| Welcome to the Brussels Edition, Bloomberg's daily briefing on what matters most in the heart of the European Union. The spell of unbridled optimism about the EU's prospects after its landmark recovery plan deal may prove as brief as Belgian summers. Consider what's looming over the horizon: Post-Brexit negotiations between the EU and one of its biggest trading partners are going down to the wire; the EU's arch-critic Donald Trump is staging something of a comeback in polls ahead of November's elections; and Turkey and Greece are on the brink of a military standoff. What's more, talks on the recovery plan are far from finalized, which may delay the flow of much-needed funds. Let's also not forget that the virus has yet to say its final word in Europe. We're not saying that anything that can go wrong will, but what if it does? Here are the consequences.

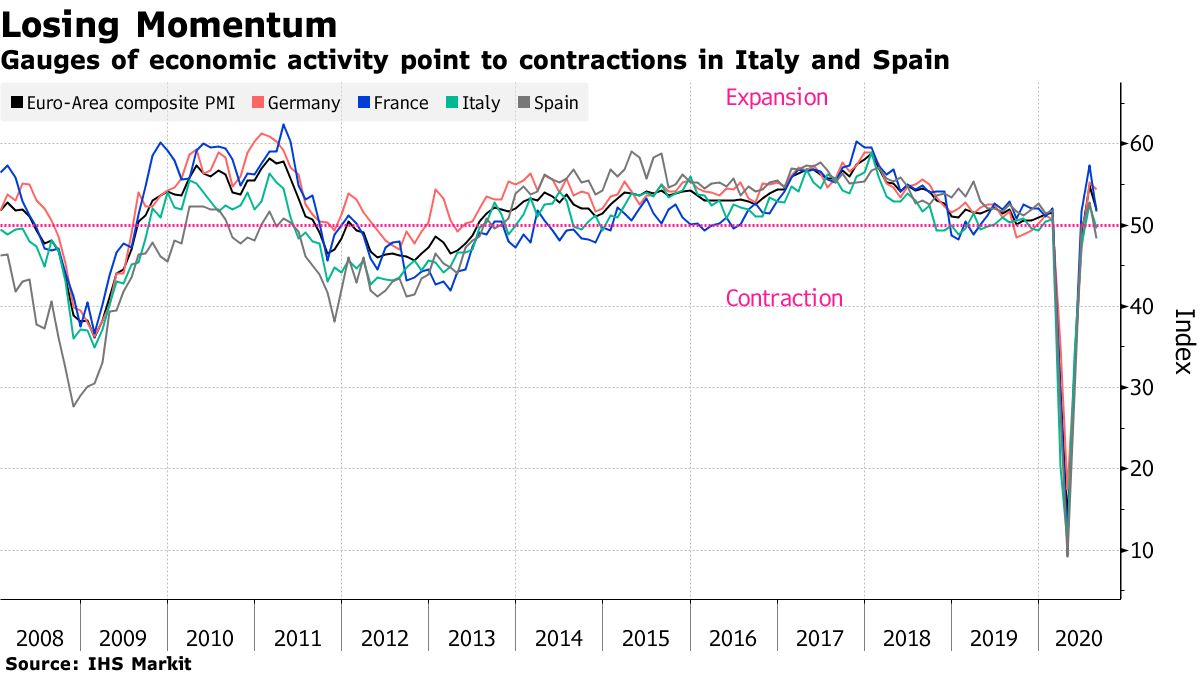

—Nikos Chrysoloras and John Ainger What's Happening Emission Cuts | EU governments are considering an intermediate goal for emission cuts by 2040 to keep the bloc on track for climate neutrality. See what's in the memo circulated by Germany obtained by Bloomberg. Mediterranean Tension | The North Atlantic Treaty Organization said Turkey and Greece agreed to discuss ways to ease tensions triggered by Turkish energy exploration in the eastern Mediterranean. Greece denied that it agreed to enter such technical talks. We'll find out perhaps what's going on today, when NATO Secretary General briefs press in Brussels. Pipeline Pressure | German Chancellor Angela Merkel is waiting for Russia's response on the poisoning of opposition leader Alexey Navalny before deciding how to react to pressure from her own party to drop support for the controversial Nord Stream 2 gas pipeline. Listen Up | This week on the Brussels Edition on radio we break down Emmanuel Macron's 100 billion-euro stimulus plan for the French economy with former advisor and Science Po professor Jean Pisani-Ferry. He says it provides a cash injection big enough to sustain the recovery. Week Ahead | A virtual meeting of the European Central Bank's Governing Council, the next round of Brexit talks and an in-person meeting of EU finance ministers in Berlin are next week's highlights. Spain's economy minister, Nadia Calviño, opens the flagship annual economic event of the European Commission on Tuesday. In Case You Missed It Post-Brexit Chaos | Prime Minister Boris Johnson is working to avert a major border crisis when the U.K. leaves the EU's trade regime, amid warnings that vital government IT systems may not be ready when the Brexit transition period expires at the end of the year. Critical Materials | The EU stepped up a push to become less dependent on imported raw materials such as rare earths and lithium, saying disruptions during the coronavirus outbreak show the need for greater self-sufficiency. The move may signal a more active industrial policy. Google's Warning | Google, which recently increased advertising fees in the U.K. due to a new digital tax, is warning that new EU legislation to rein in so-called "gatekeeper platforms" with dominant market positions could end up hurting users. Unlikely Foes | While the Czech Republic tends to toe the EU line on foreign policy, the nation of 10.7 million has entered an unlikely and worsening spat with China, its fourth-biggest trading partner. Here's how the death of a Czech politician has deepened the rift between Prague and Beijing. Chart of the Day  Bloomberg Bloomberg The euro area's recovery ran out of steam midway through the third quarter, with gauges of activity pointing to contractions in Italy and Spain. Coming in a week that saw the euro-area inflation rate drop below zero for the first time in four years, the PMI weakness is another worrying sign for the ECB. Today's Agenda All times CET. - Italian think tank, the European House, holds its 46th annual forum in Cernobbio. Speakers include French President Emmanuel Macron, EU foreign policy chief Josep Borrell and Chinese central bank governor Yi Gang

- 12:30 p.m: NATO Secretary General Jens Stoltenberg will address the press

Like the Brussels Edition? Don't keep it to yourself. Colleagues and friends can sign up here. We also publish the Brexit Bulletin, a daily briefing on the latest on the U.K.'s departure from the EU. For even more: Subscribe to Bloomberg All Access for full global news coverage and two in-depth daily newsletters, The Bloomberg Open and The Bloomberg Close. How are we doing? We want to hear what you think about this newsletter. Let our Brussels bureau chief know. |

Post a Comment