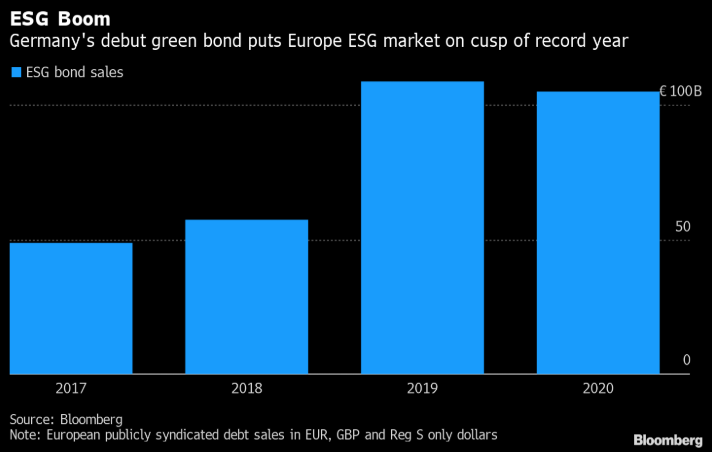

It's jobs day, no sign of stimulus but shutdown avoided, new Covid therapies explored. Payrolls Economists forecast that the U.S. unemployment rate dropped below 10% in August with 1.35 million new positions added to payrolls. Today's data, published at 8:30 a.m. Eastern Time, will have the number in employment boosted by the hiring of about 240,000 temporary workers to help conduct this year's pandemic-delayed census. The year-on-year change in earnings is seen holding above 4%. ADP employment data earlier this week came in well below expectations. Some agreement Treasury Secretary Steven Mnuchin's urgency to agree a new U.S. stimulus package has so far produced little progress, with Republicans and Democrats remaining far apart on the size of spending measures needed. The renewed contact between the sides did produce some reduction in future risks as House Speaker Nancy Pelosi informally agreed with Mnuchin to work together to avoid a government shutdown in the weeks before the election. This, at least, removes the risk of either side using funding of essential services as a bargaining chip towards a wider stimulus agreement. Covid therapyWhile a vaccine against coronavirus remains the main target for pharmaceutical companies around the world, there continues to be progress in treating the disease. Danish drugmaker Novo Nordisk A/S is exploring whether a new class of medicines that help people lose weight and control diabetes can fight the disease. If proven successful, it will add to the growing list of therapies available to doctors. The outbreak continues with India and Brazil reporting significant numbers of new infections. Markets halt routThe big selloff in U.S. stocks is looking more like a one-day event rather than a substantial change in direction this morning as global equities look to pick themselves back up again. Overnight, the MSCI Asia Pacific Index slipped 1.2% while Japan's Topix index closed 0.9% lower. In Europe, the Stoxx 600 Index was 0.7% higher by 5:50 a.m. as investors rotated into cyclical stocks and Spanish equities were boosted by news of a possible bank merger. Ahead of jobs data S&P 500 futures were pointing to a strong bounce at the open, the 10-year Treasury yield was at 0.651% and gold gained. Coming up...Canada is also publishing its August employment data at 8:30 a.m., with quarter of a million positions expected to have been added in the month. Mexico and Brazil release vehicle production data later. Oil investors who have had little to cheer about recently are unlikely to find much good news in the latest Baker Hughes rig count at 1:00 p.m. There are no earnings of note today. What we've been readingThis is what's caught our eye over the last 24 hours. And finally, here's what Emily's interested in this morningEurope's largest economy has unleashed its inaugural green debt issue and it's among the largest sovereign deals yet at 6.5 billion euros ($7.7 billion) -- five times oversubscribed, apparently -- for the 10-year securities. Germany is not the first country in the region to do so (Poland was) but it's got an interesting strategy, each deal is to be sold as a smaller twin to an earlier issue of conventional securities of the same maturity and coupon. The idea is to establish a more liquid market, by allowing investors to swap their green paper for regular debt. That fungibility should keep the two trading in line -- failing that, the government has pledged support. Germany has made clear its intention to build a green yield curve for the euro area, in line with its green bond framework -- Societe Generale's Cristina Costa notes that up to 11 billion euros of these securities are expected this year, and the next, in the fourth quarter, will be a five-year note. The government also plans two- and 30-year tandem deals.  Next up, green buyers are eyeing the peripheries, with Spain and Italy both seen considering their first issues. The German deal has provided a clear benchmark for its domestic corporate heavyweights as well: It was followed a day later by the Mercedes Benz maker, Daimler, which sold 1 billion euros of 10-year notes, earmarked for the development of emission-free vehicles. This brings total year-to-date sales of socially-responsible bonds to roughly 105 billion euros, within easy reach of the 2019 record full-year total. Follow Bloomberg's Emily Barrett on Twitter at @notthatECB Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment