Powell testimony, Republican strategy, and homebound Brits. GrillingFederal Reserve Chair Jerome Powell and Treasury Secretary Steven Mnuchin will be questioned by lawmakers in the House today, with fiscal policy and the need for more economic stimulus likely to dominate proceedings. A text of Powell's prepared remarks, released ahead of the appearance, shows the Fed Chair continues to be worried about the path of the recovery while acknowledging that "many economic indicators show marked improvements." Mnuchin's testimony is likely to focus on the continuing stalemate over a stimulus package and the rising risk of a government shutdown. Moving aheadSenate Republicans are working to fast-track President Donald Trump's Supreme Court nominee before the election. The date for a confirmation may be decided as soon as today, according to Senator John Thune of South Dakota. Democrats have little chance of voting down the nominee, with Senator Chuck Grassley saying he would support a vote ahead of the election. As to who that pick will be, the president is leaning towards Amy Coney Barrett, according to people familiar with the matter. WFHThe U.K. government is telling people to work from home again and has announced other curbs on socializing. The move -- which comes after the country's top scientific adviser warned there could be 50,000 Covid cases a day by mid-October -- is a reversal of efforts to re-open the economy after the March lockdown. There is a growing list of corporations, including Man Group Plc and Apple Inc., who see remote working becoming a more permanent phenomenon. Globally, there was a mixed picture of case growth as some recent hotspots showed signs of cooling. A plan to deploy a future vaccine around the world is moving ahead without the U.S. or China. Markets mixedEquites around the world are calmer today after Monday's drop. Overnight, the MSCI Asia Pacific Index slipped 0.6% while Japan's Topix index closed 0.5% higher. In Europe, the Stoxx 600 Index had gained 0.6% by 5:50 a.m. Eastern Time with tech stocks the best performers. S&P 500 futures pointed to a small move into the green at the open, the 10-year Treasury yield was at 0.674% and gold was lower. Coming up...U.S. August existing home sales and September's Richmond Fed Manufacturing data are at 10:00 a.m. As well as Powell in Congress, we will also hear today from Chicago Fed President Charles Evans, Richmond Fed President Thomas Barkin and Atlanta Fed President Raphael Bostic. Nike Inc. and Aurora Cannabis Inc. are among the companies reporting results. Expectations are high for an announcement at Tesla Inc.'s "Battery Day." What we've been readingThis is what's caught our eye over the last 24 hours. And finally, here's what Joe's interested in this morningBig U.S. cities are struggling right now, but there's a particular amount of focus on the future of New York City and whether this crisis will catalyze a longer-lasting deterioration.

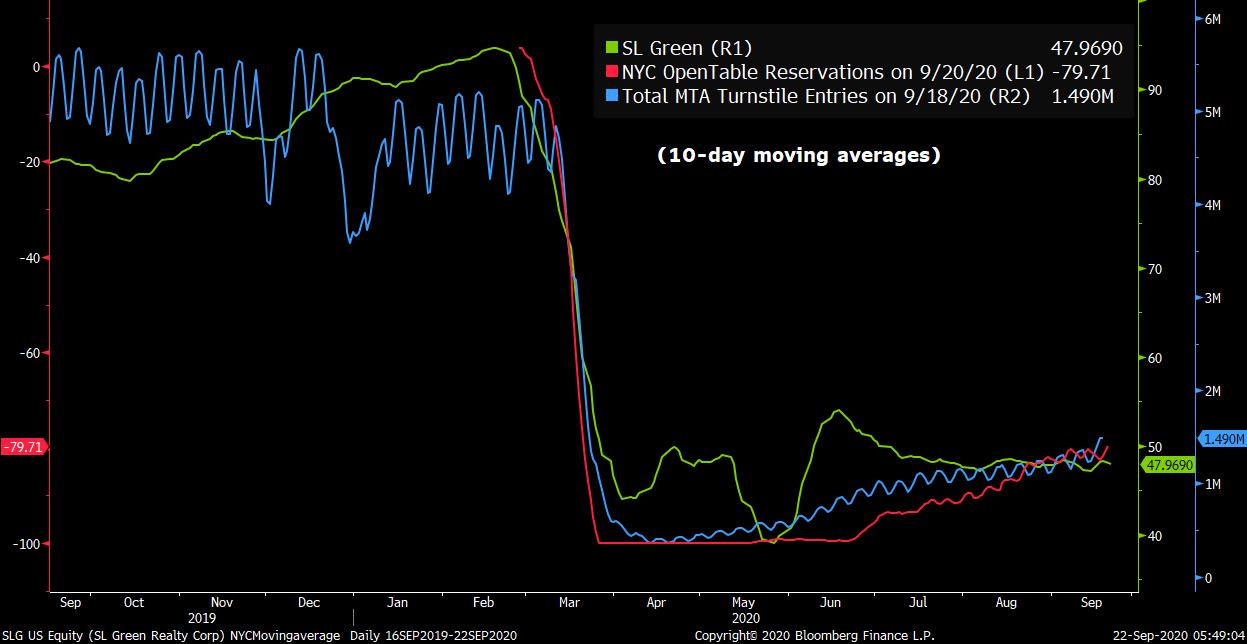

Here's a simple chart I put together to track NYC's economic recovery. The blue line is total MTA turnstile entries, so a decent proxy for how much people are going about their old, normal lives and confident enough to use public transport. As you can see, it's up from the depths in April, but at around 1.5 million per day, it's nowhere close to the old levels. Same goes for dining, the red line. At least per OpenTable, seated dining is still down around 80% on a year-on-year basis. And finally, the green line is shares of the big Manhattan office REIT SL Green. It's a nice way to see how investors are perceiving the health of commercial real estate in the city.  I'll keep updating this from time to time, but for now this seems like a decent way to get a snapshot of where the city's at. Note that each line is the 10-day moving average of each in order to smooth out the noise and see the trends better. Joe Weisenthal is an editor at Bloomberg. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment