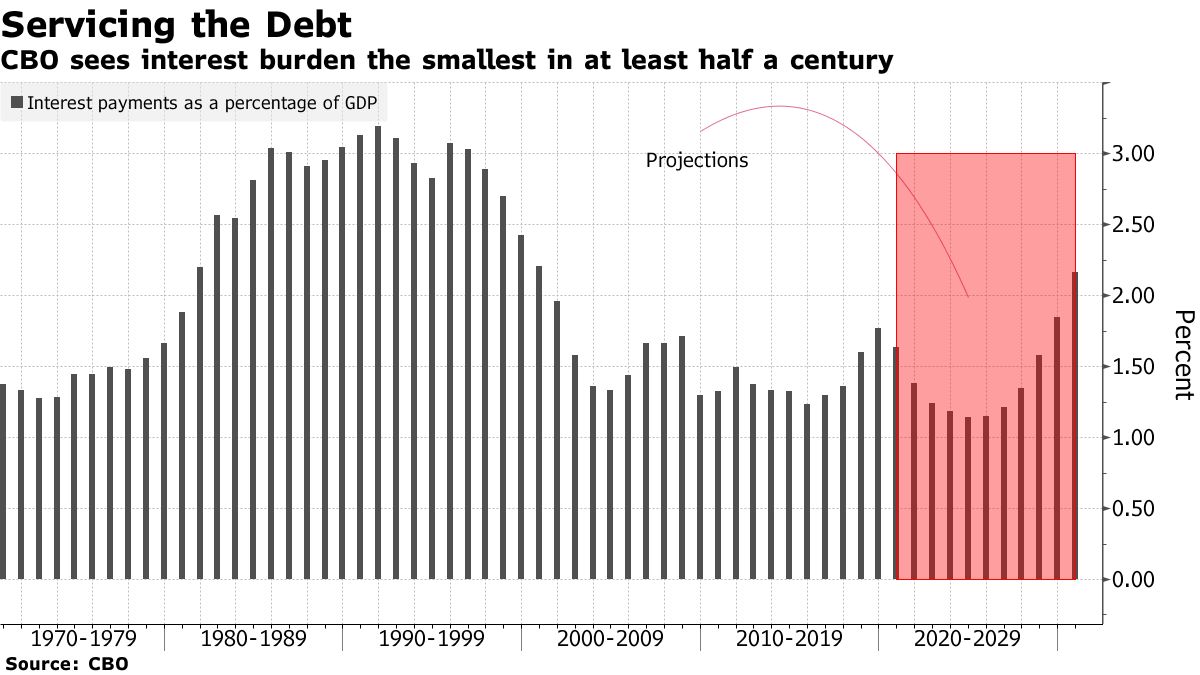

Few corners of American finance capture the giddiness (or short-sightedness) of this summer's stock market rally quite like the mad rush into those vehicles formally known as "special purpose acquisition companies." So-called blank-check companies are the hot ticket on Wall Street, a symbol that you've arrived at the top of the heap, or at the very least that you can persuade investors you're on the way. While some warn that a number of these new deals will end in tears, that hasn't stopped big-name dealmakers, small-name money managers and tech entrepreneurs from jumping in. Here are a few of the new moguls in the blank-check economy. —David E. Rovella Bloomberg is mapping the pandemic globally and across America. For the latest news, sign up for our Covid-19 podcast and daily newsletter. Here are today's top storiesThe U.S. government is paying less as it borrows more, which may be one reason investors appear more comfortable than Congress with funding another recession bailout bill (now unlikely before the election). Interest payments in the federal budget declined about 10% in the first 11 months of this fiscal year, when America was running up its biggest deficit since World War II. Over the next few years, servicing the national debt will be cheaper than at any time in the past half-century when measured against the size of the economy, according to the Congressional Budget Office. The current level of American national debt is approaching $27 trillion.  Volatility continued to grip U.S. equity markets, with stocks on track for their steepest drop since the depths of the pandemic selloff. U.S. inflation quickened in August, driven by the sharpest monthly gain in used-vehicle costs since 1969. A 5.4% surge in the cost of used cars and trucks accounted for more than 40% of the gain in the core index. High-yield bond default rates may double as companies struggle with a protracted economic downturn, warns Jeffrey Gundlach. China began testing a nasal spray vaccine for the coronavirus in what would be a world first. In the U.K., virus cases are surging among the young and the rate of infection is rising. The Austrian government added new restrictions and Israel is headed for a second national shutdown following a botched reopening. Global confirmed infections are approaching 30 million and deaths are likely to reach a million this month. India leads the world with almost 97,000 new confirmed infections every day. The U.S., which has the most total infections and fatalities, had 36,000 new confirmed cases and 938 deaths on Thursday alone. The U.S. is likely to reach 200,000 confirmed coronavirus deaths by the end of next week. Here is the latest on the pandemic.  The Pentagon's five-year budget plan for Lockheed Martin's F-35 fighter jet falls short by as much as $10 billion, a new indication that the complex fighter jet, plagued by an almost constant drumbeat of defects and cost overruns, may be too expensive to operate and maintain after all. Deadly wildfires in California and heavily populated northwest Oregon are growing, with hundreds of thousands being told to flee the encroaching flames. Some Oregon residents are refusing to leave, prompted by unfounded rumors that anti-fascists from Portland were coming to loot their homes. Meanwhile, a witness contends that the suspect in the Portland killing of a far-right demonstrator was unarmed when he was shot dead by police. The witness, an ordained minister, said police and federal agents fired dozens of rounds at Michael Reinoehl without identifying themselves or trying to arrest him. What's Emily Barrett thinking about? The Bloomberg U.S. rates reporter says investors seem convinced interest rates will remain static for some time, judging by the steadiness of overnight index swaps spanning the next few years. However, Emily says recent twitching in the tail of the Treasury curve shows there may be concern that next week's Fed meeting will bring disappointment. What you'll need to know tomorrow What you'll want to read in Bloomberg PursuitsIt was meant to be a grand reopening, heralding the return of the gleaming, seven-story shopping hub at the heart of Manhattan's newest, big-money real estate development. Yet after six long months, the doors of Hudson Yards mall reopened to little fanfare, and even fewer shoppers.  Like Bloomberg's Evening Briefing? Subscribe to Bloomberg All Access and get much, much more. You'll receive our unmatched global news coverage and two in-depth daily newsletters, The Bloomberg Open and The Bloomberg Close. The Bloomberg Green Festival: Join us virtually at the crossroads of sustainability, design, culture, food, technology, science, politics and entertainment. With 20 sessions featuring insights more than 60 speakers, the Bloomberg Green Festival will include Bill Gates, Ezgi Barcenas from AB InBev and Michael Mann from Penn State. From Sept. 14 to Sept. 18. Register here. Download the Bloomberg app: It's available for iOS and Android. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. |

Post a Comment