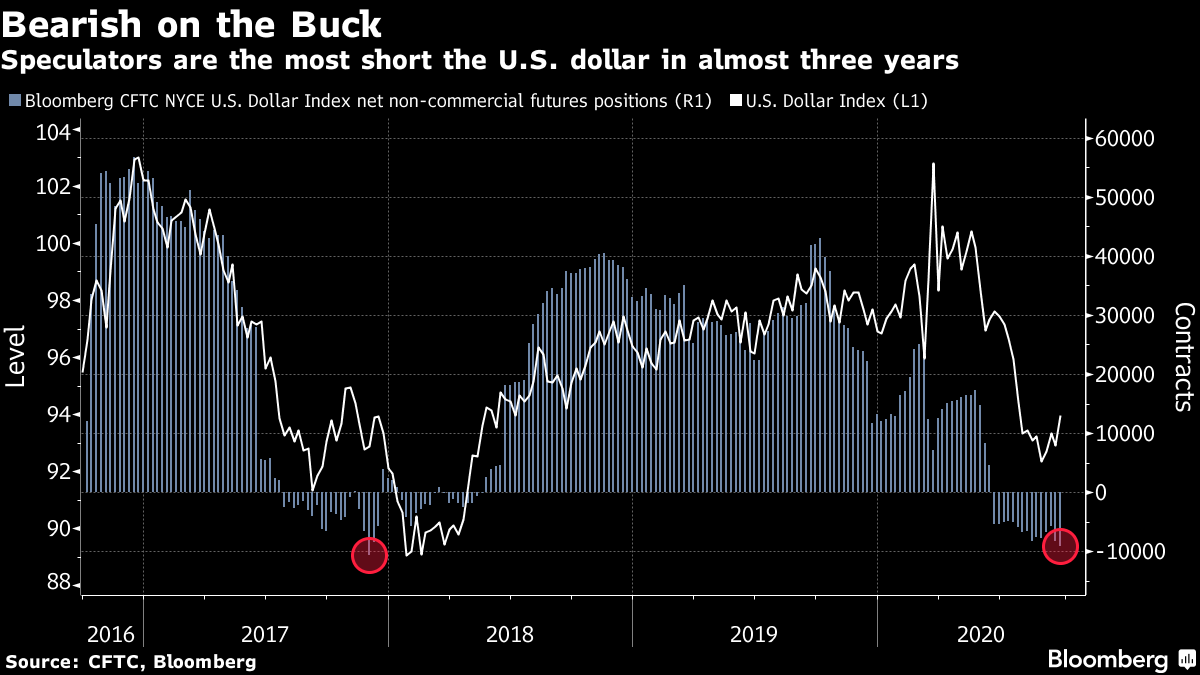

The world's most indebted developer avoids a cash crunch. An antibody cocktail shows promise for treating coronavirus patients. And markets await a slew of China data and the first U.S. presidential debate. Here are some of the things people in markets are talking about today. China Evergrande Group took a major step toward avoiding a cash crunch that had threatened to roil the nation's $50 trillion financial system and reverberate across global markets. After a turbulent few days during which banks, bondholders and senior government officials became increasingly alarmed about Evergrande's financial health, the world's most indebted developer said it reached an agreement with a group of strategic investors to avoid repayments that would have placed a sizeable strain on the junk-rated company's balance sheet. Evergrande owes $88 billion to banks, shadow lenders and individual investors across China and has borrowed $35 billion from bondholders around the world. Relief over Evergrande's announcement late Tuesday in Hong Kong helped propel one of the company's dollar bonds to its biggest gain since March, though at 80 cents on the dollar it was still trading slightly lower than before investor angst exploded to the fore on Thursday. JPMorgan admitted wrongdoing and agreed to pay more than $920 million to resolve U.S. authorities' claims of market manipulation involving two of the bank's trading desks, the largest sanction ever tied to the illegal practice known as spoofing. Over eight years, 15 traders at the biggest U.S. bank caused losses of more than $300 million to other participants in precious metals and Treasury markets, according to court filings on Tuesday. JPMorgan admitted responsibility for the traders' actions. The settlement included fresh details about spoofing on the bank's Treasuries desk, which was occurring at the same time as previously alleged market manipulation on the bank's precious metals desk. Asia stocks were set for a mixed start as traders awaited data from China that will shed light on the strength of the economy's recovery. U.S. shares earlier slipped on low volumes and the dollar fell. Equity futures edged lower in Tokyo and Australia, while Hong Kong contracts rose. S&P 500 futures dipped at the open. The S&P 500 declined 0.5% with more than two stocks falling for every one that advanced, after talks on expanding aid ended for the day with plans to resume discussions Wednesday. Oil fell toward $39 a barrel in New York. Treasuries were little changed. China markets will shut from Thursday for a week of national holidays. Volume on U.S. equity exchanges was subdued on Tuesday ahead of the first presidential election debate. Wednesday marks the final trading day of September and the end of the quarter, so portfolio rebalancing could also exacerbate market moves. U.S. President Donald Trump and his Democratic opponent Joe Biden are about to square off in their first debate, with the president's taxes added to a list of contentious topics including the Supreme Court, the pandemic, health care and civil rights. Biden is also preparing to face tough questions on China. The Democratic nominee released his most recent tax returns just hours before Tuesday night's debate in Cleveland, signaling he wants new revelations about the president's taxes at center stage. Trump's tax returns have highlighted the president's exposure to foreign influence, with income received from countries led by officials with an authoritarian bent or shoddy human rights records, including Turkey. Trump has painted his challenger as senile, so a lucid Biden performance could puncture that bubble. A stumble from either candidate may change some minds, but polls show only a tiny fraction expect to be swayed. Walt Disney Co. is laying off 28,000 workers in its U.S. resort business, the latest sign that travel and other communal experiences will be slow to recover from the pandemic. The cuts span the company's theme parks, cruise ships and retail businesses, Disney said on Tuesday. They include executives, although 67% of those being terminated are part-time workers. The Covid-19 crisis closed Disney parks around the world and while resorts in some areas have reopened, Disney still hasn't received clearance to restart operations at its two theme parks in Anaheim, California. Disney's domestic parks alone employed more than 100,000 before the pandemic. What We've Been ReadingThis is what's caught our eye over the past 24 hours: And finally, here's what Sunil's interested in this morningThe dollar is on course for its first monthly advance since March. The currency reprised its safe-haven role as investors grew concerned about the outlook for the global recovery. The Dollar Index is up about 2% in September, a period during which global stocks tumbled more than 3%. Fresh waves of coronavirus infection, stalled U.S. fiscal stimulus and uncertainty about how the Nov. 3 presidential election will unfold have all hurt sentiment. Yet, despite this parlous backdrop, the latest data on hedge fund positioning shows speculators accumulated the largest bets against the dollar in almost three years.  This increasingly crowded wager could actually point to the potential for further gains in the greenback. If the dollar keeps rising, hedge funds could rethink their bearish bets, driving up the currency. Bank of America, for instance, sees some room left for the greenback to move higher in coming weeks, though it's more cautious about the outlook further out. Sunil Jagtiani is an editor covering global markets for Bloomberg News in Bangkok. |

Post a Comment