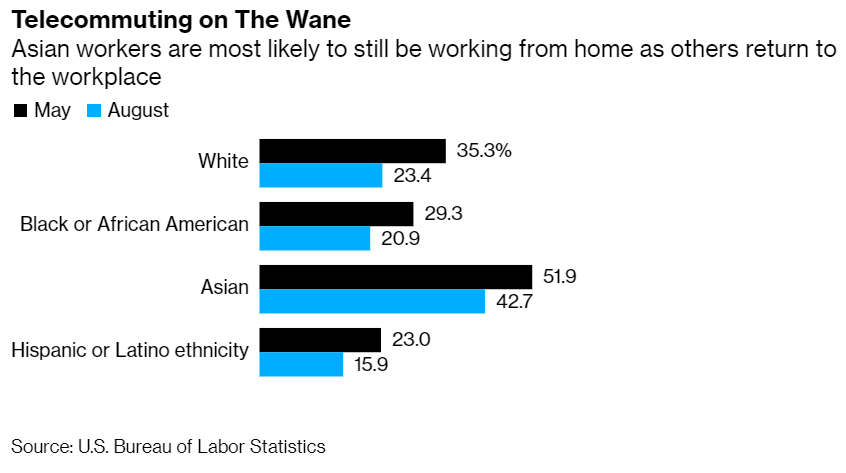

It's finally happened: One of the biggest U.S. banks has appointed a female chief executive officer, Jane Fraser, to lead Citigroup. Mission accomplished, right? Well, no. The industry has a long way to go on gender equality. On the operating teams that oversee big U.S. banks, there are two men for every woman. Reports of harassment in finance have long been ignored or hushed. And the industry's gender pay gap is a persistent problem – poorly tracked in the U.S., stubbornly stuck in the U.K.Big corporations say they can't simply decide sexism is a problem and immediately name a female CEO; they can only draw on the pool of qualified candidates. Those ranks still skew male, but U.S. banks are doing better at elevating female contenders than they used to – and better than their European counterparts are. "Jane's appointment was the result of many years of investment for Citi," said Lorraine Hariton, the CEO of Catalyst, a group that advocates for women in leadership. "It's not just something you wake up and do overnight." —Philip Gray Did you see this? Hospitals in Black communities are receiving less Covid funding because of a federal formula that's based on revenue. Newly hired women in the U.S. earned only 82% as much as their male counterparts a decade ago. By this July, the disparity had narrowed to 96%. The percentage of new directors who are Black fell in 2019, after holding steady for two years at 11%. Two initiatives bringing together dozens of corporations are working to reverse that trend, encouraging companies to hire more Black directors. The Academy Awards will stop giving its best picture Oscar to films that lack diversity. Disney's live-action "Mulan" was supposed to be a win for inclusion, but the company tainted its PR by filming in a region where China detains Muslims in internment camps and by thanking the region's authorities in the film credits. Japan's prime minister advocated for women, but his potential successors are all men. The Federal Reserve wants Wall Street to be more transparent about how it is pursuing diversity and equality. Bank of America invested $50 million in Black-owned banks. We love chartsEven when pandemic lockdowns ended, Americans still stayed home—if they could afford to do so. Education level, which varies by race, was a strong predictor of who could continue working from home.  The DIY momentCovid-19 changed our relationship with buying stuff, and that's likely to outlast the pandemic. As normal commerce became difficult, more and more people started gardening, cooking, sewing, cutting hair, raising chickens, canning food and generally seeking self-sufficiency. A Bloomberg News poll of 2,200 U.S. residents in late June found that 60% of Americans expect to continue doing more things for themselves, even in a fully reopened economy. The shift in thinking has put a premium on beehives, chicken coops and suburban real estate, not to mention once-obscure expertise: Subscriptions to a YouTube series on growing food jumped 10-fold in 48 hours. Experts say the do-it-yourself approach won't fade away anytime soon. |

Post a Comment