ETF as the largest active fund in the $4.9 trillion market. JPST has surged to $13.94 billion in assets after launching in May 2017, overtaking the $13.88 billion MINT, which debuted in November 2009. It's a coup for JPMorgan, which didn't launch its first ETF until 2014. The firm is still a relatively small player: It controls just 31 funds with roughly $39 billion under management, according to data compiled by Bloomberg. However, the firm has carved out a niche in the actively managed corner of an industry that's dominated by passive giants such as BlackRock and Vanguard. What We've Been ReadingThis is what's caught our eye over the past 24 hours: And finally, here's what Adam's interested in this morningWith economies around the world plunging into recession and this year's market turbulence, you'd be forgiven for thinking people's expectations for investment returns might become more modest. The most recent Schroders Global Investor Study suggests otherwise.  On average, global investors expect an annual return of 10.9% from their investments over the next five years, the study shows. Americans are the most bullish, predicting 13.2% on average over the next five years. These lofty expectations come with global equity valuations at the highest in almost 20 years and sovereign bond yields in much of the developed world at, or near to, record lows. There's no sign of central bank largesse being reined in any time soon, which may be supportive of further asset-price gains. Markets are looking complacent though. Some observers may suggest meeting investors' expectations will be a tall order. Adam Haigh is a Cross-Asset reporter and editor for Bloomberg News in Sydney. Are recent gains in emerging market currencies about to end? Join us virtually on September 9 at 1 p.m. GMT+8 for insights on FX's future from J.P. Morgan, Westpac, Royal Bridge Capital and more. Register here to be a part of this live, interactive conversation. |

Post a Comment