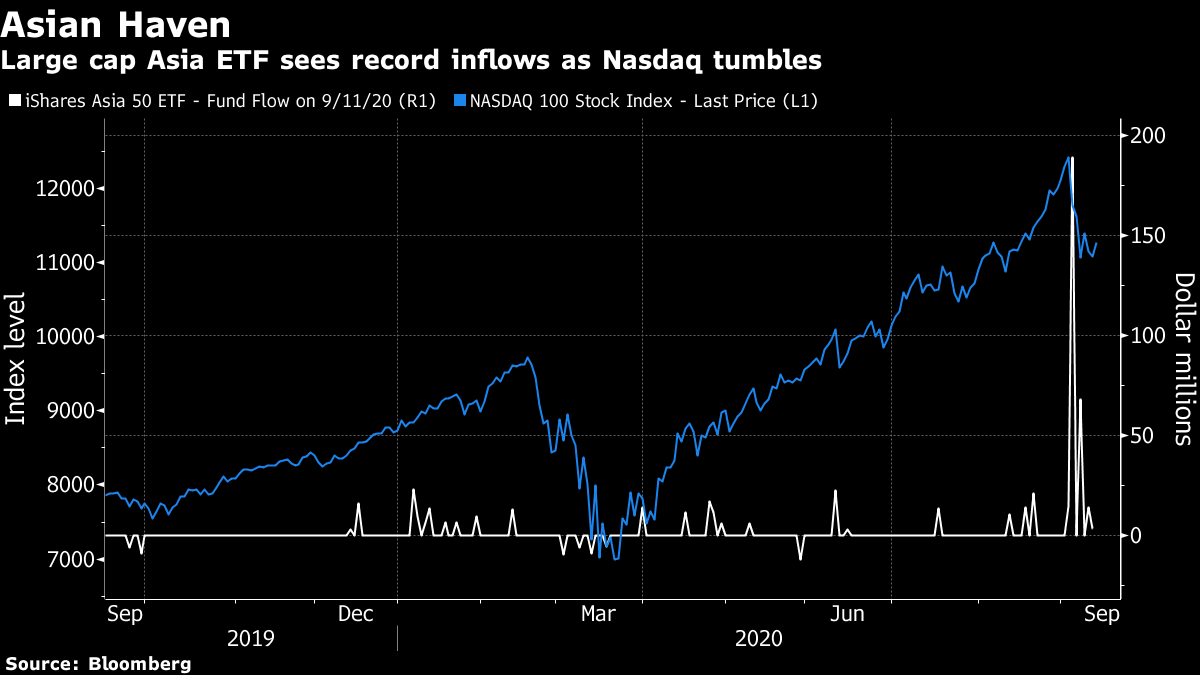

The WTO rules Trump's China tariffs violated international rules. A U.S. national security panel reviews Oracle's TikTok bid. And Ray Dalio warns the dollar's reserve-currency status is under threat. Here are some of the things people in markets are talking about today. The World Trade Organization undercut the main justification for President Donald Trump's trade war against China, saying that American tariffs on Chinese goods violate international rules. A panel of three WTO trade experts on Tuesday said the U.S. broke global regulations when it imposed tariffs on Chinese goods in 2018. Washington has imposed levies on $400 billion in Chinese exports. But the ruling failed to dissuade Washington of its "America First" trade policy and will do little to alter the current trade environment. U.S. Trade Representative Robert Lighthizer said the WTO report released Tuesday "confirmed" Trump's aggressive foreign policy that has sought to dismantle multilateral organizations like the Geneva-based trade body. While the ruling handed China a victory on paper, it means little since the U.S. already hobbled the WTO by dismantling its panel that oversees the appeals process. A U.S. national security panel reviewing Oracle's bid for TikTok was meeting Tuesday afternoon to decide whether to recommend the president approve or reject the deal, according to two people familiar with the matter. Trump said his staff are "very close to a deal" and will make a decision whether to approve the agreement "soon." Oracle's proposal lacks the payment to the U.S. government that the president has insisted be the condition of any deal, according to two people familiar with the plan. Yet the company will try to use the promise of creating 20,000 new jobs through the popular video app as a way to win the president's approval, they said. Meanwhile, a senior Chinese official accused the U.S. of "economic bullying" over TikTok. Asian stocks look set for a muted start to trading Wednesday as investors await a Federal Reserve meeting to gauge the extent of central bank support for the economic recovery. Futures pointed to modest gains in Australia and Hong Kong, and were little changed in Japan. S&P 500 futures opened relatively flat after the benchmark rose for a third consecutive session, as gains in technology shares helped offset a late slide in financials. Treasuries and the dollar were little changed. Oil rose to its highest in more than a week after economic data from China to the U.S. fueled optimism that factories are getting back to work. The Federal Reserve is expected to maintain its dovish stance at its policy meeting Wednesday. Yoshihide Suga, the man set to become Japan's new prime minister later today, has a reputation as a tough, task-based micro-manager rather than a self-styled macroeconomic helmsman like predecessor Shinzo Abe. Suga has vowed to stay true to Abenomics, but economists doubt there's much more monetary pizazz to be squeezed out of the Bank of Japan or any more major spending splurges left in a public purse that's already more reliant