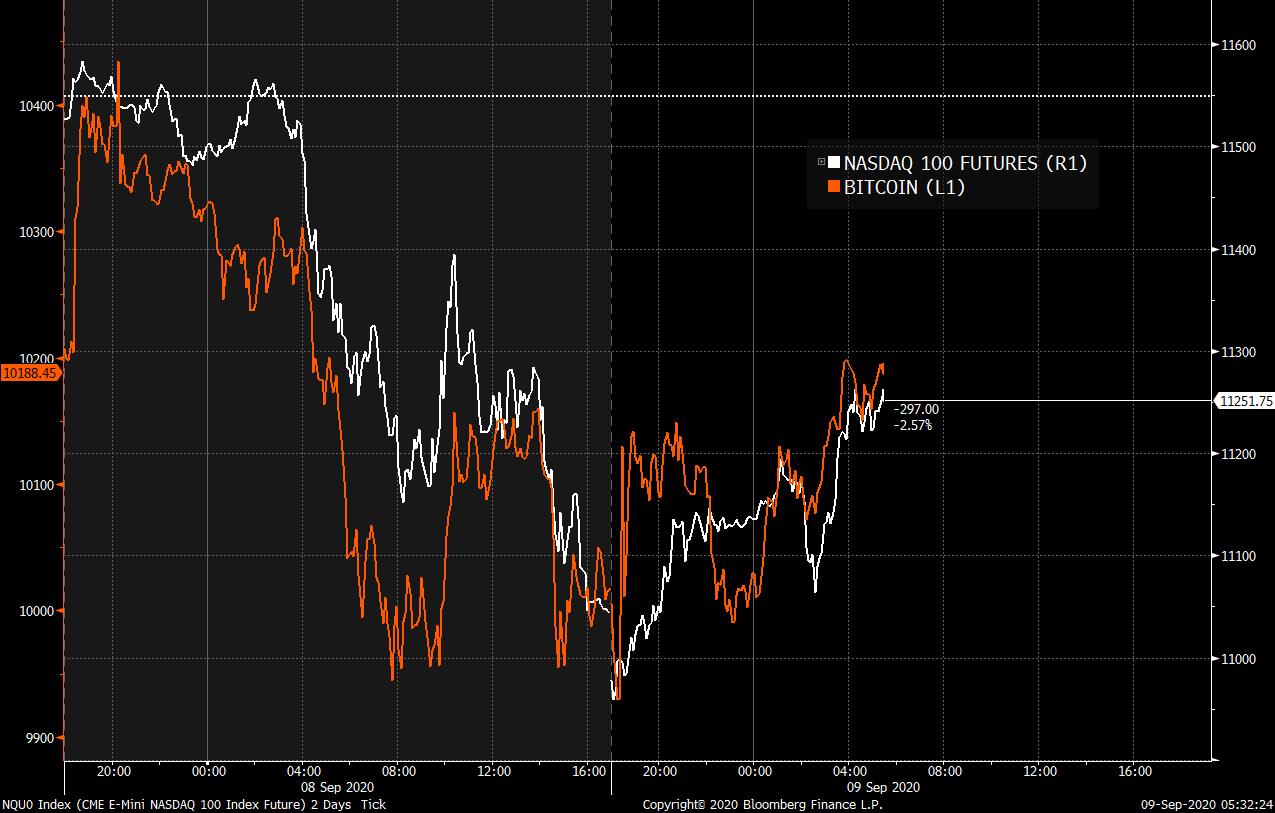

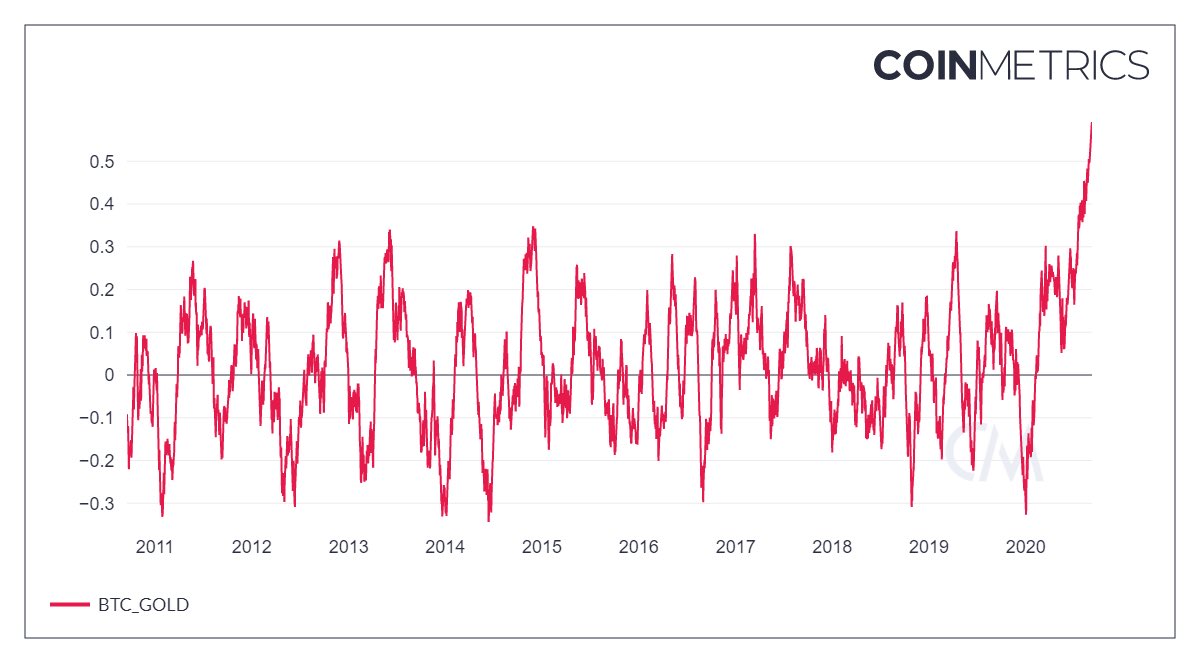

Stocks push higher, vaccine trial paused, and Britain breaking the law. Futures riseThe tech-led plunge in U.S. stocks, which pushed the Nasdaq 100 down 4.8% yesterday, is showing signs of taking a break today with futures rising for all three major U.S. indexes. DoubleLine's Jeffrey Gundlach said yesterday that the S&P 500 Index is in "nosebleed territory" and that this is not a "cheap market." Around the world, the MSCI Asia Pacific Index dropped 1% overnight, while Europe's Stoxx 600 Index had added 0.8% by 5:45 a.m. Eastern Time. Ten-year Treasury yields were at 0.684% and gold was lower. Adverse reactionAstraZeneca Plc paused human trials of its experimental coronavirus vaccine, developed with researchers from the University of Oxford, after one patient developed a mystery illness. While halts during trials of new drugs are not unusual, the delay in a leading candidate drug in the race for a Covid-19 treatment may undermine hopes for a vaccine this year. Scientists are also expressing doubts over the results from a study of Russia's vaccine, saying the published findings appeared improbable. Shares in AstraZeneca were trading about 1% lower in London this morning. Brexit The British pound has dropped 2.5% against the dollar this week as investors again become concerned about the direction talks with the EU are taking. In an extraordinary statement yesterday, a U.K. minister admitted that Boris Johnson's government will break international law in its attempts to re-write last year's divorce deal. The plan to abandon the legally binding treaty was slammed by members of Johnson's Conservative Party, and the country's most senior government lawyer while the director general at the Attorney General's office resigned. While other members of Parliament suggested it could all just be a negotiating tactic, for investors it is increasingly looking like they are in for another wild ride as negotiations continue. ContangoOil is also staging a small recovery from yesterday's selloff which saw the price of a barrel of Brent crude drop below $40 for this first time since June. While the international benchmark has climbed back above that level this morning, the demand woes that have dogged the commodity since the start of the Covid-19 outbreak remain in focus. The price differential between immediate delivery prices and contracts for supply in later months appears to be getting big enough to make a contango trade profitable. Coming up...The Bank of Canada is likely to reassure investors that rates are set to remain on hold for some time to come when it announces its latest policy decision at 10:00 a.m. U.S. July job openings data is also at that time. The Treasury will sell $35 billion of 10-year debt at 1:00 p.m. The White House may announce a list of proposed Supreme Court justices, and a further reduction in troops in Iraq. Joe Biden is set to outline his measures to combat offshoring by U.S. companies. What we've been readingThis is what's caught our eye over the last 24 hours. And finally, here's what Joe's interested in this morningI continue to be astonished by charts like this one. Here's a look at Nasdaq 100 futures vs. Bitcoin over the last couple of days, and as you can see they display a shocking degree of co-movement. Both plummeted around 8 a.m. Eastern Time yesterday before bouncing back a little bit in the morning, and then plunging again in the afternoon. Both made their lows just a little bit after 4 p.m. and then as of 4 a.m. this morning, both had started to rebound in decent fashion.  One of Bitcoin's big selling points is its diversification benefits, but these days it's almost tick-by-tick just your standard risky asset. It could be a cloud stock or Tesla. Or heck even gold. In fact, here's a chart from Coinmetrics (via Alex Thorn) showing the 60-day correlation between Bitcoin and gold having surged lately.  One might say that, well, Bitcoin is still an uncorrelated asset generally, it's just that 2020 has been an exceptional year. And that's true. Except that exceptional years are precisely when you want actual diversification. Nobody needed diversification in 2019 when things just went up. Joe Weisenthal is an editor at Bloomberg. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment