U.S. deaths from coronavirus surpass 200,000. Fed's Powell warns of long road to full recovery. China's Xi stuns with climate pledge at the UN. Here are some of the things people in markets are talking about today. The U.S. death toll from the novel coronavirus exceeded 200,000, a grim milestone that comes eight months after the pathogen was first confirmed on American soil. The U.S. Centers for Disease Control and Prevention will closely monitor people who get the first Covid-19 vaccines through daily text messages and emails, according to a federal advisory group. The agency also warned that hosts and attendees at holiday celebrations will need to take steps to limit risks. British Prime Minister Boris Johnson announced new restrictions that are likely to last six months and told people to work from home if possible, saying the country is at a "perilous turning point" for the virus. Goldman Sachs halted its London office return as a result. Federal Reserve Chair Jerome Powell said the U.S. economy has a long way to go before fully recovering from the coronavirus pandemic and will need further support. "The path forward will depend on keeping the virus under control, and on policy actions taken at all levels of government," he told the House Financial Services Committee on Tuesday. A recovery is underway; "both employment and overall economic activity, however, remain well below their pre-pandemic levels, and the path ahead continues to be highly uncertain." In his own remarks, U.S. Treasury Secretary Steven Mnuchin said he and the White House continue to seek an agreement with both parties in Congress on another fiscal relief package. Asian stocks headed for a mixed start as investors weighed signs of dip buyers emerging in the U.S. session against concern over remarks from Federal Reserve officials that pointed to a slow economic recovery. The dollar rose. Japan returns from a holiday period that's seen weakness for regional shares, with futures on the Nikkei 225 remaining below the level when equities last traded in Tokyo on Friday. Hong Kong contracts dipped, while those in Australia advanced. S&P 500 futures opened little changed. The Nasdaq 100 notched a back-to-back rally, while the Dow Jones Industrial Average underperformed amid a drop in banks. Crude oil was steady at the start. Global shares are heading for their first monthly drop since March. Less than an hour after U.S. President Donald Trump took to the virtual floor of the United Nations General Assembly and slammed China for its environmental record, China's President Xi Jinping stunned the climate community by pledging that it would become carbon neutral by 2060. The two nearly back-to-back speeches provided a marked and powerful contrast. There are still many questions to be answered about the Chinese plan — most importantly how the country will define carbon neutrality. But the bare fact that China, by far the world's biggest source of greenhouse gas emissions, has set out a net-zero pledge ahead of the U.S. shows how hard Beijing is striving to put itself at the center of global politics and the economic shift to clean energy — something Washington has been unwilling to do. China jolted markets in 2019 with three high-profile bank rescues that imposed losses on some investors. The appetite for experimenting with greater market discipline has been crushed by the coronavirus pandemic. 2020 has become the year of stealth rescues as authorities try to preempt bank failures and ensure stability for an industry at the forefront of cushioning the virus-induced economic slump. Local governments are identifying the weakest lenders among more than 4,000 rural and city banks, and drafting plans — at the request of the cabinet — to merge them into bigger and, hopefully, stronger banks, according to people familiar with the matter. So far, at least six mergers in five provinces have been engineered since May. The behind-the-scenes maneuvering has kept crucial credit flowing through local economies, but also allows risks to persist in China's vast network of regional banks. The sector, which accounts for 80 trillion yuan ($12 trillion) of banking assets, has been plagued for years by scandals, complex ownership structures, rampant off-book dealings and poor risk control. What We've Been ReadingThis is what's caught our eye over the past 24 hours: - Pfizer is on track to be first to find out if its virus vaccine works.

- Korean War "must end, completely and for good," Moon tells the UN.

- Crypto is beating gold as 2020's top asset so far.

- The yuan chips away at American dominance of the FX market.

- To save its monuments, Rome seeks corporate sponsors.

- In New Zealand, police work and social work can go together.

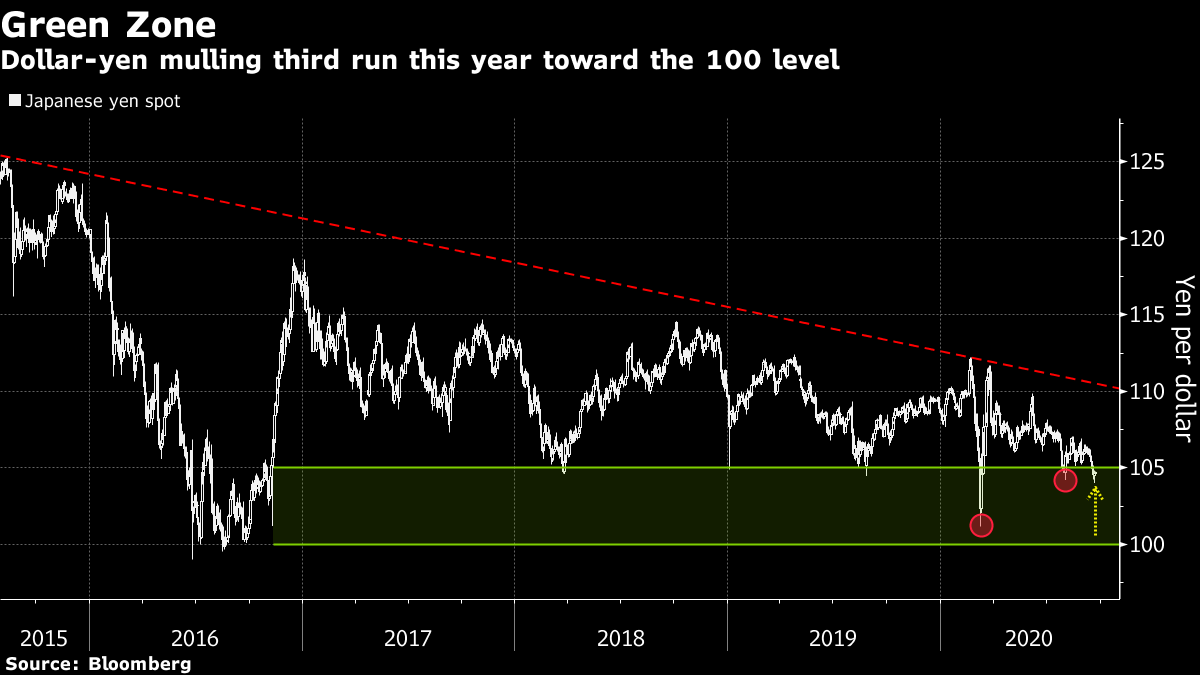

And finally, here's what Cormac's interested in this morningThe Japanese yen is emerging as a new favorite way to bet on a weaker U.S. dollar as it eyes a third run at the key 100 level this year. Fears that the euro's rally is behind it, an appraisal of policies from Japan's new prime minister and worries about a fourth-quarter volatility spike in risk assets all point to the potential for further yen strength against the beleaguered greenback.  After breaking below its recent trading range, the dollar-yen fell first below 105, a level it has defended for most of the past four years. It then briefly touched 104 on Monday amid the broad risk-off market move before a sharp overnight reversal. That brought back memories of late July, when the dollar slumped to just above 104 but quickly rebounded. Back then, Tokyo strategists suggested a combination of reduced repatriation flows and dollar demand from local investors — as well as seasonal factors — would halt its decline. This time, the looming volatility catalyst that is the U.S. presidential election is likely to keep the pressure on. The yen may get another chance yet to prove its haven bona fides are still intact. Cormac Mullen is a Cross-Asset reporter and editor for Bloomberg News in Tokyo. |

Post a Comment