on debt than any other developed economy. That leaves the third pillar of Abenomics, structural reform, as Suga's best line of attack for reshaping economic policy. Suga sees himself as a reformer who wants to bring Japan's bureaucracy into the digital age and tackle thorny issues such as regulatory reform and administrative inefficiency. Suga is mulling the need for a third extra budget and extension of virus support measures; will likely keep 2% inflation target without aggressively pushing for it; has called on more action to save jobs and says he will push for female hiring targets and more progress on child-care provision. The dollar's decades-long position as the global reserve currency is in jeopardy because of steps the U.S. has taken to support its economy during the Covid-19 pandemic, according to Ray Dalio. Trillions of dollars in fiscal spending and monetary injections are debasing the currency and have raised the possibility that the U.S. will go too far in testing the limits of government stimulus, Dalio said Tuesday: "There is so much debt production and debt monetization." Meanwhile, the billionaire is having a very bad year. His $148 billion hedge fund, Bridgewater Associates, has run up hefty losses even as rivals have minted money in the topsy-turvy markets. The damage as of August: an 18.6% drop in the flagship Pure Alpha II fund. Those losses, the worst in a decade, top a sprawling list of troubles that has plunged Bridgewater into a round of crisis management, according to more than 25 people with knowledge of the firm's inner workings. What We've Been ReadingThis is what's caught our eye over the past 24 hours: And finally, here's what Cormac's interested in this morningAsia tech investors should sleep a little easier, not having to worry about the nightly travails of the Nasdaq 100. The recent selloff in the tech-heavy U.S. benchmark coincided with a surge in demand for Asian equity exposure, in particular large and liquid technology names. Net inflows to Asia Pacific tracker funds this month have been dominated by a record $286 million injection to the iShares Asia 50 ETF, which tracks an index of the largest, most liquid stocks in Hong Kong, South Korea, Taiwan and Singapore. The biggest inflows took place on Sept. 3 and Sept. 8, at the height of the recent selloff in U.S. technology stocks.  The fund counts Tencent, Samsung Electronics and chipmaker TSMC as its three biggest stocks, accounting for more than 40% of the $1.8 billion ETF's holdings, according to data compiled by Bloomberg. As investors questioned the sustainability of U.S. tech valuations, it seems they were more comfortable with ones in Asia. The S&P Asia 50 Index — the gauge behind the iShares ETF — is trading at just 14 times forward earnings versus a whopping 27 times for the Nasdaq 100. The benchmark is up about 1% this month to Tuesday, outperforming the Nasdaq 100's near 7% slide. That should give some comfort to Asia investors, when the next "healthy" correction in U.S. tech arrives. Cormac Mullen is a Cross-Asset reporter and editor for Bloomberg News in Tokyo. |

Post a Comment