| It's PMI day, China's unhappy with TikTok deal, and some good news from Washington. StallingThe post-Covid economic recovery in the euro area stumbled this month, with IHS Markit's composite Purchasing Manager's Index unexpectedly falling to 50.1. At the country level, reports show that manufacturing in Germany was a strong point, while the services sector remained under pressure across the common-currency zone. A strong composite reading for the U.K. did also hint at a setback for the service economy ahead of a tightening of lockdown measures. PMI readings for the U.S. economy are published at 9:45 a.m. Eastern Time. TikTok trick talkChinese state-run media are denouncing the TikTok deal as "an American trap" and a "dirty and underhanded trick" as sentiment in Beijing swings against the proposal. ByteDance Ltd., the owners of the video-sharing app, said it would remain in control of the new entity that would be created in the agreement, pushing back on President Donald Trump's assertions that Oracle Corp. would be in control. The wider context of resistance from China is that the country's leaders do not want to be seen to be pushed around by unilateral U.S. actions. Back on the Hill Federal Reserve Chair Jerome Powell is in Congress again today testifying to a House select subcommittee on the coronavirus response from 10:00 a.m. Yesterday he said the U.S. economy has a long way to go before it is fully recovered and that more support will be needed. While there is still very little progress on reaching a new stimulus deal, there was some relief late yesterday when an agreement to keep the government funded through Dec. 11 was reached, avoiding a shutdown just before the election. Republican moves to get a confirmation hearing for Trump's Supreme Court nominee in the coming weeks now seem unstoppable, after Democrats gained little support in the Senate for a delay. Markets rallyEquites around the world on the rise, with indexes continuing to retrace Monday's losses. Overnight the MSCI Asia Pacific Index added 0.2% while Japan's Topix index closed 0.1% lower. In Europe, the Stoxx 600 Index was 1.5% higher at 5:50 a.m., with cyclical stocks leading the gains in a session that sees every industry sector in the green. S&P 500 futures pointed to gains at the open, the 10-year Treasury yield was at 0.676% and gold was back under $1,900 an ounce. Coming up...As well as Powell in the House, there is a slew of Fed speakers today, including Cleveland Fed President Loretta Mester, Chicago Fed President Charles Evans, Boston Fed President Eric Rosengren, Minneapolis Fed President Neel Kashkari, Atlanta Fed President Raphael Bostic, Fed Vice Chair for Supervision Randal Quarles and San Francisco Fed President Mary Daly. Latest U.S. government crude stockpile data is at 10:30 a.m. President Trump is due to speak to state attorneys general on social media abuses. The UN General Assembly continues. What we've been readingThis is what's caught our eye over the last 24 hours. And finally, here's what Joe's interested in this morningGold has had a fantastic run this year, but lately it's run out of steam. In early August it came close to hitting $2100/oz. As of this morning, it's around $1890. Gold is a weird asset, because it provokes such emotional reactions in people, and people read different things into why it moves and what it's signaling. But one thing that's clear is that its boom reflected the success with which policy makers were able to reflate the economy after the very grim days of late March and early April. I wrote about that here, the idea of gold as a marker of policy maker success.

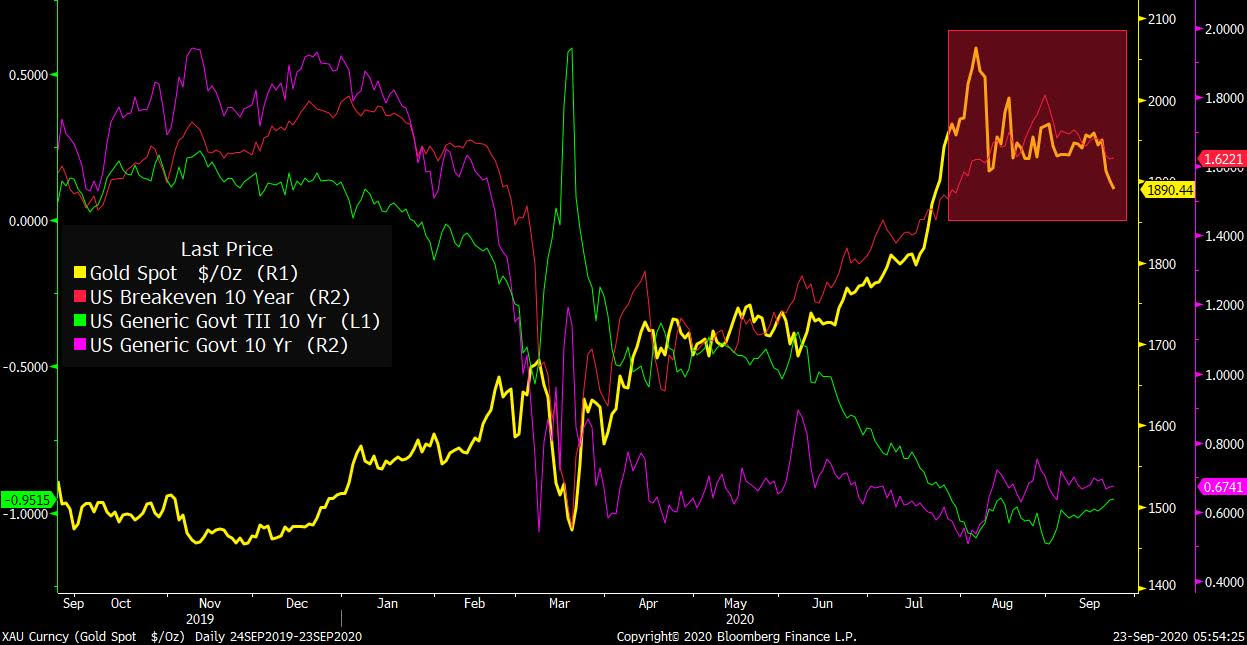

You can see it in the chart here. Gold surged as the 10-year breakeven rate (a market-based measure of anticipated inflation) quickly snapped back to pre-crisis levels. In other words, the market went from pricing in a total collapse in inflation to a more normal environment really quickly.  As you can see in the highlighted box, not only has gold topped out for now, but so have breakevens, which have also been sliding. Note that this latest leg down comes amid increasing recognition that another stimulus deal does not appear to be in the cards, at least through the rest of 2020. Policymakers engineered a surprisingly fast reflation of the economy, helped in large part by an extraordinary amount of government spending in a short period of time. Now it looks like there won't be much help coming, and the bets that were associated with this move are cooling off. Joe Weisenthal is an editor at Bloomberg. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment