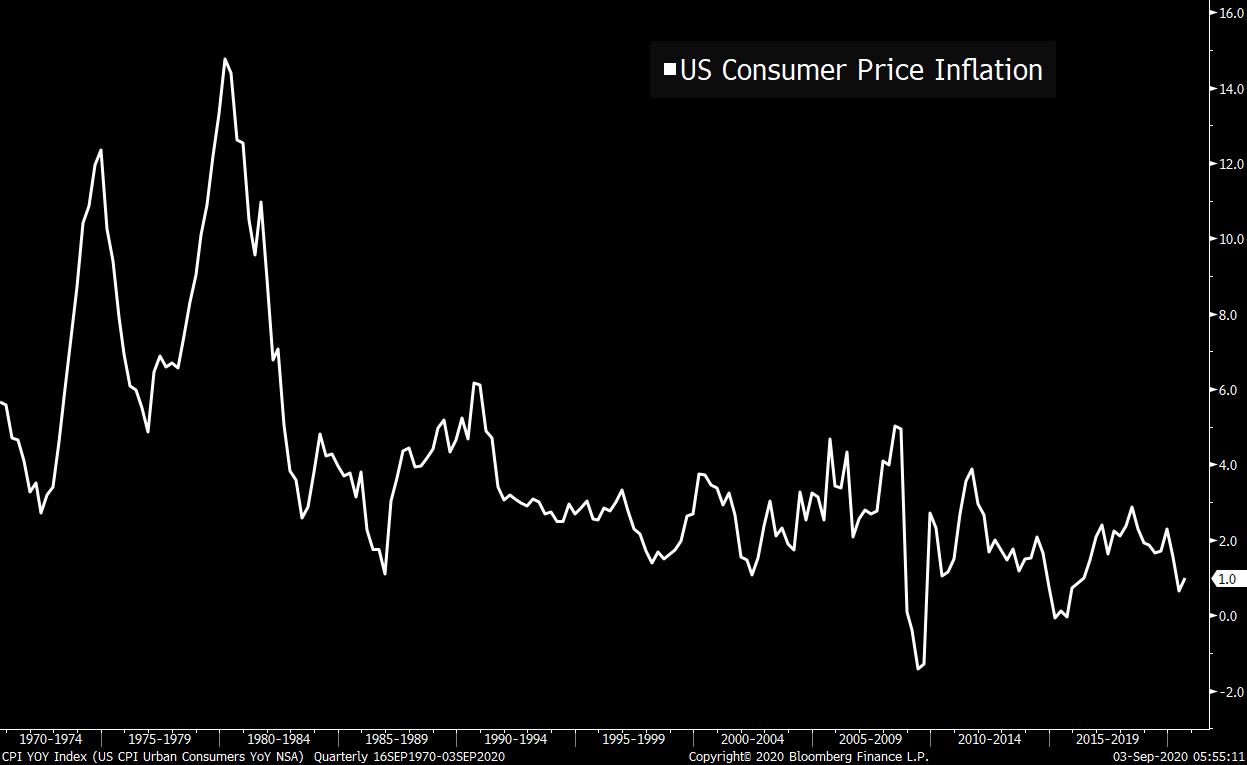

Jobless claims due, CDC tells states to prepare for vaccine, and China moves to cut U.S. tech reliance. Under 1 million?Economists are forecasting that weekly claims for unemployment benefit will drop below 1 million for only the second time since mid-March when the number is published at 8:30 a.m. Eastern Time this morning. It's the last look at the employment situation before tomorrow's payrolls which is expected to show companies added 1.35 million positions in August. Yesterday's ADP employment reading showed fewer than half the expected number of jobs were added. Vaccine The U.S. Centers for Disease Control and Prevention has told states to be ready to distribute a vaccine by Nov. 1. Despite the numerous shots being tested across the world, none of the experimental vaccines have yet finished the trials that would allow them to become widely available. Health officials said the selected date is consistent with earlier preparations to ensure the infrastructure is in place to distribute any treatment when it becomes available, and has nothing to do with the presidential election. Going it aloneChina is planning a sweeping set of new policies to develop its semiconductor industry. The five-year plan is focused on supporting third-generation chips as Beijing becomes increasingly concerned by U.S. moves which could threaten supply of the crucial components. China also affirmed its right to approve tech deals, confirming that authorities will take a major role in any sale of TikTok's U.S. operations. The Trump administration is set to make public its decisions on the scope and effective date of its bans on TikTok and WeChat later this month. Markets mixedThe rally that has driven stocks higher around the world is starting to developing some regionality this morning with not all global gauges moving in the same direction. Overnight the MSCI Asia Pacific Index was broadly unchanged while Japan's Topix index closed 0.5% higher. In Europe, the Stoxx 600 Index had added 0.9% by 5:50 a.m., with French shares outperforming on the government's announcement of a $118 billion stimulus plan. S&P 500 futures pointed to a lower open ahead of claims data, the 10-year Treasury yield was at 0.661% and gold slipped. Coming up...As well as claims, the July U.S. trade balance is published at 8:30 a.m. Markit services and composite PMI for August is at 9:45 a.m. with the ISM services index at 10:00 a.m. Chicago Fed President Charles Evans speaks later. Broadcom Inc., Campbell Soup Co. and Smith & Wesson Brands Inc. are among the companies reporting earnings. What we've been readingThis is what's caught our eye over the last 24 hours. And finally, here's what Joe's interested in this morningIn finance and economics, people love to talk about cycles. Bull and bear markets. Booms, busts and bubbles. But alongside relatively straightforward cycles that can be drawn on a chart, there's another type of cycle that matters, and that's the idea cycle. This was the topic of the latest Odd Lots podcast, in which Tracy Alloway and I interviewed former Pimco MD Paul McCulley. He identifies numerous idea fads over the years. There was monetarism that came into vogue to address inflation. Then the supply-side ideology that emerged under Reagan. Then the expansionary austerity of the Greenspan years, and then the Fed-dominant inflation targeting regime that characterized the Bernanke era. One upshot from all these ideas was the gradual crushing of inflation, and the steady grinding lower of bond yields over the last 40 years. Now he says we're "unambiguously" at the start of a new cycle, where more fiscally focused, MMT-ish policy ideas are set to take hold.  As such, this moment right now is essentially the convergence of two mega cycles at once. There's the extraordinary disruption caused by the virus. An incredible plunge in growth. Then a massive rebound in growth. All with very different impacts on different sectors of the economy, with implications that are almost impossible to know. And then this turn in the idea cycle that McCulley is talking about -- which preceded COVID -- that frustrations over the limits of monetary dominance have been accelerating ever since the financial crisis.

The long-story short is that these two things are happening all at the same time, and they will have profound implications for what markets and the economy do for years to come. Check out the full interview here. Joe Weisenthal is an editor at Bloomberg. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment