Mnuchin pushes for stimulus, ECB verbal intervention caps euro rally, and November's election is a record risk. Urgent needTreasury Secretary Steven Mnuchin emphasized the U.S. economy's need for fresh fiscal stimulus as he began talks with House Speaker Nancy Pelosi in an effort to kickstart stalled negotiations. There had been no progress since the last round of talks broke up almost a month ago. Mnuchin offered no fresh concessions to Democrats while President Donald Trump's chief of staff Mark Meadows said yesterday that the House plan for a $2.2 trillion package isn't realistic and the Republican $500 billion targeted stimulus would be a good starting point for negotiations. Lane wayEuropean Central Bank chief economist Philip Lane caused investors to hit the pause button on the recent run-up in the value of the euro after he said that the exchange rate "does matter" for monetary policy. While that may seem benign, traders are very sensitive to any comment from the central bank, which usually chooses not to comment on currency developments. After a 12% appreciation against the dollar in the past five months, there are now differing views as to whether the euro will drop back to $1.175, or restart its rally to hit $1.25. Election riskNovember's election is now the biggest event risk in the history of the U.S. stock-volatility futures market as investors are pricing elevated chances of a delayed or inconclusive outcome. Traders looking for protection on equity market, interest rate and dollar-yen positions are facing hefty fees to hedge their positions. With 62 days until the vote, Democratic nominee Joe Biden is leading Trump by eight points in the latest national poll. Markets riseGlobal stocks are rallying with yesterday's dovish comments from Federal Reserve Governor Lael Brainard helping investor optimism. Overnight the MSCI Asia Pacific Index added 0.3% while Japan's Topix index closed 0.5% higher. In Europe the Stoxx 600 Index was up 2% by 5:50 a.m. Eastern Time in a broad advance that saw every industry sector in the green. S&P 500 futures pointed to more gains at the open, the 10-year Treasury yield was at 0.688% and oil held near $43 a barrel. Coming up...ADP employment change data at 8:15 a.m. kicks off a busy three days for the labor market, with claims tomorrow and August payrolls on Friday. Factory orders numbers for July and the final reading of that month's durable goods orders are at 10:00 a.m. The EIA crude inventory report is at 10:30 a.m. It's a big day for Fed watchers with New York Fed President John Williams, Cleveland Fed President Loretta Mester, and San Francisco Fed President Mary Daly speaking later. The latest Beige Book is published at 2:00 p.m. What we've been readingThis is what's caught our eye over the last 24 hours. And finally, here's what Joe's interested in this morningOne of the big things we've seen this year is that putting cash into the hands of middle and lower-income households is an incredibly effective policy that has all kinds of positive overall benefits. Trickle-up economics works. So there's a lot of talk about tax and trade policies that we might implement on a permanent basis to shift buying power to people who are more inclined to spend that money, as opposed to rich households, who will just save it and bid up the price of financial assets.

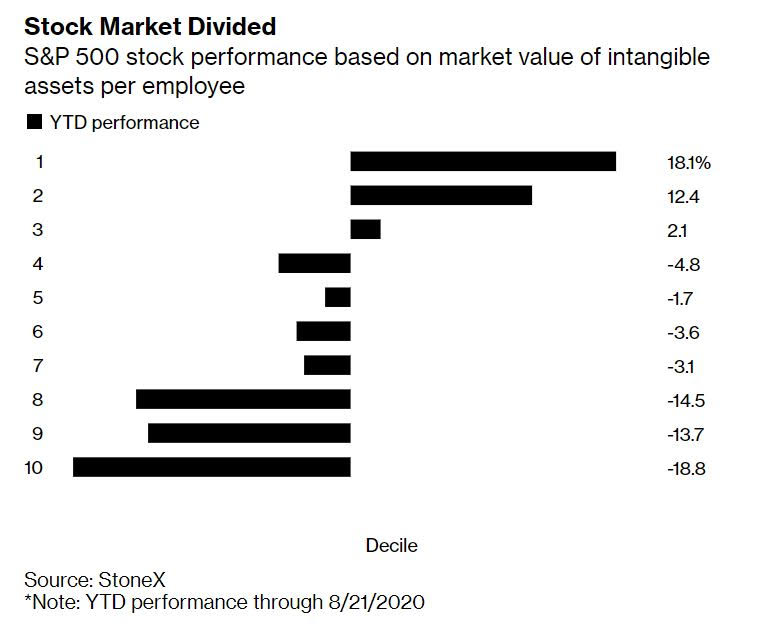

This gets to something else interesting in the market these days, which is that the really big winners are the companies that don't have that many employees, but which have a lot of "intangible assets." (A lot of tech companies, basically.)

A recent piece by Sarah Ponczek noted the degree to which companies that don't have that many actual workers are lapping the field in terms of stock returns.  Photographer: Weisenthal, Joe Photographer: Weisenthal, Joe The incredible returns and profits accruing to companies without many employees is, perhaps, yet another funnel via which more and more money goes to those who are already near the top. Economists and investors love to fret about so-called "zombies", and how keeping inefficient companies alive will somehow hold back growth. The definition of zombie is always pretty half-baked and the theory about why they're so bad is unclear. Maybe we should worry more about the superstars, and talk about the negative effect on GDP of so much money going to people who are the least inclined to spend it. Joe Weisenthal is an editor at Bloomberg. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment