Trump vows to curb economic ties with China, fears of a coronavirus resurgence become reality, and stimulus stalemate continues in Washington. Breaking upPresident Donald Trump said he is going to "end" U.S. reliance on China and threatened to punish any American company that creates jobs overseas. In his speech at the White House, during which he also leveled charges against his opponent Joe Biden, Trump suggested that he was open up to a complete decoupling of the world's two largest economies. While there were no concrete measures announced, and trade relations between the countries remain stable for now, the administration is said to be considering a ban on imports from China containing cotton from the Xinjiang region in response to Beijing's alleged repression of the Uighur Muslim minority group. SpikeFears of a second wave of coronavirus infections are becoming reality in Europe where France has seen a new peak in cases, with rates rising in Germany and the U.K. The major difference this time is that the bulk of the infections are among people aged between 15 and 44 years, meaning the death rate has so far been much lower as the elderly and vulnerable remain more disciplined about sticking to guidance on social distancing. Cases in the U.S. remain below their recent peaks, and a new experimental Covid-19 vaccine originating from the University of Oxford has begun human trials in Australia. Back to the office The Senate returns to Washington today with lawmakers and the Trump administration no closer to agreement on a package of fiscal measures. Democrats are not budging from their proposal for a $2.2 trillion relief package as Senate Majority Leader Mitch McConnell backs the White House-supported $500 billion stimulus plan. In other back-to-the-office news, Wall Street wants more employees to return to normal work arrangements, with JPMorgan Chase & Co. among the banks pushing for increased office attendance from this week. Markets dropA bounce in European stocks during yesterday's U.S. holiday is not surviving the return of American traders, with equities posting a mixed performance this morning. The MSCI Asia Pacific Index was 0.3% higher overnight, while Japan's Topix index closed 0.7% higher. In Europe, the Stoxx 600 Index reversed early-session gains to trade 1% lower by 5:50 a.m. Eastern Time. S&P 500 futures pointed to drop at the open, with tech shares again driving the losses, the 10-year Treasury yield was at 0.689% and gold fell. Coming up...There is little of note on today's economic calendar, aside from July consumer credit numbers at 3:00 p.m. In London the latest round of Brexit negotiations begin, with investors becoming nervous again about the chances of a no-deal outcome. President Trump speaks in Florida and North Carolina later and Secretary of State Mike Pompeo is at the Atlantic Council. Lululemon Athletica Inc. and Slack Technologies Inc. report results. What we've been readingThis is what's caught our eye over the weekend. And finally, here's what Joe's interested in this morningWe got the latest jobs report last week, and the most important thing is to acknowledge the good news. The U.S. unemployment rate, once again, fell by more than expected at 8.4%, as of the end of August. It's worth noting that at the June meeting, the Fed saw the unemployment rate only getting back down to 9.3% at the end of 2020, so this is already substantially better than forecast, and there's still four months to go. During the bleakest months this spring, there was a lot of skepticism about the "temporary" label when applied to the unemployed. And while the absolute levels still remain very bad, it's clear that a lot of the layoffs were, in fact, temporary.

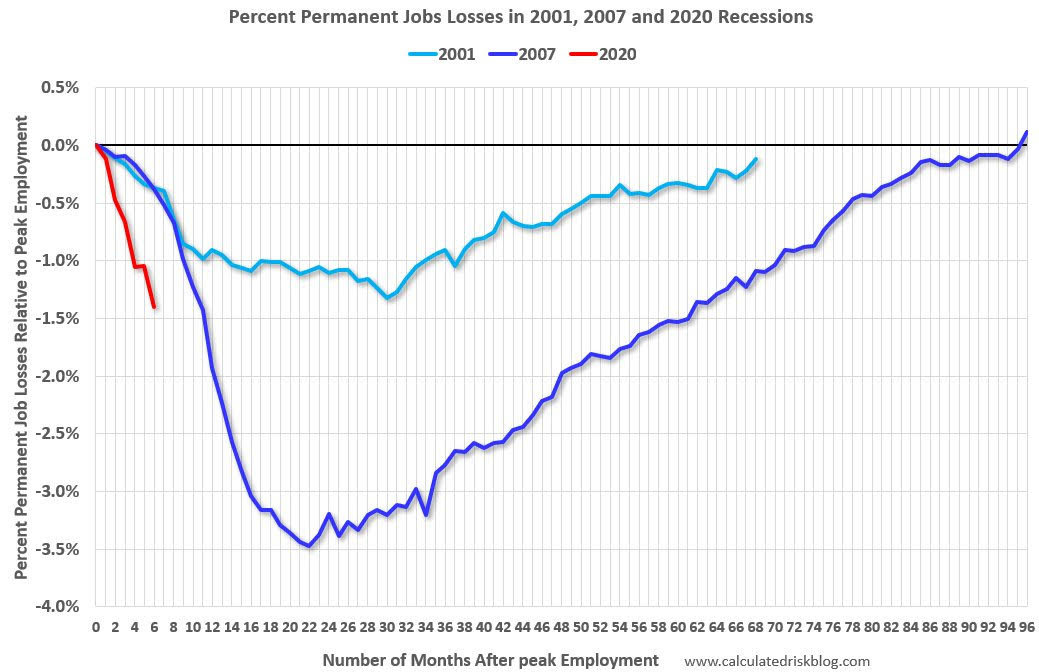

Now, here's the concerning chart. The ranks of the permanently unemployed -- people who say they don't expect to be called back to their job -- continue to shoot up at a faster pace than the Great Recession. Here's the best way to look at the situation, via Calculated Risk.

There was a brief pause in the permanent layoffs in July, but then in August they shot right back up again. This is what's concerning. Even with total employment accelerating much faster than economists had forecasted, the pace of permanent layoffs is happening faster than during the last crisis. Furthermore, we're already undergoing fiscal tightening, with the failure to extend the UI expansion and PPP, not to mention ongoing fiscal stress on towns, cities, and states. Beyond that, other headwinds may possibly emerge in the weeks and months ahead, as outdoor dining eases (due to weather), college towns suffer due to the lack of on-premise learning, and public school issues further disrupt economic activity to varying degrees around the country. Joe Weisenthal is an editor at Bloomberg. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment