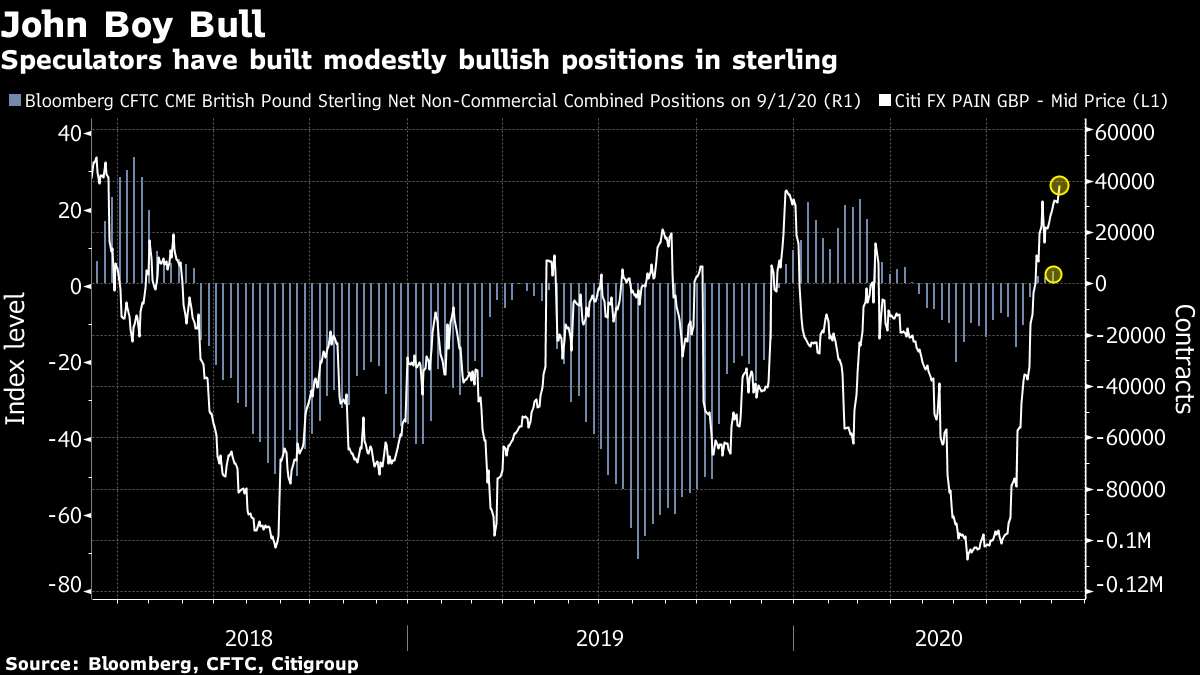

| Want the lowdown on what's moving European markets in your inbox every morning? Sign up here. Good morning. Brexit negotiators are set to meet, Europe's economy gets a health check and President Trump dials up tensions with China. Here's what's moving markets. 'Realism' The latest round of Brexit talks get underway on Tuesday with the two sides hardly sounding amicable. The European Union warned U.K. Prime Minister Boris Johnson not to tear up parts of the withdrawal agreement the two sides reached only a year ago, while the U.K.'s chief negotiator demanded "realism" from the EU. The renewed specter of a possible no-deal exit hit the pound relatively hard on Monday, and those declines have held into today. Goldman Sachs Inc. thinks Johnson still has good reason to pursue a deal and most economists and traders seem unperturbed for now. That could prove a dangerous Brexit bet, however, with plenty of reasons to believe Johnson will follow through on his threat and walk away without a deal. Europe's Economy While the Brexit negotiations dominate the agenda, we'll also have a health check on Europe's economy with GDP numbers for the euro-area. German industrial numbers yesterday pointed to a long road to any recovery and the bloc's health will provide more food-for-thought ahead of the European Central Bank meeting this week, where the virus-bruised economy and the recent strength of the euro will be front and center. How the central bank intends to tackle the euro's strength and whether it should be following the lead of the Federal Reserve in rethinking policymakers' approach, despite doubts about whether the ECB has comparable weapons at its disposal, will be in focus. In Germany, meanwhile, a balanced budget may no longer be part of the norm. China Curbs President Donald Trump said he intends to curb the U.S.'s economic relationship with China, threatening to punish American companies that create jobs overseas and forbid those that do conduct business in China from winning federal contracts. The president also used a White House news conference, with U.S. markets closed for Labor Day, to claim Democrats are holding up a deal on a stimulus bill in order to damage his re-election chances. FiveThirtyEight, the poll aggregator, said Trump's Democrat opponent, Joe Biden, currently stands a 71.1% chance of winning the election. New Epicenter India is fast becoming the center of concern about virus infection rates and is on track to eclipse the scale of the outbreak in the U.S. as Covid-19 hits the country's rural areas. The U.K., meanwhile, added seven Greek islands to its quarantine list amid an ongoing increase in domestic cases. Health Secretary Matt Hancock said the "concerning" rise in U.K. cases is being driven by young people, a big worry with universities across the country about to fill up with students. In the U.S., Democratic presidential candidate Biden said he'd follow the advice of scientists on whether to get a virus vaccine and called for transparency on any treatment that could be used, while President Trump hinted the U.S. may approve a vaccine in October, ahead of the election. Coming Up… European stock futures are trending marginally higher and U.S. futures are up too having been closed on Monday, following modest gains in Asia. Oil prices are still stuck near a two-month low on a weak short-term demand outlook. There is a smattering of earnings due in the U.K., including from industrial-equipment rental firm Ashtead Group Plc, a decent bellwether for construction activity in the U.S., and from builders' merchant Travis Perkins Plc for some insight in the U.K.'s home improvement market. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morning The pound took one on the jaw jaw as Boris Johnson ramped up the rhetoric on a no-deal Brexit, with sterling extending its losing run to the longest since June. While increased tensions can't have come as a surprise to Brexit watchers, the pound had been benefiting from a clear improvement in sentiment in recent months. While it never quite matched the attention of the FX world's new favorite currency — the euro — traders had steadily worked off their bearish positioning and turned modestly bullish. In fact a gauge of trader positioning from Citigroup Inc. is at the highest since March 2018, while speculative positions in sterling futures are back in positive territory, just. That suggests the pound will be more sensitive than it has been all year to negative newsflow, and if it continues there is room for traders to pile back on those bearish bets. The cost of hedging against swings in sterling is already climbing. It could be a tough autumn for pound bulls.  Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment