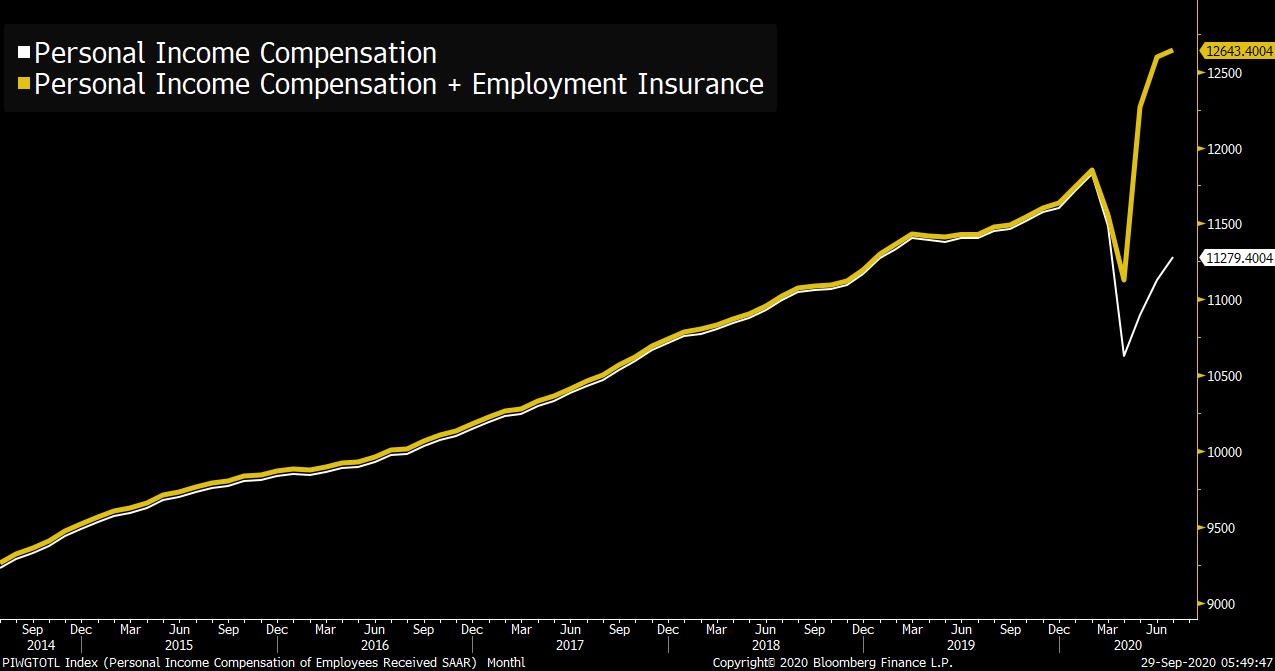

| D-day for a stimulus agreement, more coronavirus fears, and it's debate night. Deal or no deal Hopes of a new stimulus package likely rest on developments today. House Democrats released their $2.2 trillion proposal yesterday night, a move which has so far been met with silence from the Trump administration. House Speaker Nancy Pelosi talked with Treasury Secretary Steven Mnuchin, and will hold further phone conversations today. Should no deal be forthcoming, Democrats have said they will proceed with a vote on the plan and then leave town for pre-election campaigning. Winter warning The number of people who have died from Covid-19 has passed 1 million, according to data from Johns Hopkins University. The head of China's Center for Disease Control and Prevention said that the virus is unlikely to be contained in the near future. In The U.S., there are signs that the winter may be a difficult time, with hospital admissions plateauing at about 30,000 recently and the death rate averaging around 750 a day. While a lot of progress has been made on treatment, experts are warning that the virus will spread more readily in winter, putting the health care system under renewed pressure. Face off President Donald Trump and Democrat nominee Joe Biden come face to face tonight in the first of three scheduled pre-election debates. The 90-minute showdown, beginning at 9:00 p.m. Eastern Time, is not scheduled to include a discussion on Trump's tax position, although Biden is almost certain to try to score some points off the recent New York Time reports. Tonight's moderator, Chris Wallace of Fox News, has chosen the economy, the Supreme Court, Covid-19, race, and the integrity of the election as the topics for discussion. Markets mixedYesterday's brief outbreak of optimism is fading as investors take a reality check on the chances of fiscal stimulus and the re-emerging risks from the coronavirus. Overnight, the MSCI Asia Pacific Index was broadly unchanged while Japan's Topix index closed 0.2% lower. In Europe, the Stoxx 600 Index was 0.5% lower at 5:50 a.m. with banks the worst performers after the rally in the sector yesterday. S&P 500 futures fluctuated between pointing to a small loss or gain, the 10-year Treasury yield was at 0.651% and gold was higher. Coming up...U.S. wholesale inventories for August are at 8:30 a.m., July house price data is at 9:00 a.m. and consumer confidence for September is at 10:00 a.m. The New York Fed's Treasury Market conference kicks off at 9:00 a.m. with Fed officials Richard Clarida and John Williams along with speakers from the Treasury Department, SEC and CFTC discussing, among other things, liquidity in the bond market. The presidential debate is at 9:00 p.m. What we've been readingThis is what's caught our eye over the last 24 hours. And finally, here's what Joe's interested in this morningThis will go down as one of the defining charts of the crisis. Thanks to the expanded Unemployment Insurance in the CARES Act, total household income in the U.S has actually been better than a V-shaped recovery, despite huge job losses. You can see the yellow line, which includes income from both work and UI having surged back in a way that almost nobody saw coming during March and April. Meanwhile, the white line has bounced, though it's still a long way from pre-crisis levels, let alone pre-crisis trends.

This Friday we get the latest Non-Farm Payrolls Report, but on Thursday we'll get an update to the chart, and arguably that will be just as important as the number of jobs. With benefits tapering off, the question will be whether gains in the white line (people returning to work) will be enough to offset declining federal benefits. The alternative is grim: Total household income rolling over as the fiscal relief fades into history.

Joe Weisenthal is an editor at Bloomberg. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment